Now we know why they call it "Jensanity."

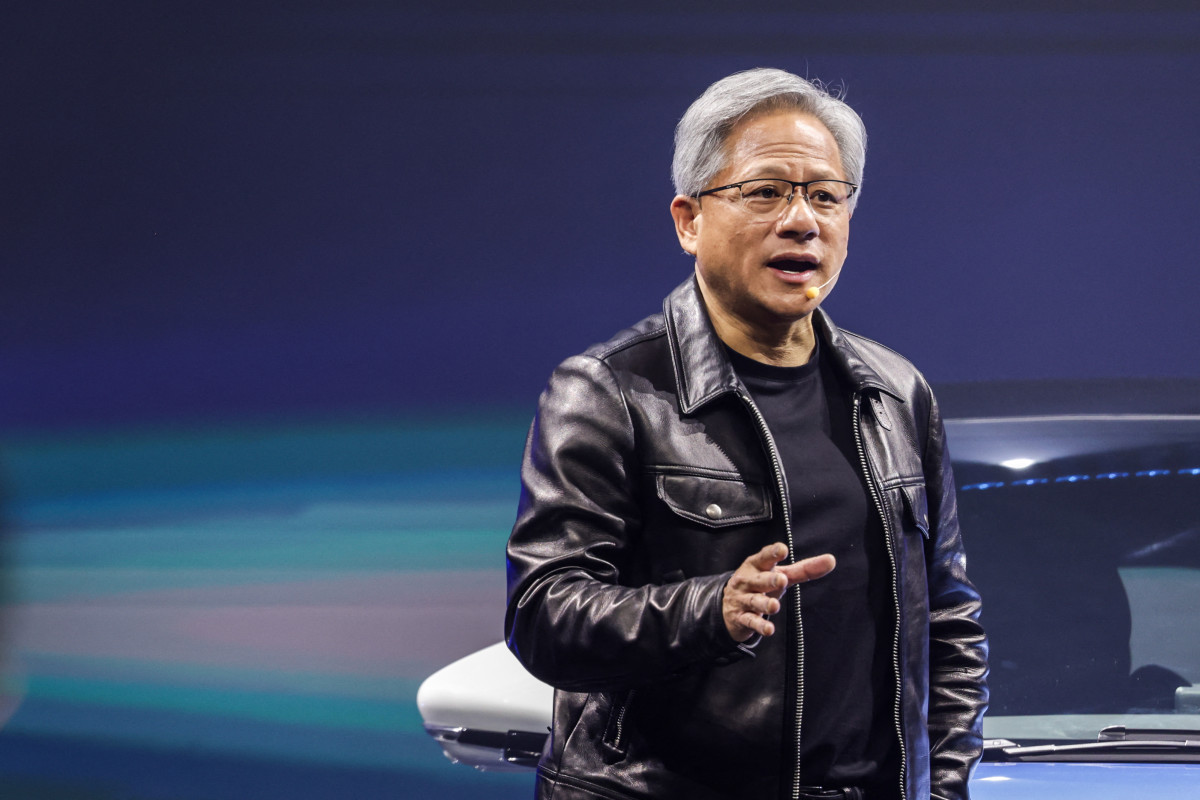

Nvidia (NVDA) CEO Jensen Huang reportedly received rock star treatment in Taiwan recently, where he was a keynote speaker at the Computex Taipei computer trade show.

Huang was the subject of wall-to-wall coverage on Taiwanese television as reporters trailed him constantly, according to Reuters.

Related: Analysts race to reset HPE stock price targets as AI powers earnings

He was mobbed by attendees at the Computex tech trade fair and featured in thousands of social media posts.

“He's just such an inspiration - he's one of us,” engineer Hol Chang said. “What he is doing will change the world.”

Broadcasters have highlighted each restaurant where Huang has dined, and “Jensanity,” as some Taiwanese have called his sky-high popularity, has taken over the island.

Professional CEO going direct:

— Lulu Cheng Meservey (@lulumeservey) June 4, 2024

Gonna need marketing and legal to sign off on my ghostwritten LinkedIn post

Jensen going direct: pic.twitter.com/WYlRvw4M42

He posed for selfies and answered questions about what he had eaten, threw the first ball at a baseball game in Taipei, and signed autographs- including a request from one female fan to sign her top across her chest.

