/Agilent%20Technologies%20Inc_%20phone%20and%20logo-by%20IgorGolovniov%20via%20Shutterstock.jpg)

Agilent Technologies, Inc. (A) is a leading provider of instruments, software, services and consumables that support laboratory workflows across life sciences, diagnostics and applied chemical markets worldwide. Agilent is headquartered in Santa Clara, California and has a market cap of $35.8 billion, reflecting its significant presence in the healthcare and research tools sector.

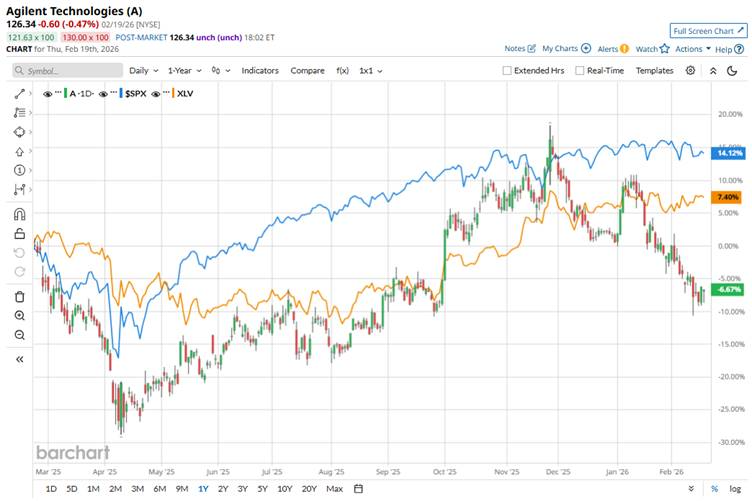

The healthcare stock has underperformed the broader market over the past year. Agilent’s stock prices have declined 7.9% over the past 52 weeks and 7.2% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 11.7% gains over the past year and marginal rise this year.

Narrowing the focus, the stock has also lagged behind the sector-focused State Street Health Care Select Sector SPDR ETF’s (XLV) 7.4% gains over the past 52 weeks and 1.6% uptick in 2026.

Agilent Technologies stock has faced downward pressure in 2026, largely due to weak sentiment and profit-taking despite stable fundamentals. Despite stable Q4 2025 results and a positive outlook for the long term, the market was concerned by persisting pressures driven by global tariffs and supply chain issues.

For the full fiscal 2026, ending in October, analysts expect Agilent to deliver an EPS of $5.93, up 6.1% year-over-year. Further, the company has a steady earnings surprise history. It has surpassed or met the Street’s bottom-line projections in each of the past four quarters.

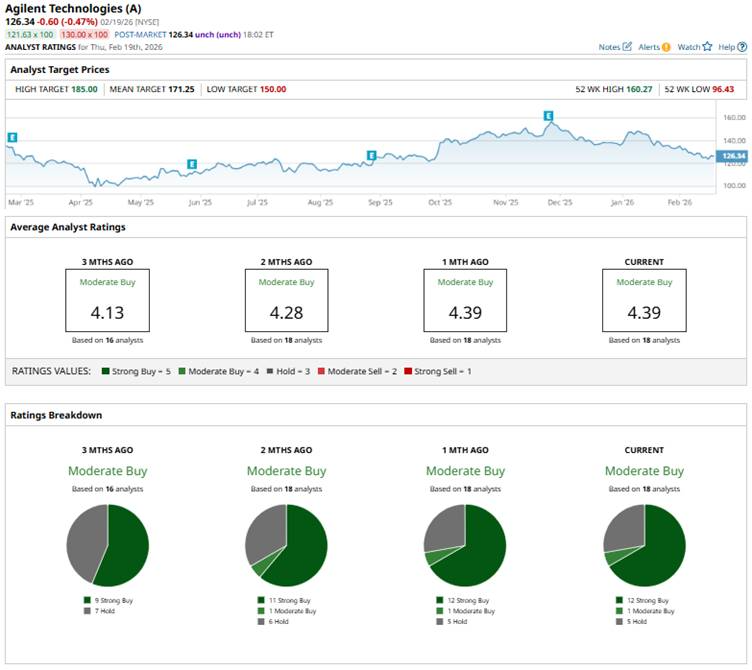

Among the 18 analysts covering the Agilent stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” and five “Holds.”

This configuration is more bullish than three months ago, when there were nine “Strong Buy” ratings.

Last month, HSBC initiated coverage on Agilent Technologies with a “Buy” rating and a $180 price target.

Agilent’s mean price target of $171.25 represents a 35.5% premium to current price levels. Meanwhile, the street-high target of $185 suggests a notable 46.4% upside potential.