/A_O_%20Smith%20Corp_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $9.5 billion, A.O. Smith Corporation (AOS) is a global manufacturer of residential and commercial water heating and water treatment solutions, serving customers across North America, India, China, and other international markets. Headquartered in Wisconsin, the company is best known for its water heaters, boilers, and related products used in homes, commercial buildings, and industrial applications.

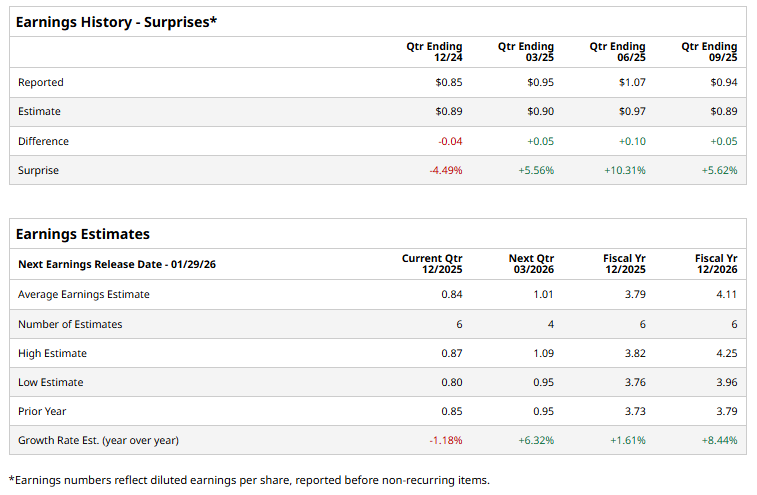

The industrial behemoth is set to unveil its fourth-quarter results soon. Ahead of the event, analysts expect AOS to report non-GAAP earnings of $0.84 per share, down 1.2% from $0.85 per share reported in the year-ago quarter. The company has surpassed the Street’s bottom-line projections in three of the past four quarters, while missing on another occasion.

For the current year, its earnings are projected to rise 1.6% to $3.79 from $3.73 per share reported in the past year. Additionally, in fiscal 2026, its earnings are expected to improve 8.4% annually to $4.11 per share.

AOS stock has declined marginally over the past 52 weeks, underperforming the Industrial Select Sector SPDR Fund’s (XLI) 18.6% surge and the S&P 500 Index’s ($SPX) 16.8% uptick during the same time frame.

Over the past year, A. O. Smith has lagged the broader market as its core growth engine has lost momentum. Organic revenue has stalled over the past two years, signaling plateauing demand and raising concerns that future growth may rely on acquisitions rather than underlying business strength. At the same time, earnings growth has been muted, with EPS expanding at a low single-digit pace, well below sector norms.

The consensus opinion on AOS is reasonably bullish, with a “Moderate Buy” rating overall. Of the 13 analysts covering the stock, opinions include four “Strong Buys,” eight “Holds,” and one “Strong Sell.” Its mean price target of $78.50 suggests a 15.9% upside potential from current price levels.