Zoom Video Communications, Inc. (ZM) has announced impressive quarterly revenue figures, exceeding predictions thanks to robust sales in the enterprise sector. The result demonstrates the company’s ability to thrive in the competitive business collaboration software market.

An encouraging 3.2% rise in fiscal third-quarter sales has propelled the figures to approximately $1.14 billion, surpassing the predicted $1.12 billion. Similarly, Zoom’s EPS was reported at $1.29, significantly higher than the consensus estimate of $1.08. Enterprise revenue has risen by 7.5% to a hefty $660.60 million for the quarter.

Following Zoom’s rapid growth during the pandemic as it became a household name in the lockdowns, it now focuses on introducing several essential features for businesses, such as word processing capabilities and an increased utilization of artificial intelligence to reinforce its flagship video conferencing service.

In light of these developments, alongside the rising demand stemming from hybrid work trends and the infusion of artificial intelligence into its product offerings, Zoom has revised upwards its annual revenues and profit forecasts.

It predicts an adjusted EPS between $4.93 and $4.95, a considerable raise from the previous forecast range of $4.63 to $4.67. Simultaneously, the company’s full-year revenue is now anticipated to fall between $4.506 billion and $4.511 billion, up from the previous prediction of $4.485 billion to $4.495 billion.

“We bolstered Zoom’s all-in-one intelligent collaboration platform with advanced new capabilities like Zoom AI Companion and continued to evolve our customer and employee engagement solutions,” CEO Eric Yuan said.

Given the robust performance indicators and steady growth demonstrated, Zoom could present a prime opportunity to diversify and complement existing portfolios. Following are key metrics that substantiate this positive stance.

Analyzing Zoom Video Communications’ Financial Performance Between January 2021 and October 2023

