Wynn Resorts (WYNN) has withstood a lot of volatility in the travel-and-leisure sector this year.

It’s quietly putting in its seventh daily gain in the past eight sessions -- and is working on a key breakout.

At the start of the year, many travel-related stocks, like airlines, cruise lines, booking sites, Las Vegas stocks and more, were exploding higher. With all the talk of a looming economic slowdown and possible recession, the travel sector was indicating something much different.

Then, a number of these names topped out in February and suffered nasty pullbacks.

In the case of Wynn, the shares hit a high of $116.51 on March 3, then pulled back by more than 12%.

Don't Miss: Two Key Las Vegas Strip Resorts Casinos Could Be Sold

What’s followed has been a bull case that's slowly but surely gaining steam. The shares have put in a series of higher lows — a bullish technical development — while continuing to struggle with the $116 to $117 resistance area.

Other Vegas stocks continue to hold up, too. While Wynn Resorts is up 39% so far this year, MGM Resorts (MGM) and Las Vegas Sands (LVS) are up 33.3% and 32.1%, respectively. LVS recently just broke out to new year-to-date highs.

Trading Wynn Resorts Stock

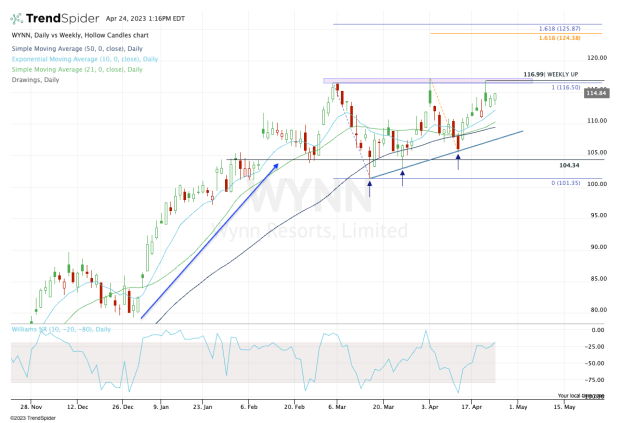

Daily chart of TrendSpider.com

Wynn stock had an explosive move to the upside, chopped below $105, then broke out over this level, too. The $105 area then became solid support — another bullish technical development.

This simply looks like bullish consolidation after a monstrous rally. Consolidation after a big rally can often be interpreted as bullish, as the stock bides its time before another potential move higher.

Three times now, the rally has stopped in the $116 to $117 zone, with last week’s high coming into play at the top of that zone.

Don't Miss: Procter & Gamble: Bulls Enjoy the Breakout; Now What?

What bulls are looking for is obvious: They want Wynn stock to break out over this area. If it can do so, $120 is a reasonable area to trim the position. But ideally the shares will rally toward the $124 to $126 area.

That zone is the 161.8% upside extension for the March range and the April range and would be the ideal area for short-term traders to lighten up on their holdings.

On the downside, it would be nice to see Wynn hold the 10-day, 21-day and 50-day moving averages near $110. Below that puts uptrend support in play.