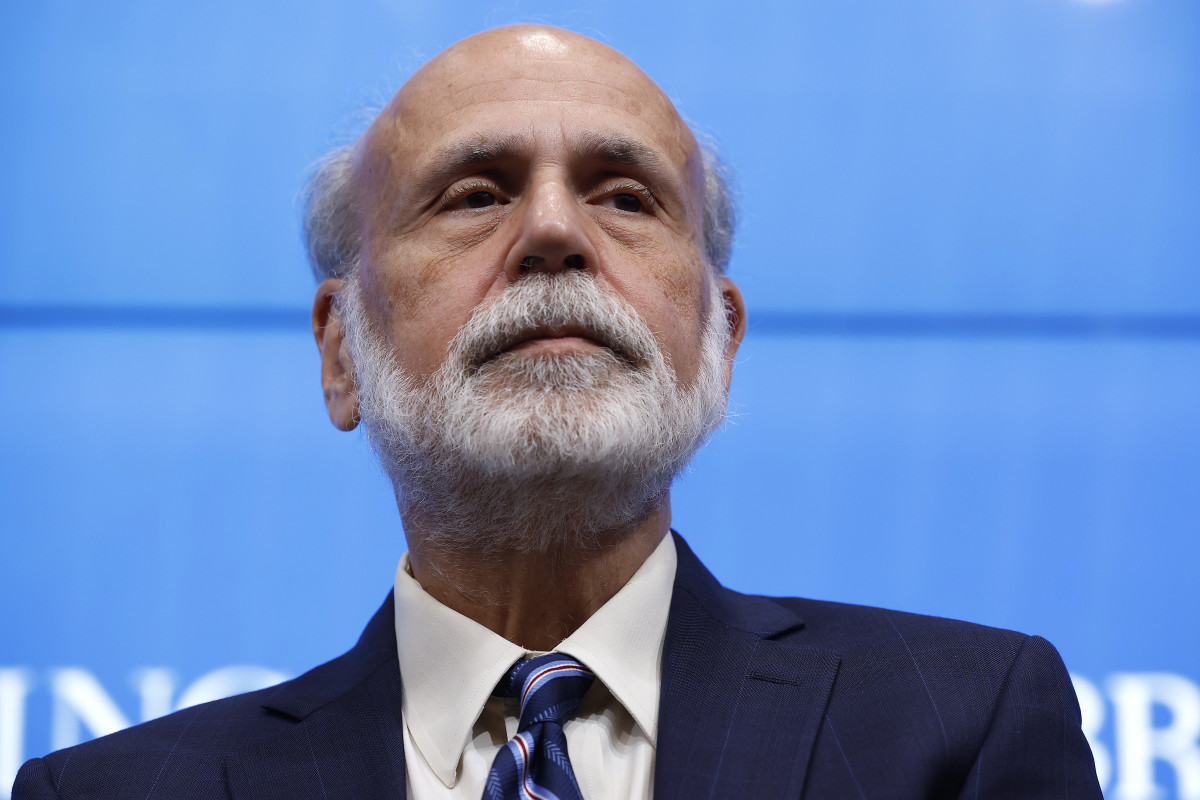

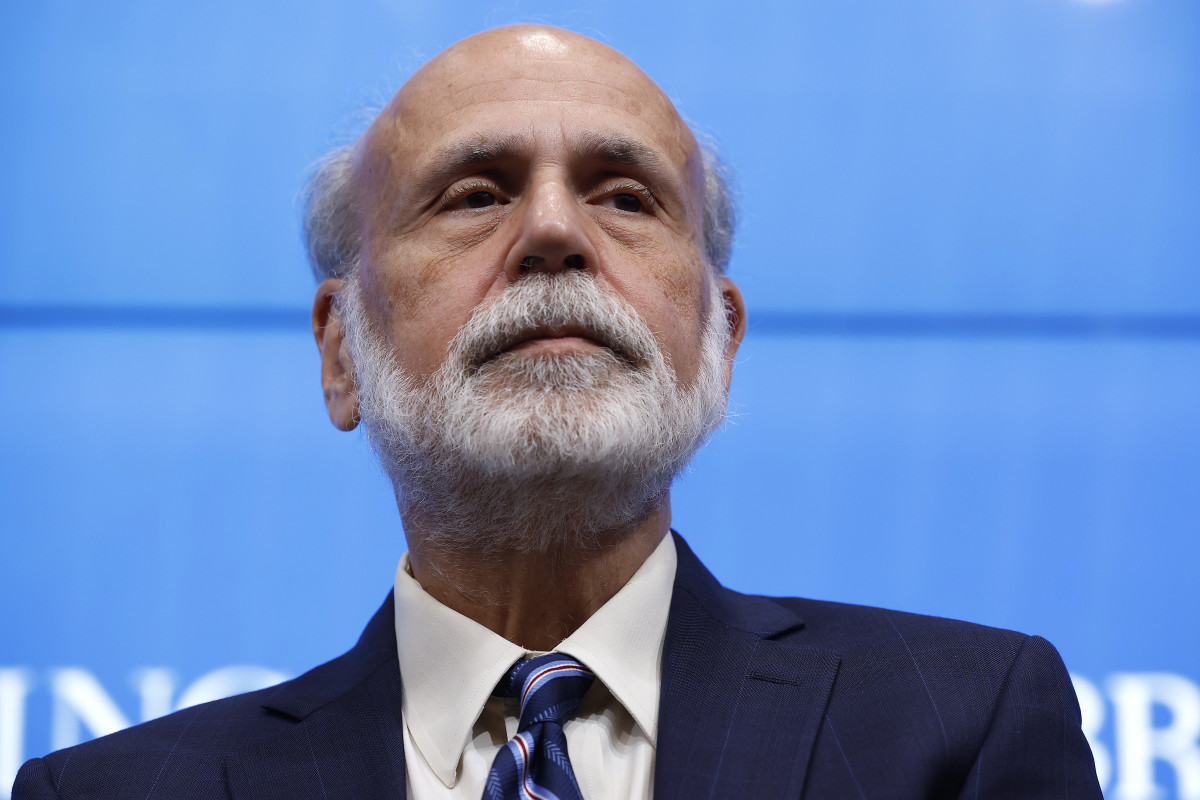

Ben Bernanke is an American economist, professor, and the 14th Chairman of the Federal Reserve. Best known for guiding the Fed's monetary policies through the Financial Crisis of 2007–2008 and subsequent Great Recession, Bernanke served under Presidents George W. Bush and Barack Obama.

His PhD dissertation at MIT focused on the Great Depression, and upon his appointment to his second term as Fed Chairman, President Obama praised him for averting another financial meltdown, saying, “As an expert on the causes of the Great Depression, I’m sure Ben never imagined that he would be part of a team responsible for preventing another.”

What is Ben Bernanke known for?

Bernanke is best known for his calm, nearly unflappable demeanor and affable, scholarly presence. During his tenure at the Federal Reserve, he increased agency transparency by instituting quarterly press conferences to explain the actions of the Federal Open Market Committee (FOMC). He also instituted a formal optimal annual inflation threshold of 2%.

But there was one event in particular that made him a household name ...

How did Bernanke and the Fed respond to the Financial Crisis & Great Recession?

Stemming from the implosion of U.S. subprime mortgages, the Financial Crisis of 2007–2008 had widespread effects, as banks had securitized the toxic debts and then traded them to investment banks for profits around the globe.

As interest rates rose, so did the monthly payments on adjustable-rate mortgages. Homebuyers could no longer afford to make their home payments, effectively toppling the first of many financial dominos.

Lehman Brothers — a large investment bank that was highly leveraged in subprime debt — declared bankruptcy, and other institutions threatened to follow suit. The S&P 500 plummeted 20% over one week in October 2008 — the very definition of a stock market crash.

Related: What happened to Lehman Brothers? Why did it fail?

Bernanke responded to the crisis with his signature calm demeanor. Helming the nation’s central bank, he positioned it as the “lender of the last resort” and played a key role in “bailing out” Wall Street investment banks, which had shouldered heavy losses from subprime mortgages and teetered on the brink of insolvency.