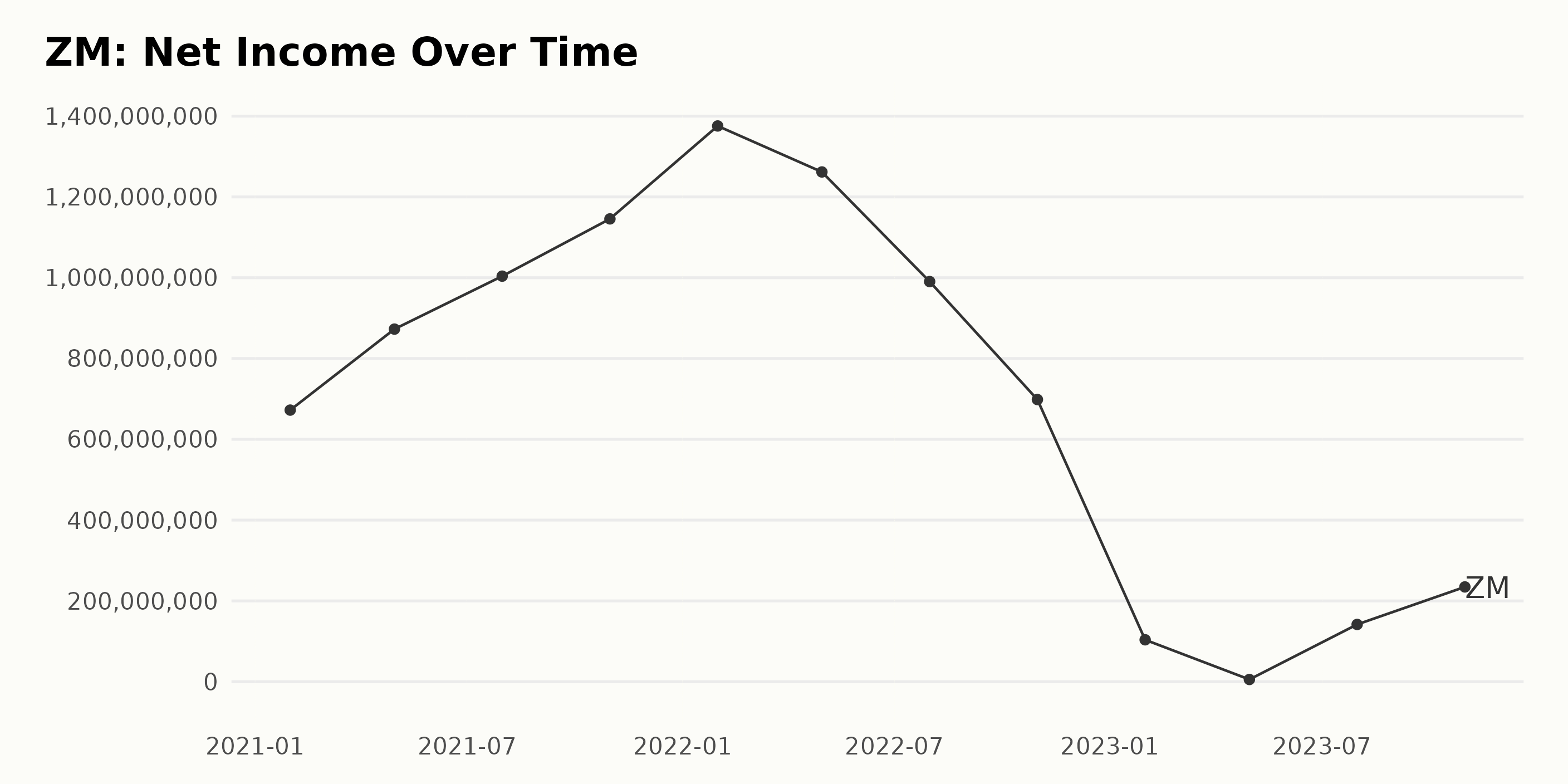

Here is a summary of the trailing-12-month Net Income trend and fluctuations for ZM based on the provided data:

- In January 2021, ZM started with a Net Income of $672.32 million, which steadily increased over subsequent quarters, reaching a peak of $1.38 billion in January 2022.

- However, ZM’s Net Income faced significant fluctuations afterward, with sharp declines observed towards April 2023, where it fell to $5.50 million, followed by a recovery to $234.58 million by October 2023.

- Between January 2021 to October 2023, the company’s Net Income surged from $672.32 million to $234.58 million. This represents a decrease rather than a growth rate when measuring from the first to the last value.

- The most recent data (October 2023) shows a significant recovery from the preceding quarterly figure, although it’s far below the peak value observed in the series.

