Mortgage rates are finally inching down after a string of Federal Reserve rate cuts, and that shift could be enough to get buyers off the sidelines. With borrowing costs beginning to ease, many homeowners are asking the same question: Is now the right time to sell?

But for many homeowners, the choice isn’t just about market momentum; it’s about math. Do you list a home now and risk giving up a cherished ultra-low mortgage interest rate, or wait for even cheaper borrowing costs and possibly more competition?

With 2025 winding down and rates gradually easing, now is the moment to weigh your options: sell before inventory grows, or hold tight for a potentially sweeter borrowing environment. We break down what’s at stake next.

Current housing market conditions

Mortgage rates have inched lower over the past year, even if they’re still far from the pandemic-era lows many homeowners locked in. After the Federal Reserve cut interest rates three times this year, the federal funds rate fell from a range of 4.25% – 4.50% in January to 3.50% – 3.75% by December.

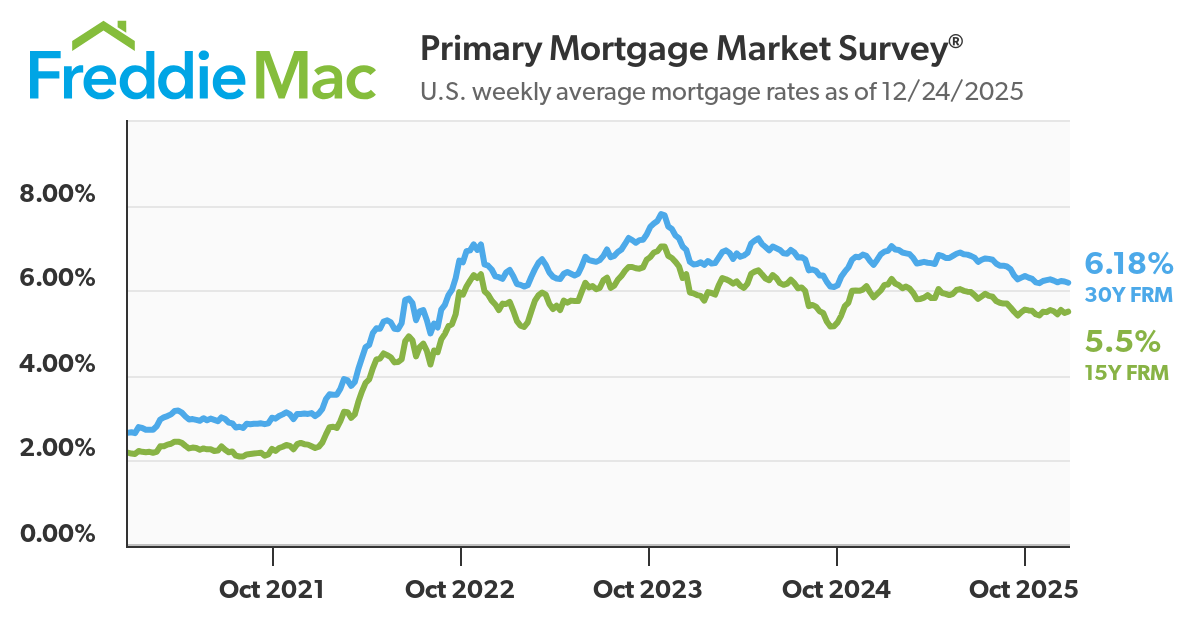

That shift has filtered into mortgage pricing. At the start of the year, the average 30-year fixed mortgage rate stood at 7.04%, with the 15-year fixed at 6.27%, according to Freddie Mac.

By December, those averages have eased to 6.18% and 5.50%, respectively. While that’s a notable improvement from the peak levels seen in 2023, borrowers shouldn’t expect a return to the ultra-low rates of 2021.

For sellers, the rate pullback is arriving alongside continued inventory constraints. Existing-home sales rose 0.5% month over month in November to a seasonally adjusted annual rate of 4.13 million, though sales remain down 1.0% from a year earlier, according to the National Association of Realtors (NAR).

Total housing inventory fell to 1.43 million units, a 5.9% decline from October, translating to a 4.2-month supply, still below levels considered balanced.

“Existing-home sales increased for the third straight month due to lower mortgage rates this autumn,” said Lawrence Yun, chief economist at NAR. “However, inventory growth is beginning to stall. With distressed property sales at historic lows and housing wealth at an all-time high, homeowners are in no rush to list their properties during the winter months.”

