Albemarle Corporation (ALB), based in Charlotte, North Carolina, is a global leader in specialty chemicals, specializing in lithium and bromine. It operates three main divisions: Energy Storage for lithium in electric vehicles (EVs) and device batteries; Specialties for bromine applications; and Ketjen for catalyst refining. The company has a market capitalization of $20.82 billion.

The company is expected to report its fourth-quarter results for fiscal 2025 on Feb. 11, after the market closes. Ahead of the release, Wall Street analysts are optimistic about the company’s bottom-line trajectory.

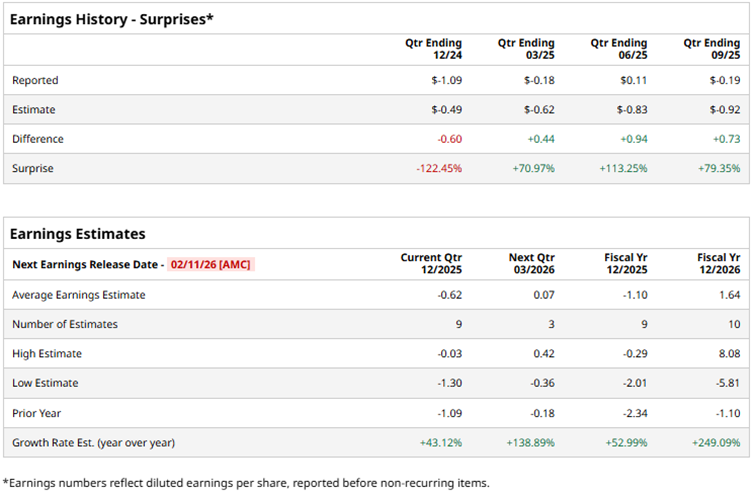

Analysts expect Albemarle to report a loss of $0.62 per share on a diluted basis for Q4, showing an improvement of 43.1% year-over-year (YOY). The company has a history of surpassing consensus estimates, topping them in three of the four trailing quarters. For the full fiscal year 2025, Wall Street analysts expect the company’s diluted loss per share to reduce by 53% annually to $1.10, followed by a 249.1% improvement to an EPS of $1.64 in fiscal 2026.

Based on a rebound in lithium prices from their lows, driven by strong demand in the energy storage industry, Albemarle’s stock has surged robustly. Over the past 52 weeks, the stock has gained 91.7%, and over the past six months, it has climbed 147%. On the other hand, the broader S&P 500 Index ($SPX) has increased by 18.6% and 10.5% over the same periods, respectively. Hence, Albemarle has outperformed the broader market over the past year.

Next, we compare the stock with its own sector’s performance. The State Street Materials Select Sector SPDR ETF (XLB) has been up by 13.1% over the past 52 weeks and 7.1% over the past six months. Therefore, the stock has also outperformed its sector over these periods.

On Nov. 5, 2025, Albemarle reported its third-quarter results for fiscal 2025, which exceeded Wall Street analysts’ estimates. The company’s net sales declined 3.5% YOY to $1.31 billion, driven by lower pricing in the Energy Storage segment. However, the impact was offset by 8% volume growth in both the Energy Storage and Ketjen segments. The company’s adjusted loss per share decreased by 87.7% from the prior-year period to $0.19. After a small dip on Nov. 6, the stock gained 6.5% intraday on Nov. 7.

Wall Street analysts have been bullish about Albemarle’s future. Among the 26 analysts covering the stock, the consensus rating is “Moderate Buy.” The rating configuration is more bullish than it was a month ago, with 11 “Strong Buy” ratings now, up from seven. The stock also has two “Moderate Buys” and 13 “Holds.” The mean price target of $144.21 implies an 18.8% downside from current levels. However, the Street-high price target of $210 implies an 18.3% upside.