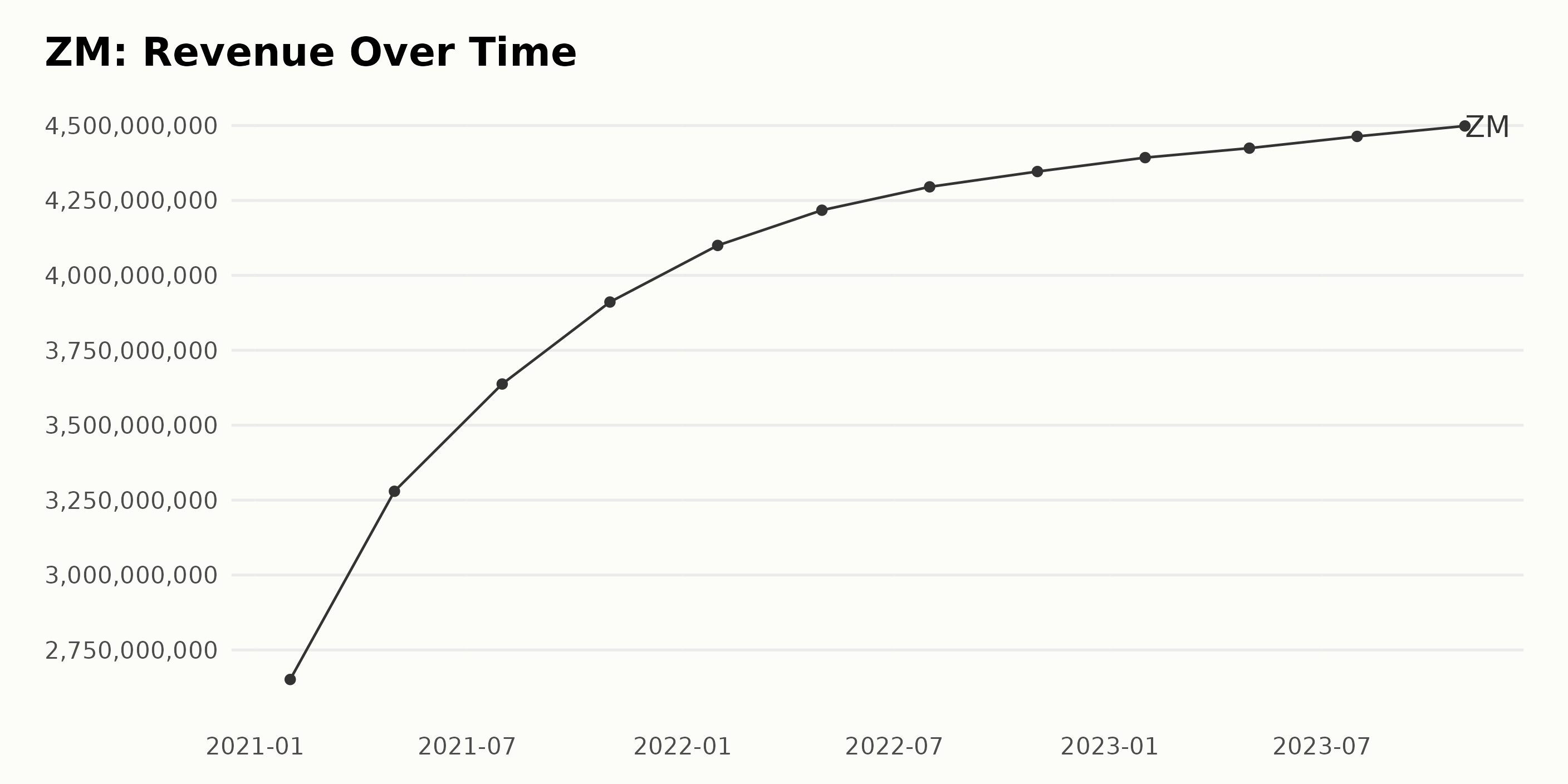

The trailing-12-month revenue trend of ZM from January 2021 to October 2023 can be summarized as follows:

- In January 2021, ZM’s Revenue was $2.65 billion.

- There was a consistent upward trend in Revenue through April 2022, reaching $4.22 billion.

- From April 2022 onward, there is slower but continuous growth up until the last recorded data point in October 2023, where the Revenue was $4.5 billion.

- The total growth rate calculated from the initial (January 2021) value to the final value (October 2023) is approximately 69.8%.

