In the latest blow to the cryptocurrency sector, Genesis Global Capital and Gemini Trust were charged with the unregistered offer and sale of securities through the Gemini Earn crypto asset lending program, the Securities and Exchange Commission said.

Genesis and Gemini "raised billions of dollars’ worth of crypto assets from hundreds of thousands of investors," through the unregistered offering, the SEC charged on Jan. 12.

Investigations into other securities law violations and into other entities and persons relating to the alleged misconduct are ongoing, the SEC said.

Cryptocurrency lender Genesis Global Capital is part of a subsidiary of Digital Currency Group, which was founded by billionaire Barry Silbert.

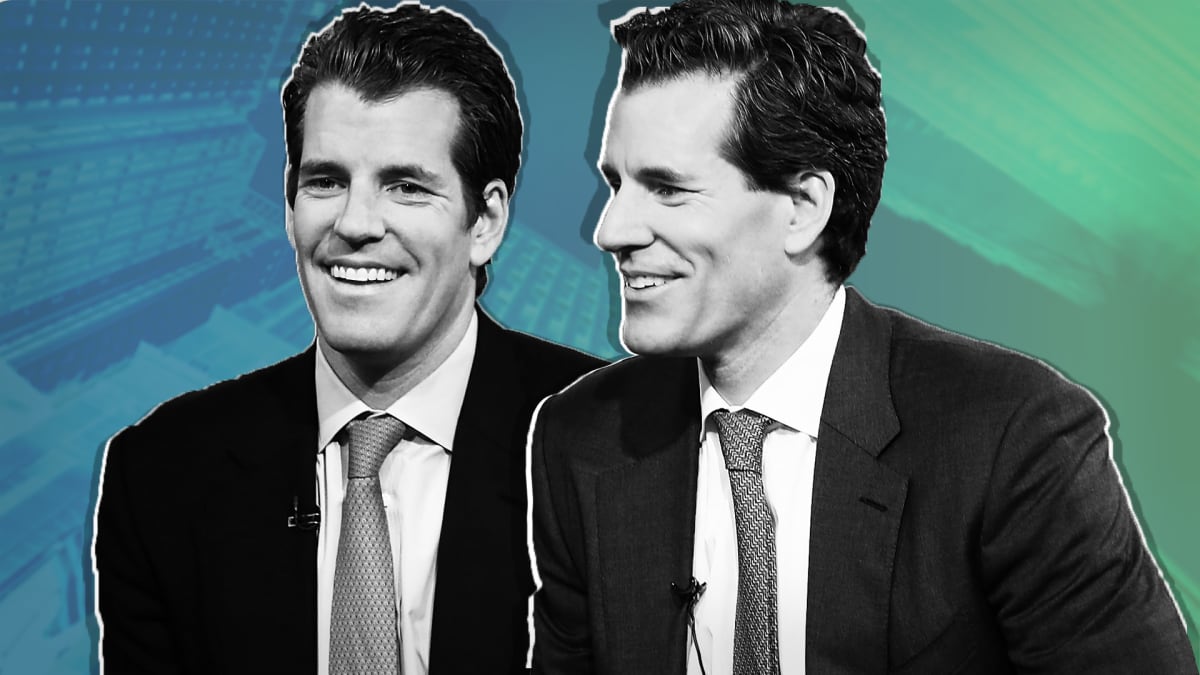

Gemini, cryptocurrency exchange, was founded Tyler and Cameron Winklevoss.

SEC Chair Gary Gensler said in a statement that the charges "build on previous actions to make clear to the marketplace and the investing public that crypto lending platforms and other intermediaries need to comply with our time-tested securities laws."

Gensler: 'It's Not Optional. It's the Law'

"Doing so best protects investors," Gensler said. "It promotes trust in markets. It’s not optional. It’s the law.”

Tyler Winklevoss decried the SEC's actions as "super lame' and called the charges "a manufactured parking ticket."

