1929’s “Black Thursday” was a stock market crash that marked the beginning of the great depression. 1987’s “Black Monday” was also a devastating blow to financial markets that decimated $1.71 trillion of wealth in a single day.

Despite its similar name, Black Friday is the moniker of a much more benign phenomenon — the biggest and most publicized shopping day of the year.

Every year on the Friday after Thanksgiving, millions of turkey-stuffed Americans used to overcome their tryptophan-induced tiredness to brave early-morning shopping center crowds in search of the best deals on the hottest products ahead of the winter holidays.

And while this still occurs to some extent today, much of the fervor has moved online, where cold temperatures, overnight camping, and dangerous retail stampedes can be easily avoided. And since the bulk of Black Friday shopping now occurs “from the warm glow of shoppers’ smartphone screens,” it’s become quite a bit easier to measure its volume in recent years.

💰💸 Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter 💰💸

So, just how much have Black Friday and Cyber Monday sales volume grown over time? And were 2024’s Black Friday and Cyber Monday the biggest ever?

Here’s what you should know.

Were Black Friday & Cyber Monday 2024 the biggest ever?

According to Adobe analytics, Black Friday 2024 was the biggest ever by online sales, which reached $10.8 billion. This marks a 10.2% increase year over year.

Interestingly, many shoppers got a jump on their Black Friday shopping, spending a whopping $6.1 billion in online retail on Thanksgiving itself. November 30th, the day after Black Friday, saw $5.3 billion in online retail sales, according to the analytics firm.

Online Cyber Monday sales also broke last year's record, according to Adobe, reaching an all-time high of $13.3 billion, exceeding the firm's projection by $100 million.

Mastercard shared slightly different figures, reporting that online Black Friday sales rose 14.6% compared to 2023, while brick-and-mortar retail sales jumped 3.4% year over year.