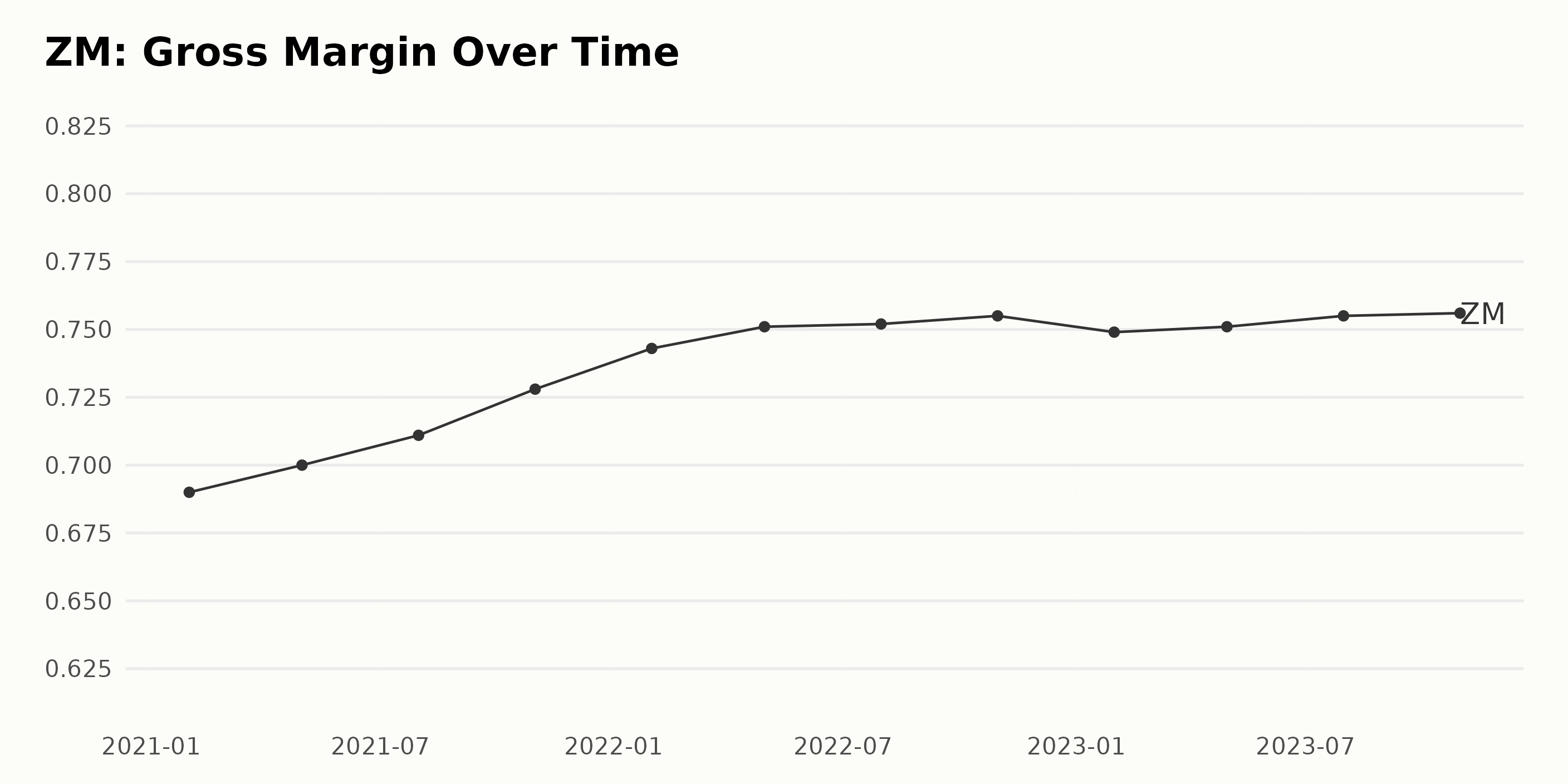

In examining the Gross Margin of ZM, it is interesting to see a relatively constant upward trend that spans over the course of nearly three years, from January 2021 to October 2023.

- In January 2021, the Gross Margin was 69%.

- This rose modestly to 70% by April of the same year.

- Subsequent months saw a steady increase, hitting 71.1% in July 2021 and 72.8% by October 2021.

- The start of 2022 continued this trend with an uplift to 74.3% in January and a slight growth, reaching 75.1% in April 2022.

- By July 2022, the Gross Margin subtly increased to 75.2%.

- It continued modest growth until October 2022, when its Gross Margin escalated to 75.5%.

- In a surprising move, the value slightly dropped down to 74.9% in January 2023 but then regained to score 75.1% in April 2023.

- Again, looking towards the later part of the year, we find Gross Margin hitting 75.5% in July 2023 and finally resting at 75.6% in October 2023.

When considering the growth rate from the first value (69%) to the last recorded value (75.6%), ZM showed a meaningful growth of approximately 9.57%. Most importantly for the decision-making process, there is an evident positive trend in the Gross Margin over this period, despite small fluctuations, which might suggest that ZM is managing its costs of goods sold effectively.