Jensanity, indeed.

Nvidia shares are coming on strong

Huang, 61, was born in the southern city of Tainan, Taiwan's historic capital, before emigrating to the United States at the age of 9.

Some observers have noted that this kind of intense interest never happens in the U.S., where he's sometimes, but not always, recognized.

Related: Analyst resets Nvidia stock price target as CEO unveils new AI platform

No matter. People most definitely recognize the company, which has an 80% share of the market for the graphics chips that power the massive artificial intelligence datasets of hyper scalers like Meta Platforms (META) , Microsoft (MSFT) , and Alphabet (GOOG) .

Nvidia shares experienced their own kind of insanity on June 5. Shares rallied to record highs, overtaking computer giant Apple's (AAPL) in market cap.

The company had a market value of $3.019 trillion at the end of the session, compared with Apple’s, which stood at $2.99 trillion.

Nvidia became the second-most valuable public company, behind Microsoft, the world's most valuable company with a market capitalization of $3.15 trillion.

During his keynote address at Computex, Huang signaled that his company aims to introduce a new version of its flagship AI chips yearly.

“Our company has a one-year rhythm,” Huang said. “Our basic philosophy is very simple: build the entire data-center scale, disaggregate and sell to you parts on a one-year rhythm, and push everything to technology limits.”

He said a big upgrade of Nvidia's next-generation Rubin GPU (graphics processing unit) is in the pipeline and will be available from 2026.

“The next wave of AI is physical AI," Huang said. "AI that understands the laws of physics, AI that can work among us."

The company recently announced plans to begin shipping its new Blackwell GPU system in the coming months. Huang said it will update that GPU to Blackwell Ultra next year.

Bank of America Securities analysts led by Vivek Arya reiterated the firm’s buy rating on Nvidia and their $1,500 price target Wednesday after hosting investor meetings for company executives, including Chief Financial Officer Colette Kress.

The analysts said they believe Nvidia is best positioned to enable the $3 Trillion IT industry to deliver AI services.

Related: Intel's new chips take the AI fight to Nvidia, AMD

Fund manager makes a decision on Nvda stock

“Despite claims by rivals (AMD, Intel, custom chips or ASICs), we see NVDA with a multi-year lead in performance, pipeline, incumbency, scale, and developer support,” Ayra said in a research note.

Last month, Nvidia posted blowout first-quarter earnings that included a five-fold increase in overall revenue, which topped $26 billion, and a massive surge in net income that produced a bottom line of $15.24 billion.

More AI Stocks:

- Analysts retool C3.ai stock price target after earnings

- Analysts revamp Salesforce stock price targets after earnings

- Veteran fund manager issues blunt warning on Nvidia stock

Nvidia also announced a ten-for-one forward stock split that goes into effect after June 7.

A stock split is a decision by a company’s board to increase the number of outstanding shares in the company by issuing new shares to existing shareholders in a set proportion.

Stock splits come in multiple forms, but the most common are 2-for-1, 3-for-2, or 3-for-1 splits.

"One reason companies split their shares is that a psychological barrier might occur with trading high-priced shares," FINRA said on its website. "A very high stock price can intimidate investors who fear there is little room for growth, or what is known as price appreciation."

The authority reminded investors that stock splits do nothing to change a company's value and that a stock's long-term performance will depend on multiple factors, not on how its shares are split.

Nvidia, which went public in 1999, has split five times since June 2000.

TheStreet Pro's Chris Versace decided to trim back his position in AI chipmaker ahead of the stock split.

"We've seen NVDA shares drift higher so far this week, following CEO Jensen Huang’s comments at Computex and a few price target increases across Wall Street," said Versace, who began his career in equity research before founding Versace Management in 2005.

"Our view is the 10-for-1 split is largely cosmetic, and we’d rather lock in the more than 50% gain on our original NVDA purchase," he said.

Related: Single Best Trade: Wall Street veteran picks Palantir stock