Related: Amazon has an airline? Everything you need to know

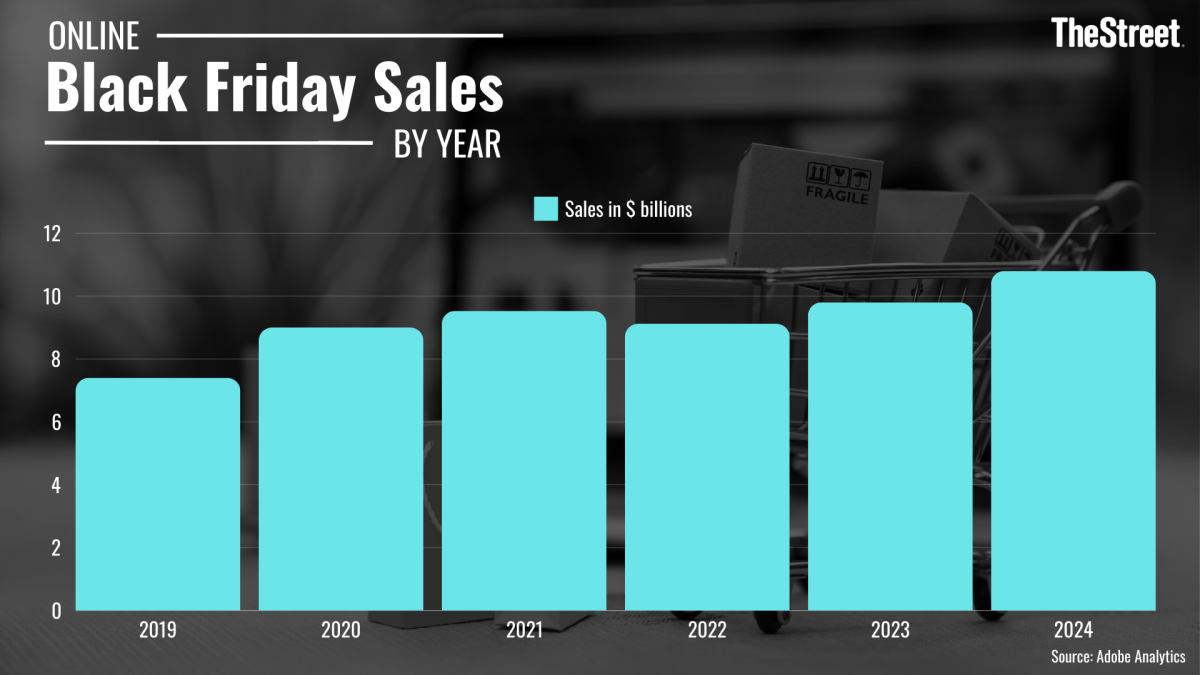

Black Friday sales volume by year

Since 2019, consumers have spent more money online shopping on Black Friday than they did the year before, with one exception — on Black Friday 2022, online shoppers spent about $410 million less than they did in 2021. At the time, the inflation rate had been above 6% for a year, which could help explain the slight decline in Black Friday shopping.

Here’s how much consumers spent online on Black Friday each year from 2019 to 2024:

| Year | Online Black Friday spending |

|---|---|

2024 |

$10.80 billion |

2023 |

$9.80 billion |

2022 |

$9.12 billion |

2021 |

$9.53 billion |

2020 |

$9.00 billion |

2019 |

$7.40 billion |

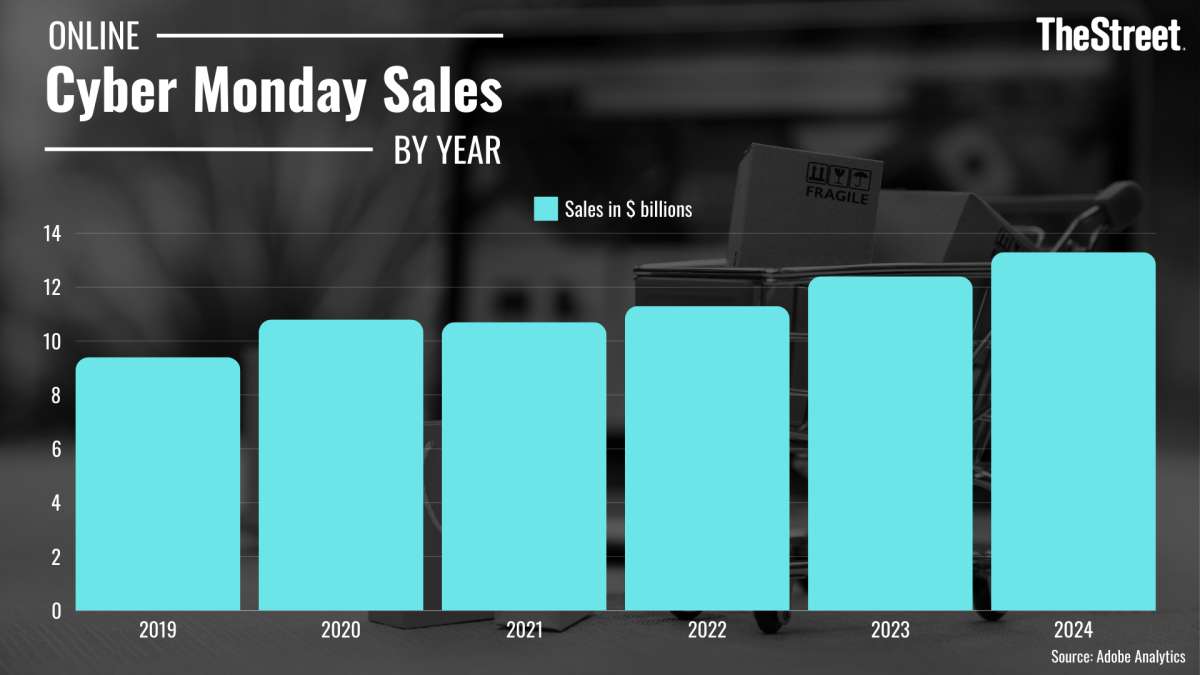

Cyber Monday sales volume by year

Much like Black Friday, online Cyber Monday revenues have increased every year since 2019 with a single (and relatively small) exception — this time in 2021 instead of 2022. In November of 2021, inflation had only been above the Fed’s 2% target for about 8 months, and Cyber Monday sales only dropped by about $100 million compared to the year before.