Mortgage rates remain closely tied to the 10-year Treasury yield, which has stayed elevated amid lingering inflation concerns and economic uncertainty. Even so, modest declines in borrowing costs can still influence buyer activity, a dynamic that continues to shape the balancing act for homeowners deciding whether to sell now or wait.

The chart below shows the trajectory of 30-year and 15-year fixed mortgage rates over the past five years.

High prices and limited inventory keep the market tight

Home prices aren’t rising as quickly as they were a year or two ago, but they’re still high. After years of rapid appreciation, price growth has cooled slightly as mortgage rates have eased.

Some overheated markets, particularly in parts of the South and West, are seeing modest pullbacks. For buyers, that may offer breathing room on pricing.

Still, the bigger story is supply. Homes remain in short supply nationwide, and that continues to put a floor under prices. According to the National Association of Realtors, inventory levels remain below what’s considered a balanced market, even as sales activity has picked up modestly.

The result is a housing market that’s less frenzied than it was during the pandemic boom, but still tilted toward sellers. Prices may not be surging, but they’re holding steady. For homeowners considering a sale, the combination of limited inventory and easing mortgage rates could help preserve negotiating power in the months ahead.

How mortgage rates impact sellers

A lower federal funds rate influences all kinds of borrowing costs, including mortgage rates. Homeowners with home equity lines of credit (HELOCs) or adjustable-rate mortgages (ARMs) should see some savings as interest rates drop. And anyone who bought when rates were higher may finally benefit from refinancing.

While lower rates can help existing borrowers, they also shape the broader housing market. Cheaper borrowing costs tend to bring more buyers back into play, which can boost demand and help sellers attract stronger offers. Conversely, when rates rise, buyers pull back, forcing sellers to price more competitively or offer concessions to close a deal.

Many would-be sellers remain “locked in” to ultra-low mortgage rates from a few years ago. Even after the Fed rate cuts, today’s 6% mortgages are still well above the 3% loans many owners refinanced into during the pandemic. That gap discourages moves unless there’s a major life change or financial need.

Still, falling rates could spur a modest wave of refinancing and home-equity borrowing, allowing homeowners to remodel, consolidate debt or fund other goals without selling.

For those with ARMs or HELOCs, lower rates can free up monthly cash flow, sometimes enough to make staying put more attractive. If borrowing costs continue to slide into 2026, more sellers may re-enter the market, easing the inventory crunch that’s kept prices high.

Should you sell your home now?

Selling a home is always a personal decision, but recent rate cuts and shifting market conditions may make now a more favorable time. Here are three reasons why it could make sense to list sooner rather than later.

1. Interest rate cuts

Lower borrowing costs often bring more buyers into the market, creating stronger demand and faster sales. As mortgage rates ease, sellers may find themselves fielding more offers and negotiating better terms.

For homeowners who’ve been waiting to downsize or relocate, a lower-rate environment can make the transition more affordable while also boosting overall housing supply.

2. Rising home equity

Many homeowners have built up substantial equity as home prices climbed over the past few years. That equity can serve as a cushion when moving, allowing you to make a larger down payment, pay off debt or upgrade to your next home with less financial strain.

Selling while values remain high can help you lock in those gains before the market adjusts further.

3. Favorable market conditions

Even as price growth slows, inventory remains tight. With more buyers competing for fewer homes, sellers could still see strong prices and even bidding wars in some areas. Listing while conditions are in your favor could help you secure top dollar before the next market shift.

Should you wait and sell your home until later?

Not every homeowner will benefit from selling right now. Here are a few reasons it might make sense to hold off.

1. Inflation and higher costs

While rate cuts can help stimulate demand, inflation remains sticky in many parts of the economy. Sellers may still face higher moving expenses, taxes and closing costs. Finding a new home at a comfortable price point could also be challenging.

2. You’ve recently refinanced

If you refinanced in the past few years, it may not be worth selling yet. Closing costs typically range from 2% to 5% of your loan balance, which can take years to recoup. Selling too soon could wipe out the savings you gained from refinancing.

3. Your home needs major repairs

Big-ticket fixes like replacing a roof or windows can quickly add up. If your home needs significant work, waiting until you’ve made improvements, or until your budget allows for them, could help you command a higher sale price later.

Bottom line

Falling rates and steady demand are bright spots for sellers, but the decision ultimately depends on your financial situation and long-term goals.

If you have strong equity and plan to move anyway, now could be an advantageous time to list. But if affordability, repairs or timing are concerns, waiting for a more balanced market might be the smarter move.

Curious about today's mortgage rates? Use the tool below to explore and compare some of today's top mortgage offers, powered by Bankrate: