Zoom Video (ZM) stock is getting hit on Tuesday after the videoconferencing-tech company reported earnings after the close on Monday.

Shares of Zoom are down about 8% at last check. At the session low, the stock was down more than 10%. And from its all-time high Zoom stock is now down 88%.

Today’s decline comes after the company reported a mixed result. Earnings beat analysts’ expectations, while revenue was in line. However, guidance was an issue.

The company’s fourth-quarter and full-year revenue outlooks were a bit short of consensus estimates, after accounting for currency impacts. In constant-dollar terms, both outlooks were ahead of estimates.

Maybe that's just a small consolation prize, but I thought it was notable.

Even as ZM is a profitable free-cash-flow positive firm with more than $5 billion in cash and limited debt, investors are shunning the name, as it was the face of the pandemic growth-stocks group.

Let’s see what clues the chart holds.

Trading Zoom Video Stock

Chart courtesy of TrendSpider.com

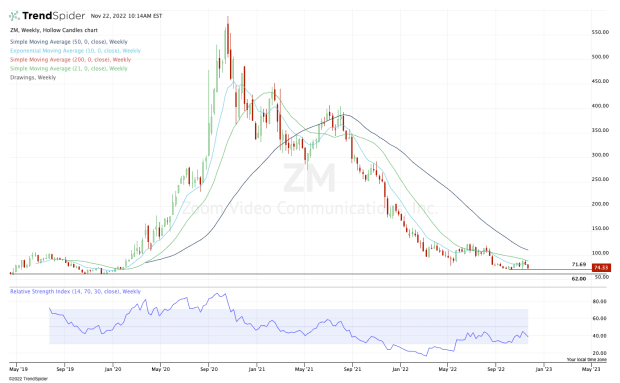

When we zoom out — no pun intended — one can see that Zoom Video stock has had a roller coaster ride.

The stock went public in 2019, bouncing between $100 on the upside and the $60 to $62 area on the downside.

Now the stock is trading below its 10-week and 21-week moving averages, and the trend still points lower. The shares are leaning on support in the $70 to $72 region, which has buoyed the stock over the past several months.

If this area continues to hold as support, bullish investors will need to see Zoom Video stock reclaim its short-term moving averages.

But if this area fails as support, it opens the door down to the key zone of $60 to $62. This zone has been support since Zoom Video has gone public.

If we reach this area — and right now, that feels like a very big “if” — then the chances seem reasonable that it acts as support.

And if we do get to this zone, aggressive buyers can buy the dip and treat the stock as a speculative position.

Otherwise, more conservative bulls can consider waiting to see if there’s a break of this support area, then buying Zoom Video stock if it can reclaim this zone. The new risk point would be the low after the stock reclaims the $60 to $62 zone.

Known as a bullish reversal, it’s a lower-risk approach to a stock in free-fall. However, the risk is also that the stock doesn't break support and the setup doesn’t come to fruition.

Black Friday Sale

Get Action Alerts PLUS + Quant Ratings investing insights for one low price.

- Action Alerts PLUS: Unlock portfolio guidance, access to portfolio managers, and market analysis every trading day.

- Quant Ratings: Get stock ratings, key financial metrics, and ratings upgrades and downgrades for your stock analysis.