The domestic pay TV industry just experienced its worst quarterly cord-cutting ever in Q1, losing 2.3 million customers, 300,000 more than the same period a year ago, according to figures compiled by equity research company MoffettNathanson.

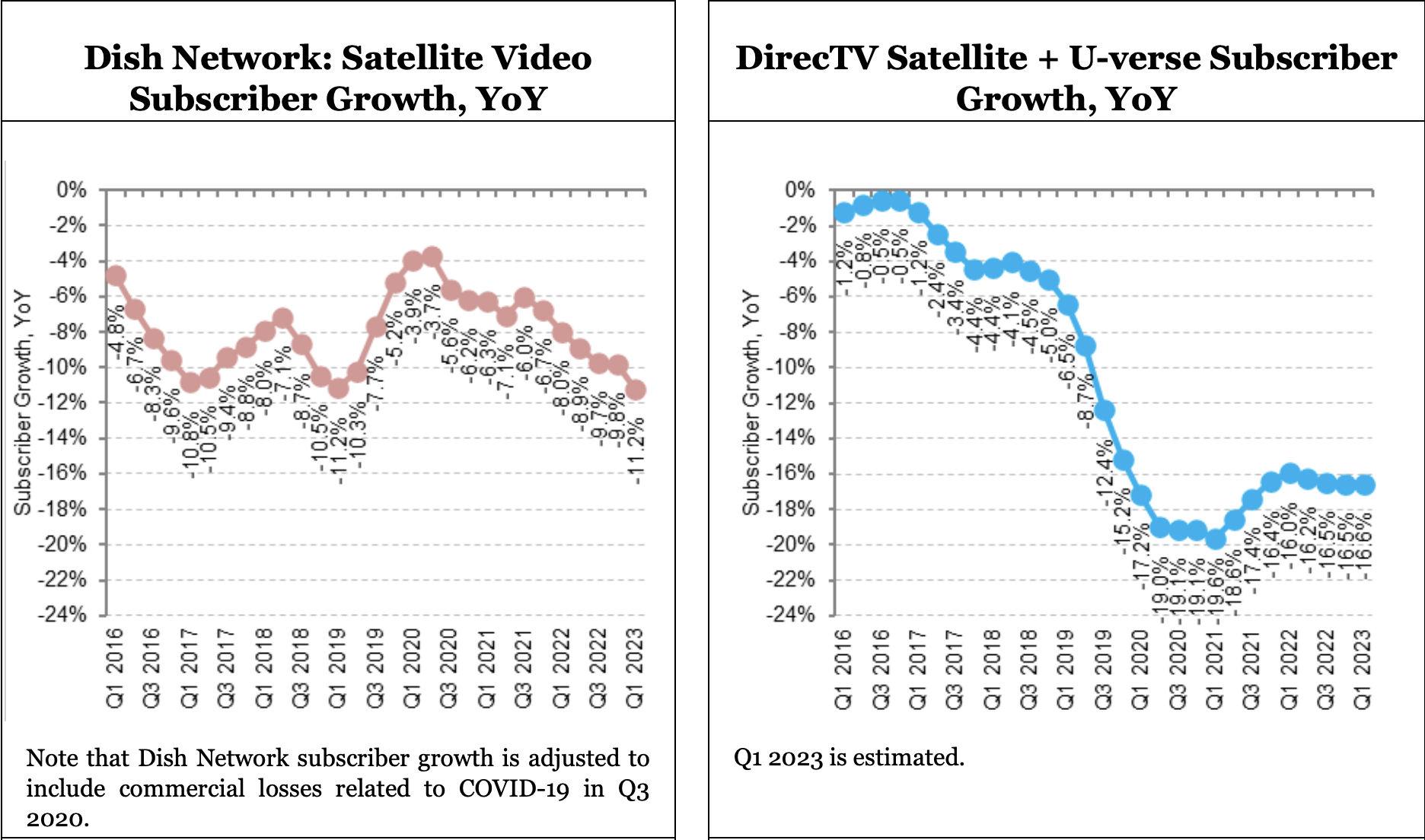

Last week, after Dish Network revealed that its cord-cutting had accelerated to an all-time-high 11.2%, Next TV made the point that the domestic pay TV industry seems to have passed a threshold, whereby the erosion of the user base further degrades the overall value proposition ... thereby further accelerating the rate of decay.