After Lehman Brothers declared bankruptcy on September 15, 2008, Bernanke, along with Treasury Secretary Hank Paulson and New York Fed President Timothy Geithner, worked to prevent a similar meltdown at AIG. They also provided emergency capital to keep Bear Stearns afloat and encouraged Bank of America to acquire Merrill Lynch with the promise that the Fed would guarantee their bad loans. Doing so prevented further financial contagion.

Under Bernanke’s leadership, the Fed also began cutting interest rates in order to encourage banks to lend again — to each other as well as to consumers.

In order to foster an economic recovery, the Fed Chairman also implemented quantitative easing measures by purchasing trillions worth of securities — often Treasury securities — in an effort to increase the money supply and thus inject liquidity into the markets. These actions effectively boost the economy as they foster increased spending as well as investment from banks, who then pass on the expanded credit to consumers and businesses, spurring GDP growth.

Why is Ben Bernanke called “Helicopter Ben?”

Bernanke himself coined the moniker when speaking in regard to the way Japan handled its economic crisis in the 1990s. He proposed that a broad-based tax cut could have solved its deflation problem. Instead, Japan’s central bank had implemented crippling rate hikes to calm its housing bubble — to disastrous economic effects.

Related: What Was Japan’s Lost Decade? How Did It Happen?

Responding to these actions, Bernanke argued for ways to re-inflate an economy through fiscal programs from its central bank. “A money-financed tax cut is essentially equivalent to Milton Friedman’s famous ‘helicopter drop’ of money,” he said.

However, critics have responded by blaming Bernanke for essentially “printing money” through quantitative easing, saying that over the long term, the practice creates more ill effects — such as inflation — than good.

Why did Ben Bernanke Receive the Nobel Prize?

In October 2022, Ben Bernanke was awarded the Nobel Prize in Economics. He won the award along with Douglas Diamond, an economics professor at the University of Chicago, and Philip Dybvig, an economics professor at the Washington University in Saint Louis.

Together, they published a research paper in 1983 that illustrated how bank runs had extended and deepened the Great Depression because their collapse effectively prevented savings from being turned into productive investments. This paper provided valuable lessons for his response to the Financial Crisis, and some say, could have been useful in steering the economy out of the COVID-19 Recession.

How old Is Ben Bernanke? What is his background?

Benjamin Shalom Bernanke was born on December 13, 1953, in Augusta, Georgia. His family is of Judeo-Ukrainian descent, and his grandparents immigrated to the United States in 1921. His father, a pharmacist, owned a drugstore, and his mother was an elementary school teacher.

Bernanke was the class valedictorian of his high school and received dual degrees in economics from Harvard University in 1975. He then obtained a PhD from MIT in 1979.

Before helming the Federal Reserve, Bernanke taught at Stanford University, New York University, and Princeton University. He also co-wrote two economics textbooks.

Bernanke is married and has two adult children.

More on prominent financial figures:

- Cathie Wood net worth: Why the Ark Invest CEO is an investor to watch

- Who is Jerome Powell & what is his job as Fed Chair?

- Who is Bernie Madoff? An overview of the infamous investor's life & death

When was Ben Bernanke chair of the Federal Reserve?

Bernanke served as a member of the Federal Reserve Board of Governors from 2002 to 2005. He was added to President Bush’s Economic Council in 2005 and was appointed Fed Chair on February 1, 2006.

Bernanke was subsequently appointed to a second term by President Obama and was confirmed by the Senate in 2010. His term ended in 2014.

Who replaced Ben Bernanke?

Janet Yellen was Bernanke’s successor as Fed Chair. She was the first woman to be appointed to the role and served from 2014 to 2018.

What Is Ben Bernanke’s Net Worth?

According to CNN, the then-Fed Chair’s assets ranged between $1.3 million and $2.3 million in 2013. In addition to his government salary, he also earned about $100,000 in annual royalties from sales of the textbooks he co-authored.

Celebrity wealth website Celebritynetworth.com estimated Bernanke's wealth at $5 million as of mid-2024.

Where Is Ben Bernanke Now?

Today, Bernanke is a senior fellow at the Brookings Institution in Washington, DC. He also serves as senior advisor to Pimco, an investment management firm. He maintains a residence in Skillman, New Jersey.

Related: Veteran fund manager picks favorite stocks for 2024