20 analysts have shared their evaluations of Tractor Supply (NASDAQ:TSCO) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 7 | 6 | 7 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 5 | 5 | 6 | 0 | 0 |

| 3M Ago | 1 | 0 | 1 | 0 | 0 |

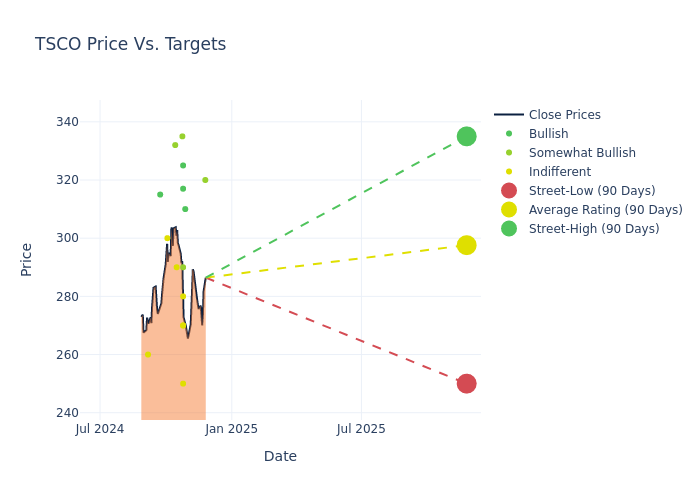

Analysts have recently evaluated Tractor Supply and provided 12-month price targets. The average target is $300.45, accompanied by a high estimate of $335.00 and a low estimate of $250.00. Witnessing a positive shift, the current average has risen by 4.94% from the previous average price target of $286.32.

Breaking Down Analyst Ratings: A Detailed Examination

An in-depth analysis of recent analyst actions unveils how financial experts perceive Tractor Supply. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Zachary Fadem | Wells Fargo | Lowers | Overweight | $320.00 | $325.00 |

| John Lawrence | Benchmark | Raises | Buy | $310.00 | $280.00 |

| Michael Lasser | UBS | Raises | Neutral | $280.00 | $272.00 |

| Matthew McClintock | Raymond James | Raises | Outperform | $290.00 | $285.00 |

| Seth Sigman | Barclays | Raises | Equal-Weight | $250.00 | $240.00 |

| Michael Baker | DA Davidson | Raises | Buy | $325.00 | $300.00 |

| David Bellinger | Mizuho | Raises | Neutral | $270.00 | $250.00 |

| Seth Basham | Wedbush | Maintains | Neutral | $270.00 | $270.00 |

| Scot Ciccarelli | Truist Securities | Lowers | Buy | $317.00 | $325.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $335.00 | $335.00 |

| John Lawrence | Benchmark | Maintains | Buy | $280.00 | $280.00 |

| Joseph Feldman | Telsey Advisory Group | Raises | Outperform | $335.00 | $300.00 |

| Christopher Horvers | JP Morgan | Raises | Neutral | $290.00 | $260.00 |

| Scot Ciccarelli | Truist Securities | Raises | Buy | $325.00 | $293.00 |

| Peter Keith | Piper Sandler | Raises | Overweight | $332.00 | $300.00 |

| Zachary Fadem | Wells Fargo | Raises | Overweight | $325.00 | $295.00 |

| Oliver Wintermantel | Evercore ISI Group | Maintains | In-Line | $300.00 | $300.00 |

| John Lawrence | Benchmark | Maintains | Buy | $280.00 | $280.00 |

| Karen Short | Melius Research | Announces | Buy | $315.00 | - |

| Anthony Chukumba | Loop Capital | Raises | Hold | $260.00 | $250.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Tractor Supply. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Tractor Supply compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Tractor Supply's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Tractor Supply analyst ratings.

About Tractor Supply

Tractor Supply is the largest operator of retail farm and ranch stores in the United States. The company targets recreational farmers and ranchers and has little exposure to commercial and industrial farm operations. Currently, the company operates 2,270 of its namesake banners in 49 states, including 81 Orscheln Farm and Home stores (rebranded as Tractor Supply), along with 205 Petsense by Tractor Supply stores. Stores are generally concentrated in rural communities, as opposed to urban and suburban areas. In fiscal 2023, revenue consisted primarily of livestock, equine & agriculture (27%), companion animal (25%), and seasonal & recreation (22%).

Tractor Supply: Delving into Financials

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Tractor Supply's remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 1.65%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Tractor Supply's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 6.96%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 10.51%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 2.47%, the company showcases effective utilization of assets.

Debt Management: Tractor Supply's debt-to-equity ratio stands notably higher than the industry average, reaching 2.33. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Significance of Analyst Ratings Explained

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.