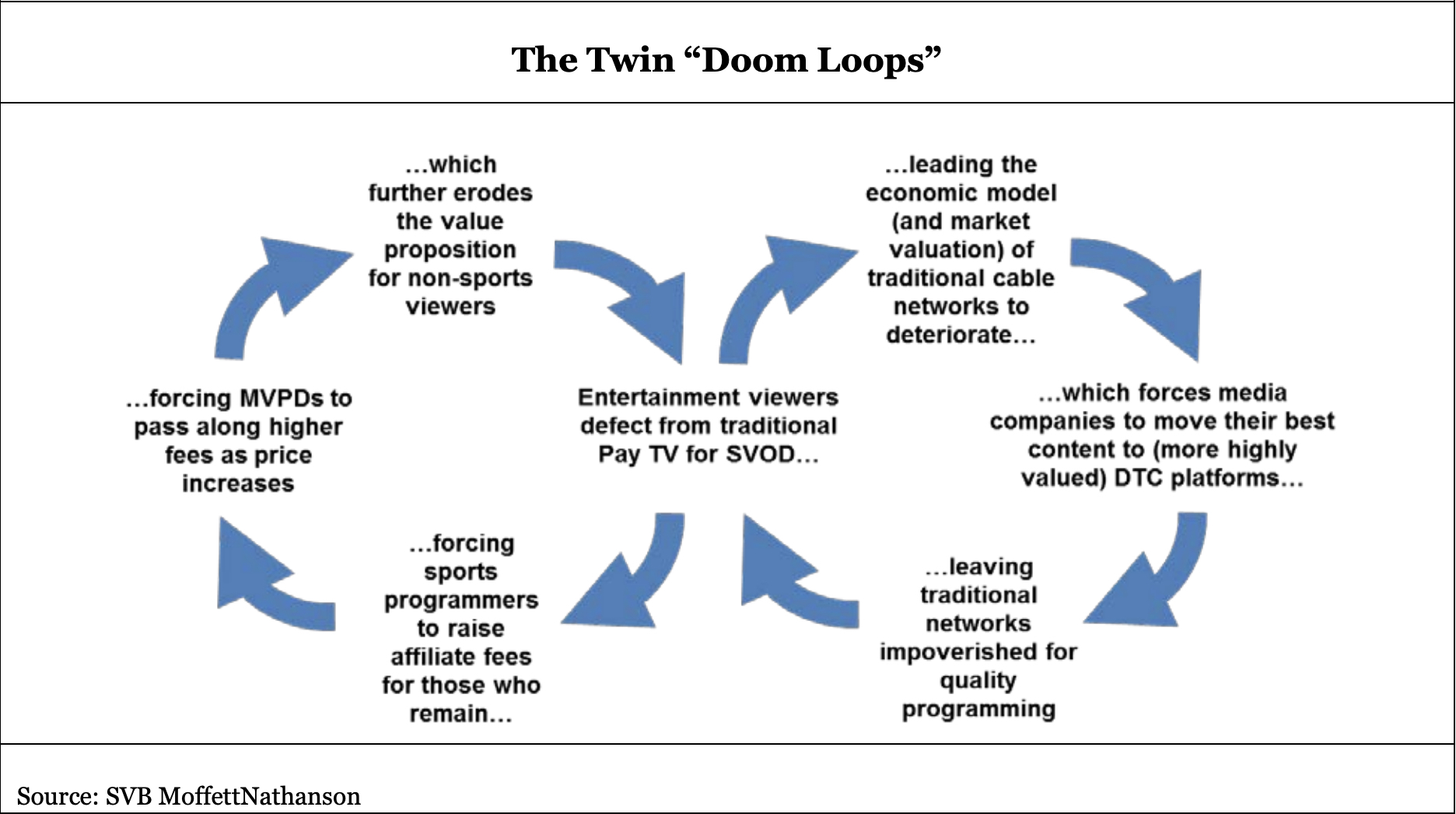

We always read deftly written MoffettNathason's reports with with a level of dread — forget ChatGPT, who needs us when these guys put it so damned clearly and eloquently, with first-hand information? And it happened again here in the firm's Q1 ”Cord-Cutting Monitor” report — principal analyst Craig Moffett even put a clever name on what's happening to linear pay TV operators: “The Doom Loop.”

The graphic below explains the virtuous cycle quite nicely. (We also think that cramming so much commercial load into linear channels to make up for declining revenue has been a huge contributor to the value erosion of pay TV.)

As Moffett puts it, the cycle of ever increasing sports licensing costs drove up pricing, chasing entertainment-seeking non-sports customers out of the market and onto things like SVOD platforms.

As churn increased, content suppliers sent more and more of their best wares to subscription streaming to chase after these lost customers — thus kicking off the “impoverishment cycle.”