2024's Cyber Monday sales reached an all-time high of $13.3 billion, exceeding Adobe's expectations by $100 million.

Here’s how much consumers spent online on Cyber Monday each year from 2019 to 2024:

| Year | Online Cyber Monday Spending |

|---|---|

2024 |

$13.30 billion |

2023 |

$12.40 billion |

2022 |

$11.30 billion |

2021 |

$10.70 billion |

2020 |

$10.80 billion |

2019 |

$9.40 billion |

More consumer finance:

- Amazon has an airline? Everything you need to know

- Starbucks 2024 holiday menu: When it launches & what to order

- The most punctual (& delayed) airlines in 2024

How have Black Friday and Cyber Monday changed over the years?

Aside from some inflation and supply chain-related hiccups, Black Friday and Cyber Monday have been growing steadily in popularity, and more and more consumer dollars have been flowing into online retail each year.

Over the past decade or so, retailers have been beginning their Black Friday and Cyber Monday promotions earlier and earlier — and extending them longer and longer, muddying the waters of which sales do and don’t count as part of these events. Cyber Monday has become Cyber Week, and Black Friday, according to some, has been expanded to Black November.

Adobe Analytics, one of the most-cited holiday shopping statistic authorities, shared a variety of projections regarding sales volume on Black Friday and Cyber Monday proper as well as the holiday shopping season as a whole. Here's what they projected for 2024:

- Projected Black Friday 2024 online sales: $10.80 billion (confirmed)

- Projected Thanksgiving Day 2024 online sales: $6.1 billion (confirmed)

- Projected Cyber Monday 2024 online sales: $13.2 billion

- Projected overall online consumer sales November 2024: $135.50 billion

- Projected overall online consumer sales December 2024: $105.30 billion

What is Amazon’s market share of Black Friday sales?

Amazon is the undisputed behemoth of online shopping in the U.S., with $574.8 billion in total sales and an e-commerce market share of almost 63% in 2023, according to Statista. The company’s next-largest competitor, Walmart, had about a sixth of Amazon’s online sales volume that year.

But what does Amazon’s dominance of the overall online retail market look like on Black Friday — and during the rest of the holiday shopping season?

Unfortunately, we don’t have a clear answer to this question, but we do have a series of related statistics that shed some light on how pervasive Amazon is in the holiday shopping arena:

- In a 2024 survey of 1,000 Americans by Drive Research, 85% of respondents said they planned to conduct some of their Black Friday shopping on Amazon. Comparatively, only 59% said the same about Walmart.

- According to e-commerce marketing firm WiserNotify, Amazon accounts for about 17.7% of total Black Friday sales, although no source is provided for this statistic.

- 35% of respondents to Goldman Sachs’ 2024 holiday survey listed Amazon as their top holiday shopping destination.

- An article on Money & Markets claims that $1 out of every $5 spent during the holidays is spent at Amazon.

The takeaway

Love it or lament it, Black Friday (and the rest of the highly commercialized and ever-expanding holiday shopping season) is here to stay, growing year over year, and showing no signs of slowing down. 2024 saw the highest online Black Friday sales volume yet at an estimated $10.8 billion, exceeding 2023's sales by $1 billion or 10.2%.

Luckily for the crowd-avoidant, the bulk of holiday shopping volume (about 71%, according to Demandsage) now occurs online. And when it comes to online holiday shopping, Amazon is the clear leader among the major e-commerce retailers competing for holiday traffic.

Related: The 10 best investing books (according to stock market pros)