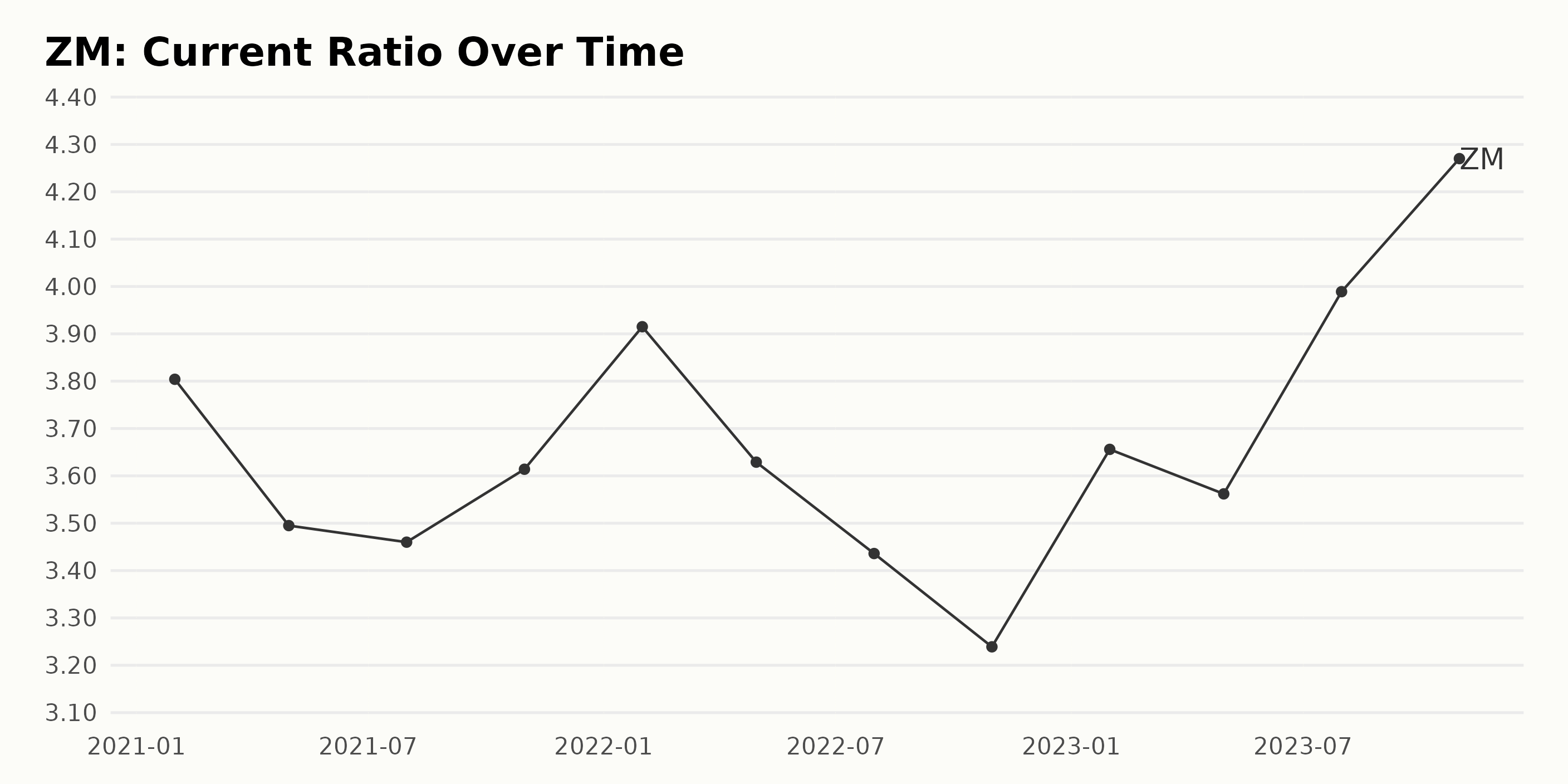

Zoom Video Communications, Inc. (ZM) ’s Current Ratio experienced several fluctuations throughout the period from January 2021 to October 2023. Here’s a brief summary:

- January 2021: The Current Ratio began at 3.80.

- April 2021 - July 2021: There was a slight downwards trend as the ratio dropped from 3.49 in April to 3.46 in July.