And that cycle has gotten to the point at which, as Moffett noted, even the pay TV ecosystem’s most staunch supporter, ESPN, is now counting its the days for the linear model.

“We’re going to get to a point where we take our entire network, our flagship programming, and make it available direct to consumer," ESPN chief Jimmy Pitaro said last week.

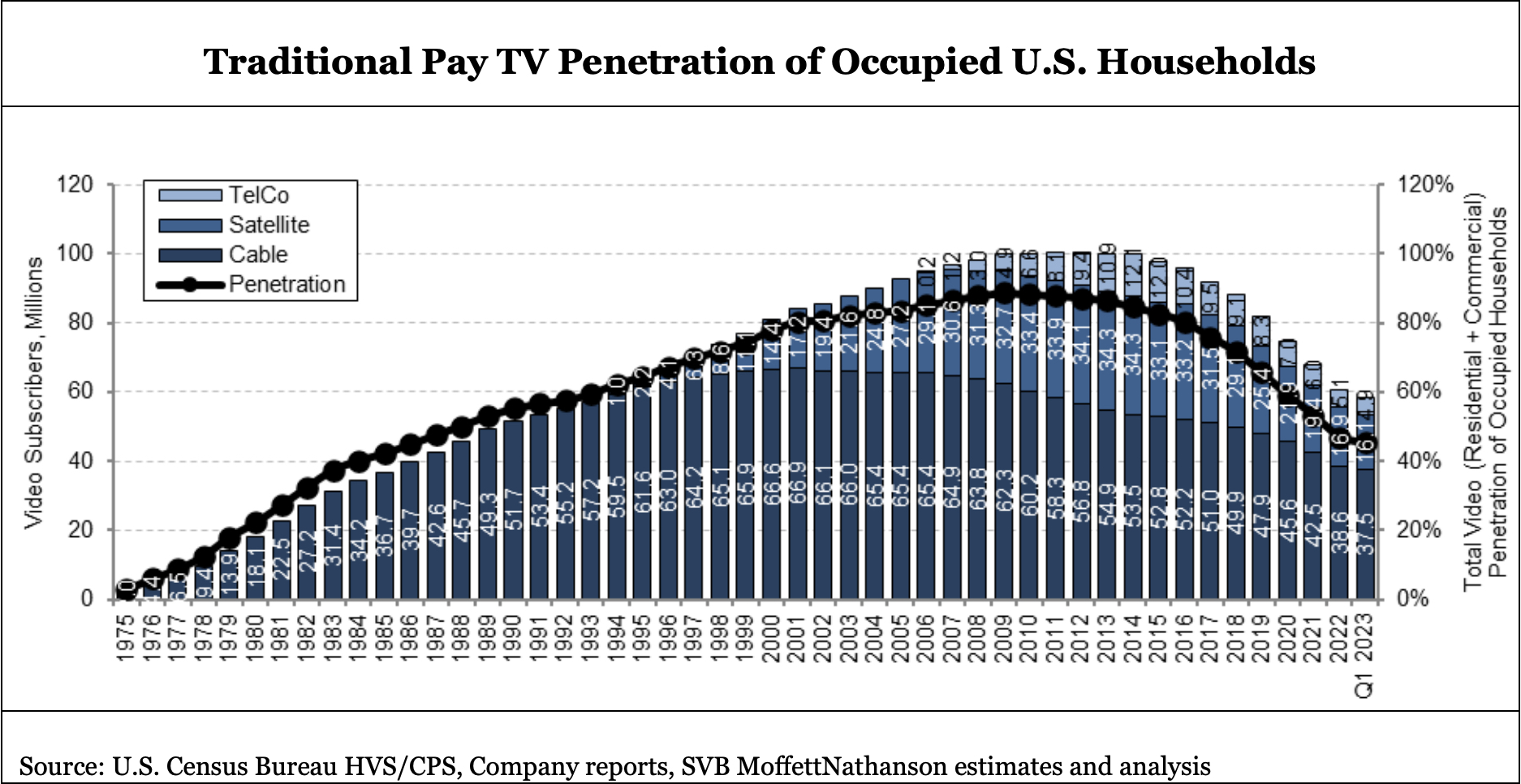

How bad are things? You have to go back 37 years to find a point at which linear cable, satellite and telco penetration (excluding vMVPD) was at just over 40 million U.S. households.