The SEC said that in December 2020 Genesis entered into an agreement with Gemini to offer Gemini customers an opportunity to loan their crypto assets to Genesis in exchange for Genesis’ promise to pay interest.

Genesis and Gemini began offering the Gemini Earn program to retail investors in February 2021, where Gemini Earn investors tendered their crypto assets to Genesis, with Gemini acting as the agent to facilitate the transaction.

Gemini deducted an agent fee, sometimes as high as 4.29%, from the returns Genesis paid to Gemini Earn investors.

Genesis then exercised its discretion in how to use investors’ crypto assets to generate revenue and pay interest to Gemini Earn investors, the SEC said.

Last November, Genesis stopped customers from making withdrawals and issuing new loans as a result of the spectacular collapse of FTX. Gemini was also forced to pause withdrawals related to Gemini Earn.

At the time, Genesis held about $900 million in investor assets from 340,000 Gemini Earn investors.

Gemini terminated the Gemini Earn program earlier this month and Gemini Earn retail investors have still not been able to withdraw their crypto assets.

Winklesvoss Says SEC Actions 'Super Lame'

A DCG spokesperson said the company had no comment. Gemini did not immediately respond to a request for comment, but co-founder Tyler Winklevoss had plenty to say on Twitter.

"It’s disappointing that the @SECGov chose to file an action today as @Gemini and other creditors are working hard together to recover funds," Tyler Winklesvoss tweeted on Jan 12. "This action does nothing to further our efforts and help Earn users get their assets back. Their behavior is totally counterproductive."

He said that there was discussions with the SEC about the Earn program for more than 17 months and "they never raised the prospect of any enforcement action until AFTER Genesis paused withdrawals on November 16th."

"Despite these ongoing conversations, the SEC chose to announce their lawsuit to the press before notifying us," Tyler Winklevoss tweeted. "Super lame. It’s unfortunate that they’re optimizing for political points instead of helping us advance the cause of 340,000 Earn users and other creditors."

He added that "we look forward to defending ourselves against this manufactured parking ticket. And we will make sure this doesn’t distract us from the important recovery work we are doing."

Silbert founded a crypto empire consisting of DCG, which controls Grayscale Investments, a digital-asset-management company that runs a bitcoin trust.

Cameron Winklevoss and Silbert have had a very public feud over the situation with both sides trading accusations.

DCG is also the parent of Foundry Digital, a crypto-mining-services provider, and Luno, a London cryptocurrency exchange.

The firm also owns the crypto news site CoinDesk, which had published the article that caused suspicion around FTX, and Genesis.

Gensler's SEC 'Following Up on Enforcement'

"As frequently promised, Gary Gensler’s SEC is following up on their enforcement of the ICO market by going after crypto asset lending programs such as Gemini Earn," said David Lesperance, managing partner of immigration and tax adviser with Lesperance & Associates.. This is not unexpected when one analyses these offerings under the Howey Test, which defines securities."

Lesperance said the Howey Test states that an offering is a security if there is an "investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.”

"Whether ICOs, lending programs or various new DeFi offerings," he said, "this latest enforcement effort means that those operating in the crypto space always need to keep a weather eye on securities compliance."

Frank Corva, senior analyst for digital assets with Finder, criticized the SEC's actions as "too little, too late."

"What we are seeing from SEC Chair Gensler and the SEC is yet another instance of their regulating by enforcement," Corva said. "Gensler has become well known for not providing a proper regulatory framework under which crypto companies should operate and then arbitrarily charging companies with violating the law."

He noted that the Earn program has existed since February 2021, meaning the SEC "had almost two years to assess the product and to request that Gemini and Genesis shut the product down."

"Gensler and the SEC want to swoop in now, though, after 340,000 unsecured creditors for Gemini’s Earn program are out a total of $900 million," Corva said. "The SEC’s job is to protect American investors, but said investors have already been hurt due to a lack of proper oversight from the SEC."