- August 2021 - January 2022: The ratio then increased from 3.61 by the end of October to 3.91 by end of January.

- February 2022 - October 2022: This was followed by a negative trend as the Current Ratio decreased from 3.62 in April to 3.24 in October.

- November 2022 - October 2023: A strong resurgence occurred, with the rate rising consistently from 3.65 in January to a peak of 4.27 in October.

Examining the progress from the inception of this series in January 2021 (3.80) towards its culmination in October 2023 (4.27), there is an evident growth in Zoom Video Communications, Inc.’s Current Ratio. The growth rate, measured by comparing the first value to the last, amounts to approximately 12%, suggesting a gradual but consistent strengthening of the company’s ability to meet its short-term liabilities with its short-term assets over this time period. Greater emphasis is placed on the most recent data, indicating an upward trend in Zoom’s liquidity position.

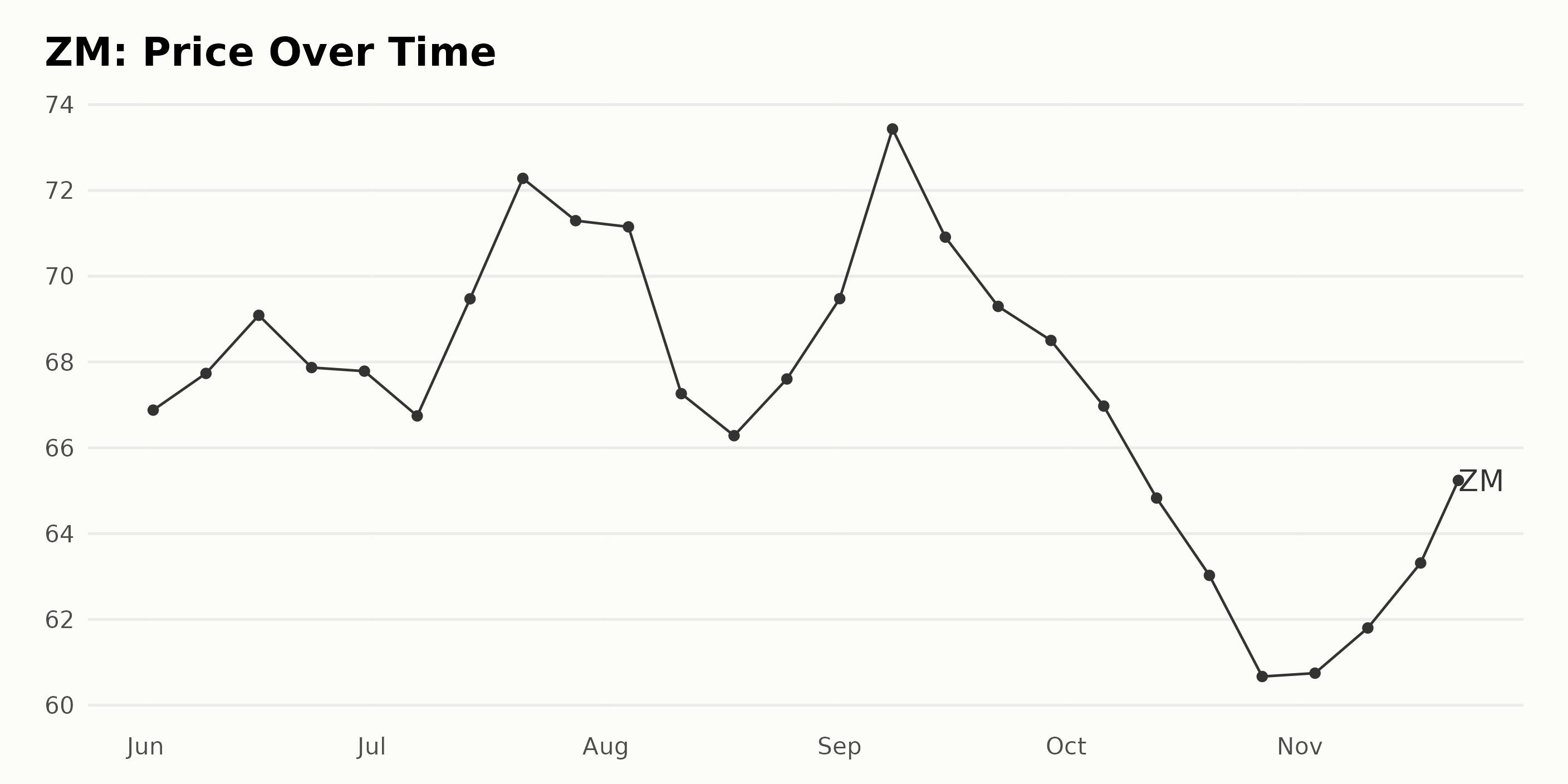

Zoom’s Share Fluctuations: A Five-Month Downward Trend with Brief Recovery Periods

The share price of Zoom Video Communications, Inc. (ZM) exhibits fluctuations, but a general downward trend over the five-month period from June to November 2023 can be observed. The data indicates that:

- Starting at a price of $66.88 on June 2, 2023, the share price saw slight growth to peak at $69.09 by June 16, 2023.

- However, a brief fluctuation was observed at the end of June, with prices decreasing to $67.79 on June 30, 2023.

- In July 2023, the price continued to rise initially, reaching a peak of $72.28 on July 21, 2023, before slightly falling to $71.29 by the end of the month.

- In August 2023, a clear downward trend began, with the price declining from $71.15 at the beginning of the month to $66.28 by August 18, though it did rebound slightly to $67.60 by the end of the month.

- September 2023 sees the last high point in our data, with a high of $73.43 before falling consistently downwards, ending with a price of $68.50 at the end of the month.

- The downward acceleration continues from October into November 2023, starting from $66.97 on October 6 and falling to a low of $60.67 by October 27.

- There appears a small rebound in November, with the price increasing from $60.75 on November 3 to $65.24 by November 22, 2023.

In summary, there is a fluctuating trend with a general decrease in the share price from June to November 2023. While there were some upward trends, the highest growth rate was observed in July 2023. The accelerating decline started in August and continued through October, with a slight recovery seen in November. Here is a chart of ZM’s price over the past 180 days.