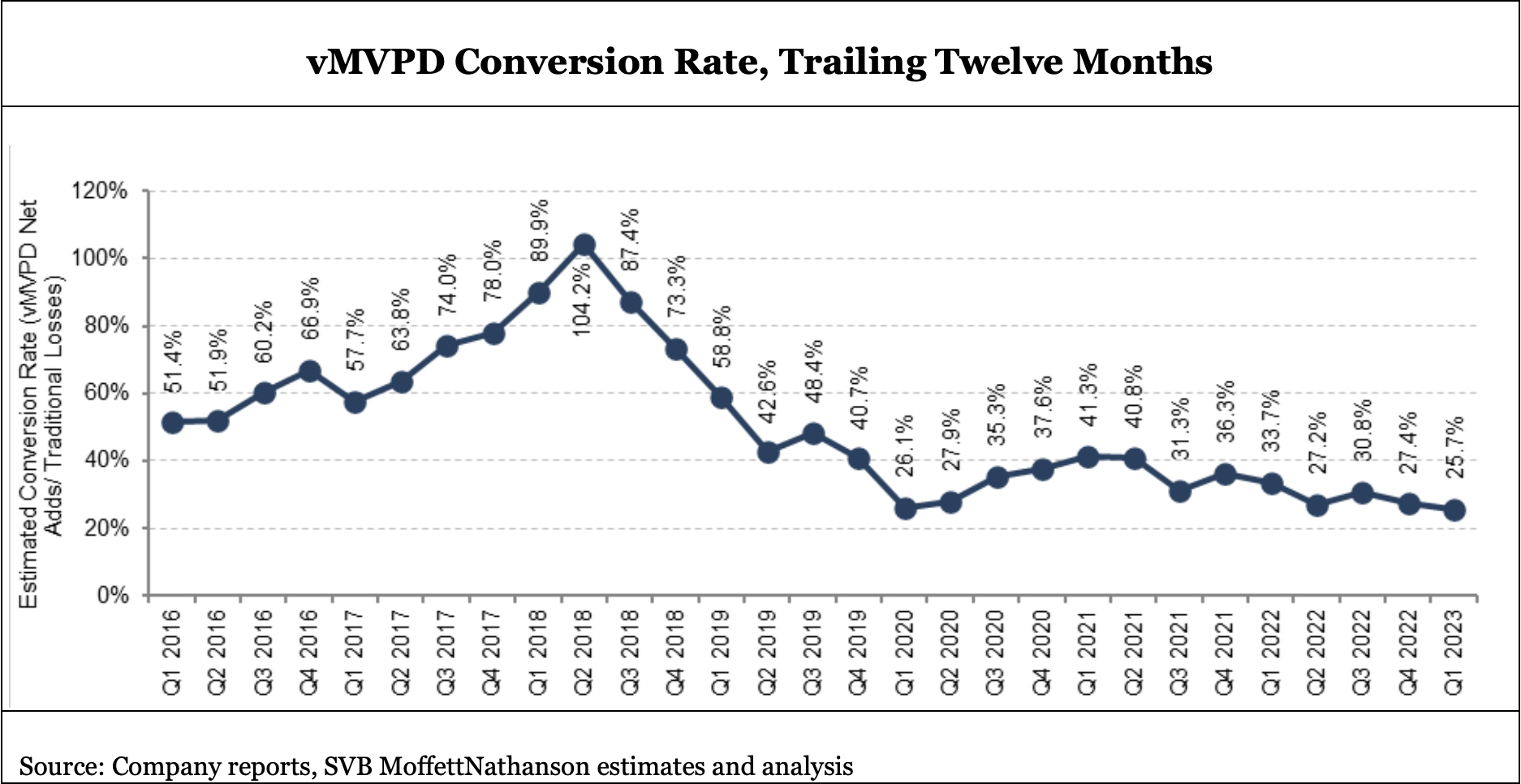

At least for a while, virtual services were capturing most, or all, of the customers that left more expensive traditional pay TV platforms. But vMVPD's have steadily risen in price, eroding their value proposition, too, and that "conversion rate" hit an all-time low of 25.7% in Q1, MoffettNathanson said.

The “Cord-Cutting Monitor” is chock full of interesting tidbits, but this one also caught our eye. (Not that eye. The other one. Our good eye.) DirecTV has been shielded from public view ever since AT&T spun it off with private equity back in 2021, but MoffettNathanson estimates it's bleeding even faster than Dish.

In fact, the firm estimates that DirecTV — which includes DirecTV satellite, DirecTV Stream vMVPD and AT&T U-verse is collapsing even faster than Comcast, which was 12.1 percent smaller, video base-wise, on March 31, 2023, than it was a year prior.