While so much of the TV advertising business has faced unprecedented change as technology enables more consumer choice and a variety of new ways to spend their money, this year’s upfront might not look very different from last year’s, a new survey by iSpot.tv found.

And despite the gloom and doom about linear television, advertisers still aren’t ready to shift a lot of ad dollars to streaming.

The iSpot survey found that 27% of advertisers plan to spend either a bit more or much more during this year’s upfront, compared to last year.

The advertisers who expected to spend much more were down a bit to 3% from 5%, while 54% said spending would be about the same, little changed from 53%.

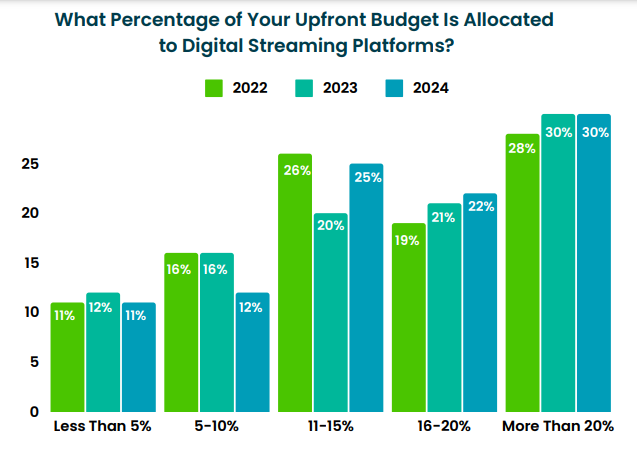

Surprisingly, advertisers said they wouldn’t be pouring money into streaming. The share of clients spending more than 20% of their budgets on streaming was steady at 30%. There was a big drop in the share of advertisers spending 5% to 10% of their budgets on streaming, to 12% from 16%.

Meanwhile the number of marketers spending from 11% to 15% of their budgets on streaming rose to 25% from 20%.

Hulu is the biggest winner among the streamers, with 75% of the advertisers responding saying they’re buying the Disney-controlled platform. Peacock attracted dollars from 51% of advertisers; followed by Paramount Plus and YouTube TV, with 47% each; and Roku, with 41%.

What are advertisers finding difficult? Fragmentation was the biggest headache, followed by cross-platform reach and frequency management and allocation across publishers.

With that in mind, 58% of advertisers said they don’t receive data on linear and streaming overlap from their streaming vendors.

The iSpot report found that 87% of advertisers that spend more than $250 million were interested in new currencies.

The potential benefits from new currencies including eliminating inefficient ad spend, the ability to reach audiences with precision over screens.

New currencies also help avoid brand harm while making faster decisions,

iSpot said it surveyed more than 260 marketers from 177 brands, advertisers and agencies about their plans for the upfront. The survey was distributed over one month from February 20 to March 12.