The stock market indices posted losses in the last trading session, with the S&P 500 declining 0.1%, while the Dow and the tech-heavy Nasdaq Composite lost 0.2%. The stock market moved downward after the Fed’s chair Jerome Powell stated in Congress that the Central Bank is ‘strongly committed’ to lower inflation, stoking recession fears.

The Fed recently dished out a 75 basis point rate hike, marking its largest increase in decades. Moreover, according to a Reuters economist poll, the central bank might deliver another 75-basis-point interest rate hike in July, followed by a half-percentage-point rise in September.

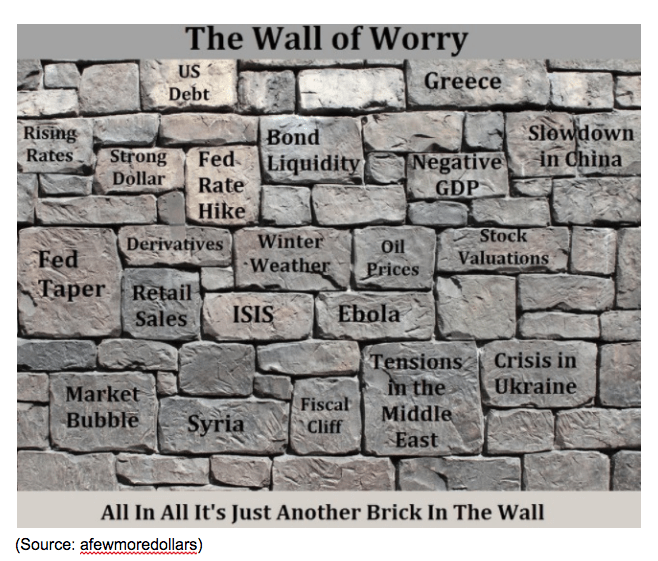

The inflation and the aggressive rate hikes have led to significant market volatility. The CBOE Volatility Index (^VIX) is up almost 70% this year. Moreover, the FTSE Russell completes the rebalancing of indices this Friday, which might induce more volatility in an already nervous market.

Amid this situation, the fundamentally strong and stable stocks Johnson & Johnson (JNJ), Roche Holding AG (RHHBY), and KT Corporation (KT) might be ideal investments. These stocks are rated ‘Strong Buy’ or ‘Buy’ in our proprietary POWR Ratings system.

Johnson & Johnson (JNJ)

JNJ engages in the global research, development, manufacture, and sale of various healthcare products. The company operates through the three broad segments of Consumer Health; Pharmaceutical; and MedTech.

On June 20, JNJ announced the launch of the new J&J Satellite Center for Global Health Discovery (Satellite Center) at Singapore’s Duke-NUS Medical School. On April 25, JNJ announced the launch of the J&J Satellite Center for Global Health Discovery at its Holistic Drug Discovery and Development Centre, University of Cape Town, in Cape Town, South Africa. The center establishments are expected to bolster the company’s global scientific network.

On April 19, the company declared a quarterly dividend of $1.13 per share, which marked a 6.6% increase from its prior dividend of $1.06 per share. The dividend was payable on June 7 and cumulates to $4.52 per share annually. This reflects on JNJ’s ability to shareholder return.

For the fiscal first quarter of 2022, JNJ’s reported sales increased 5% year-over-year to $23.43 billion. Adjusted net earnings and adjusted EPS came in at $7.13 billion and $2.67, registering a rise of 3% and 3.1% from the same period the prior year.

Analysts expect JNJ’s EPS to increase 3.6% year-over-year to $2.57 for the quarter ending June 2022. Likewise, Street expects revenue for the same quarter to improve 2.4% from the prior-year quarter to $23.87 billion. Moreover, JNJ has an impressive surprise earnings history, as it has topped consensus EPS estimates in each of the trailing four quarters.

JNJ’s shares 4.7% over the past six months and 2.7% year-to-date to close its last trading session at $175.74.

JNJ’s strong fundamentals are reflected in its POWR Ratings. The stock has an overall rating of A, equating to Strong Buy in our proprietary rating system. The POWR Ratings are calculated by considering 118 different factors, with each factor weighted to an optimal degree.

JNJ has a Stability grade of A and a Quality grade of B. In the 168-stock Medical – Pharmaceuticals industry, it is ranked #12.

Click here to see the additional POWR Ratings for JNJ (Growth, Value, Momentum, and Sentiment).

Roche Holding AG (RHHBY)

RHHBY, based in Basel, Switzerland, is a prescription pharmaceutical and diagnostics company operating internationally. The company’s offerings include pharmaceutical products and in vitro diagnostics solutions.

On June 16, RHHBY announced the launch of its human papillomavirus (HPV) self-sampling solution in countries accepting the CE mark, which enables patients to collect samples for HPV screening privately. The new launch should add to the company’s revenue stream.

On June 15, the company announced that it had received Emergency Use Authorization (EUA) for the cobas SARS-CoV-2 Duo PCR test from the U.S. Food and Drug Administration (FDA). The new test might benefit the company.

For the fiscal year 2021, RHHBY’s sales increased 7.7% year-over-year to CHF62.80 billion ($65.12 billion). Core net income rose 4% from the prior year to CHF18.07 billion ($18.74 billion). Core EPS improved 3.4% from the same period the prior year to CHF19.81.

The consensus revenue estimate of $64.96 billion for the fiscal year 2023 indicates a 1.2% year-over-year increase.

The stock has gained 1.4% over the past five days and 1.7% intraday to close its last trading session at $39.64.

It’s no surprise that RHHBY has an overall B rating, which translates to Buy in our POWR Rating system. The stock has an A grade for Stability and a B for Value and Quality. It is ranked #16 in the Medical – Pharmaceuticals industry.

To see the additional POWR Ratings for Growth, Momentum, and Sentiment for RHHBY, click here.

KT Corporation (KT)

KT is a telecom service provider based in Seongnam, South Korea. The company’s offerings comprise fixed-line telephone services, broadband internet services, other data communication services, and media and content services.

On March 21, KT announced that it had signed an MoU in content business with CJ ENM, a media and content business company. The collaboration is expected to widen the company’s original content distribution channels.

In the first quarter of fiscal 2022, KT’s operating revenue increased 4.1% year-over-year to KRW6.23 trillion ($4.83 billion). Operating income increased 41.1% from the prior-year quarter to KRW626.60 billion ($482.25 million). The company’s net income came in at KRW455.40 billion ($350.49 million), up 39.5% from the same period last year.

The consensus revenue estimate of $14.97 billion for the fiscal year 2023 indicates a rise of 2.7% year-over-year. The consensus EPS estimate for the same year of $2.30 reflects an increase of 3.4% from the prior year.

The stock has gained 3.3% over the past six months and 11.1% year-to-date to close its last trading session at $13.97.

This positive outlook is reflected in KT’s POWR Ratings. The stock has an overall rating of A, equating to Strong Buy in our proprietary rating system.

KT has a Value, Stability, and Sentiment grade of A. In the 46-stock Telecom – Foreign industry, it is ranked #1. The industry is rated A.

In addition to the POWR Ratings grades we’ve stated above, one can see KT ratings for Growth, Momentum, and Quality here.

JNJ shares were trading at $178.81 per share on Thursday afternoon, up $3.07 (+1.75%). Year-to-date, JNJ has gained 5.87%, versus a -20.14% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

Worried About A Market Meltdown? Then Buy These Stable Stocks Now StockNews.com