Bitcoin (CRYPTO: BTC) was sliding over 4% lower on Friday after Federal Reserve chair Jerome Powell threw the markets into chaos during his annual speech at the Jackson Hole Symposium.

Ethereum (CRYPTO: ETH) was the hardest hit, plummeting over 8%, while Dogecoin (CRYPTO: DOGE) fell slightly more modestly in tandem with Bitcoin, declining about 5%.

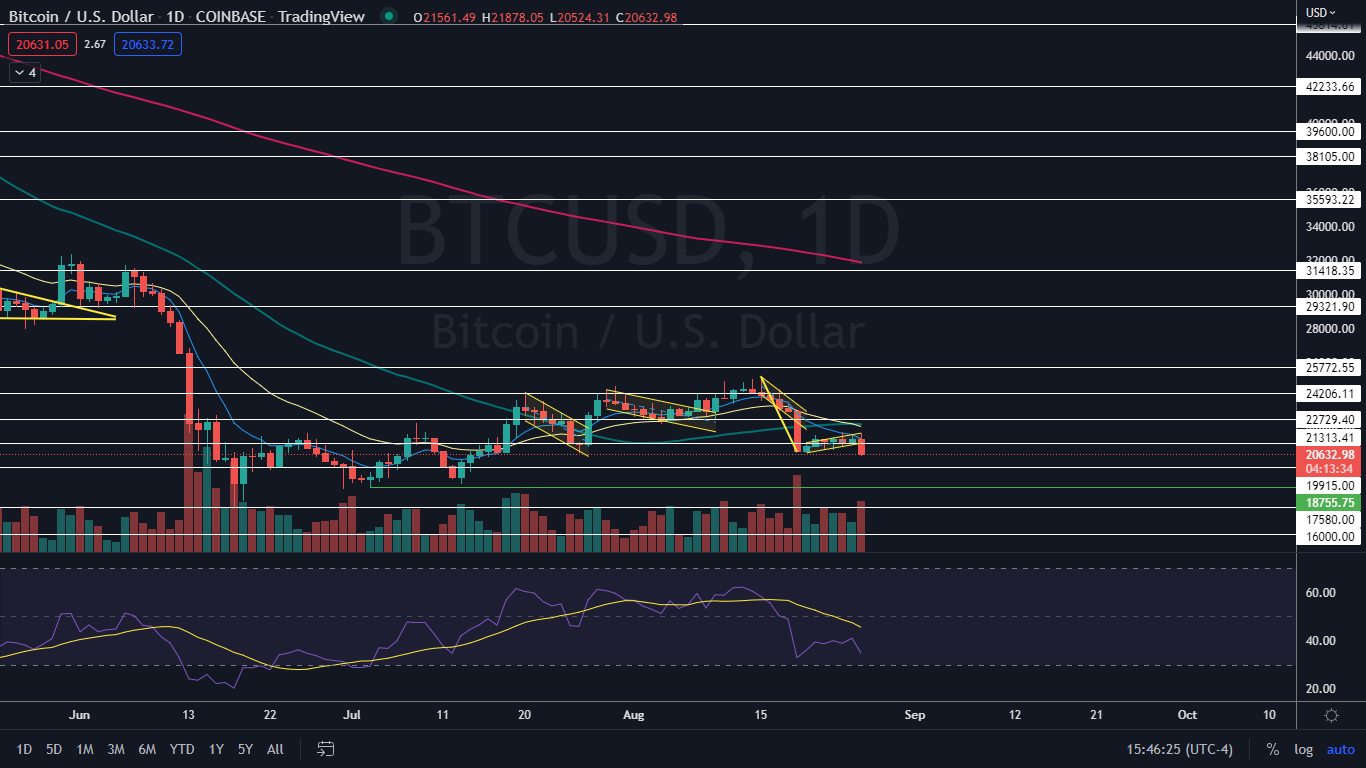

The bearish reaction to Powell’s hawkish tone caused the three cryptos to break bearishly from bear flag patterns that Benzinga pointed out on Wednesday.

The bear flag pattern is created with a steep drop lower forming the pole, which is then followed by a consolidation pattern that brings the stock higher between a channel with parallel lines or into a tightening triangle pattern.

For bullish traders, the "trend is your friend" (until it's not) and the stock may continue to rise upwards within the following channel for a short period of time. Aggressive traders may decide to purchase the stock at the lower trendline and exit the trade at the higher trendline.

- Bearish traders will want to watch for a break down from the lower descending trendline of the flag formation, on high volume, for an entry. When a stock breaks down from a bear flag pattern, the measured move lower is equal to the length of the pole and should be added to the highest price within the flag.

- A bear flag is negated when a stock closes a trading day above the upper trendline of the flag pattern or if the flag rises more than 50% up the length of the pole.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The Bitcoin Chart: Bitcoin’s bear flag pattern developed between Aug. 15 and Thursday, with the downward sloping pole formed over the first five days of that time frame and the flag printing over the days that followed. The measured move of the pattern is about 17%, which indicates the crypto could fall toward $18,100.

- Friday’s sharp decline also negated the uptrend in which Bitcoin was trading within the flag formation. In order for Bitcoin to confirm a new downtrend is in the cards, the crypto will have to rise up to print a lower high under $21,925.

- The move lower came on higher-than-average volume, which indicates the bears are both interested and in control. At press time, Bitcoin’s volume was measuring in at about 29.5 million on Coinbase compared to the 10-day average of 23.78 million.

- If the crypto closes the 24-hour trading session near its low-of-day price, Bitcoin will print a bearish Marubozu candlestick, which could indicate lower prices will come again on Saturday. If the crypto bounces up to form a lower wick, the low may be in and the crypto could trade higher over the weekend.

- Bitcoin has resistance above at $21,313 and $23,729 and support below at $19,915 and $18,775.

- Unlike Bitcoin, Ethereum hasn’t yet negated its uptrend. If the crypto drops below the most recent higher low, which was printed on Aug. 22 at $1,520, the uptrend will be officially over and a downtrend could occur.

- Ethereum has resistance above at $1,717.14 and $1,957.44 and support below at $1,421.80 and $1,245.

At the time of writing, Dogecoin’s volume on Coinbase was measuring in at about 307.2 million compared to the 10-day average of 323.83 million.

- The lower-than-average volume hampered the move lower, and although Dogecoin negated its uptrend slightly, the sideways pattern in which the crypto has been trading within the flag formation is still intact.

- Dogecoin has resistance above at $0.075 and $0.083 and support below at $0.065 and $0.057.