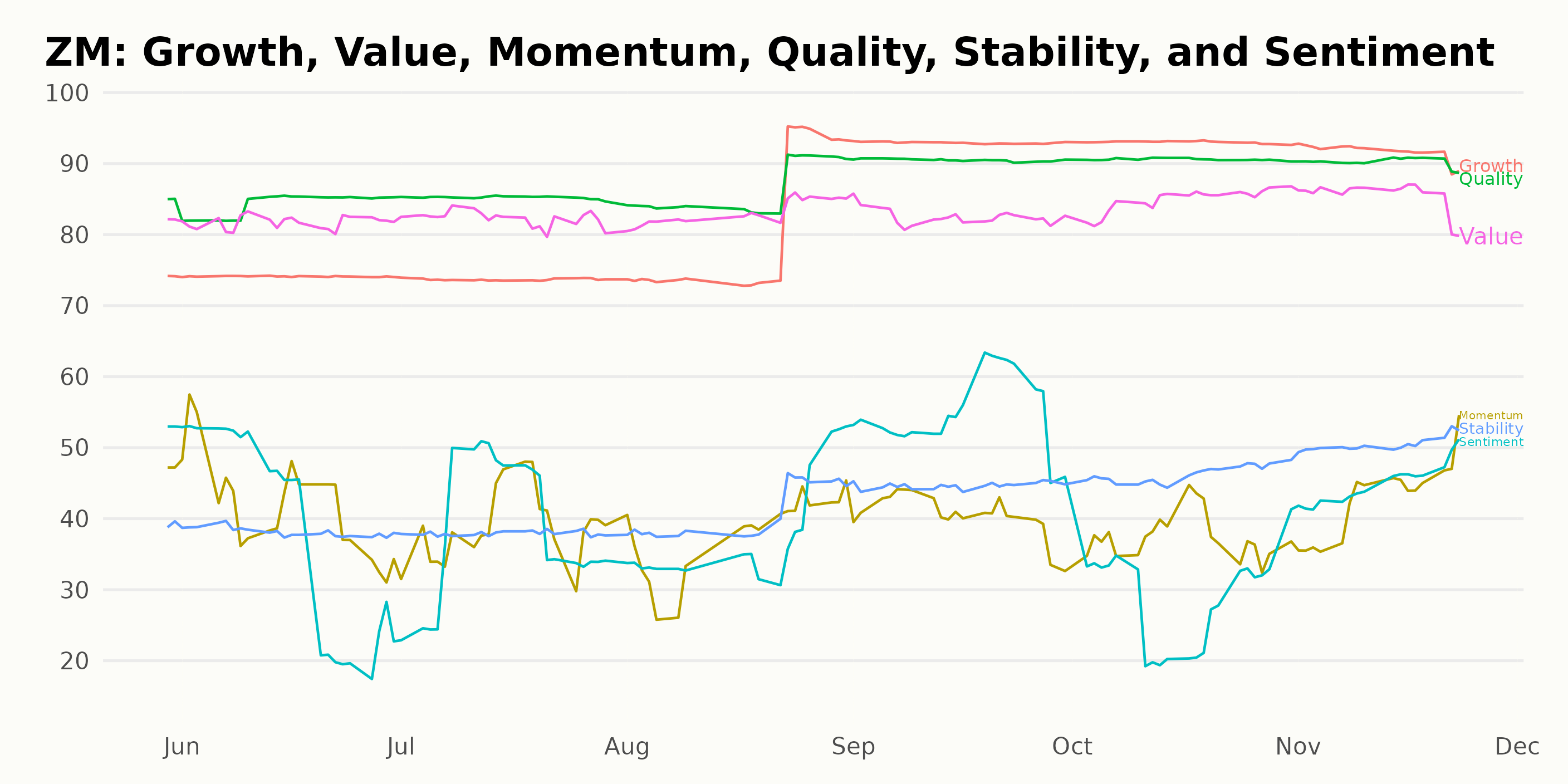

Zoom’s 2023 POWR Ratings Trend: Growth, Quality, and Value Analysis

ZM has an overall A rating, translating to a Strong Buy in our POWR Ratings system. It is ranked #6 out of the 74 stocks in the Technology - Services category.

Looking at the POWR Ratings for Zoom Video Communications, Inc. (ZM) along six dimensions, the three most noteworthy dimensions presented are Growth, Quality, and Value.

Growth: The growth dimension was 74 in May 2023 and remained stable until August 2023, when it increased to 82. Thereafter, the growth exploded, reaching 93 by September 2023. It stayed at that level through October 2023 before a slight dip to 92 in November 2023.

Quality: In May 2023, Zoom had a strong Quality rating of 85. The rating slightly decreased to 84 in June but returned to 85 in July and August 2023. There was a significant increase in the quality rating in September 2023, reaching to 91 and maintaining this up to October. However, there was a small decrease to 90 in November 2023.

Value: In terms of the Value dimension, Zoom obtained a robust rating of 82 in May and June 2023, which held steady until July. We see a modest rise to 83 in August. September showed no change, but an increase was observed in October, with a score of 85. This upward trend continued, ultimately reaching 86 in November 2023.

These three dimensions suggest that for most of 2023, Zoom Video Communications, Inc. had high growth potential, exhibited high-quality operation and offered relative value compared to its price.

How does Zoom Video Communications, Inc. (ZM) Stack Up Against its Peers?

Other stocks in the Technology - Services sector that may be worth considering are Box, Inc. (BOX), LiveRamp Holdings, Inc. (RAMP), and Teradata Corporation (TDC) -- they have better POWR Ratings.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

ZM shares were trading at $64.43 per share on Friday afternoon, up $0.60 (+0.94%). Year-to-date, ZM has declined -4.89%, versus a 20.28% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

Zoom Video Communications (ZM) Post-Earnings Analysis: Insights for Investors StockNews.com