/Huntington%20Ingalls%20Industries%20Inc%20logo%20and%20site-by%20Wirestock%20Creators%20via%20Shutterstock.jpg)

With a market cap. of $15.2 billion, Huntington Ingalls Industries, Inc. (HII) is a leading U.S. defense company that designs, builds, overhauls, and repairs military ships, including nuclear-powered aircraft carriers and submarines for the U.S. Navy and Coast Guard. It also provides advanced mission technologies such as C5ISR systems, cybersecurity, artificial intelligence, and fleet sustainment solutions.

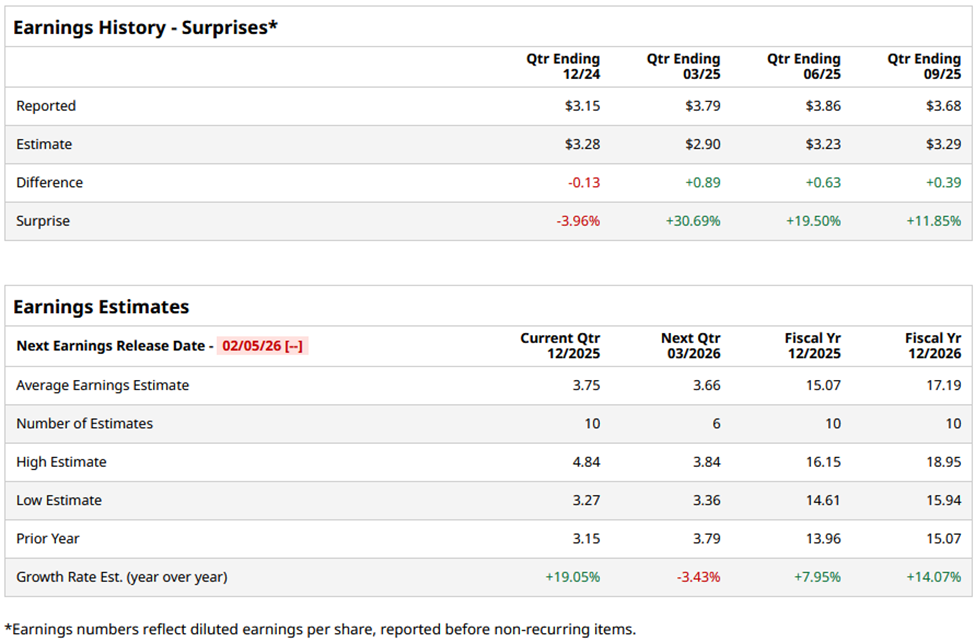

The Newport News, Virginia-based company is expected to release its Q4 2025 results soon. Ahead of the event, analysts anticipate Huntington Ingalls to report a profit of $3.75 per share, up 19.1% from $3.15 per share in the year-ago quarter. It has exceeded Wall Street's earnings expectations in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts expect HII to report EPS of $15.07, a rise of nearly 8% from $13.96 in fiscal 2024. Moreover, EPS is anticipated to grow 14.1% year-over-year to $17.19 in fiscal 2026.

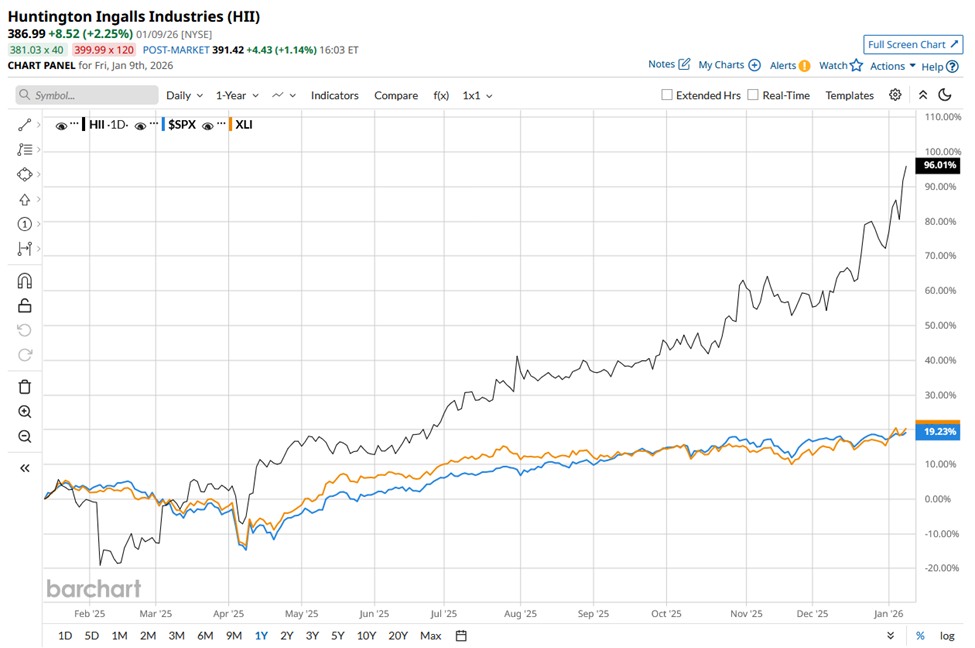

HII stock has surged 107.1% over the past 52 weeks, outperforming the S&P 500 Index’s ($SPX) 19.4% rise and the State Street Industrial Select Sector SPDR ETF’s (XLI) 23.7% return during the same time frame.

Shares of HII climbed 6.9% on Oct. 30 after the company reported strong Q3 2025 results, including record revenues of $3.2 billion and net earnings of $145 million, or $3.68 per share. Investors also reacted positively to improved profitability, with operating income rising to $161 million and operating margin expanding to 5%, driven by stronger performance at Newport News and Ingalls shipyards.

In addition, HII raised its full-year free cash flow guidance to $550 million - $650 million, backed by a strong $55.7 billion backlog and $2 billion in new contract awards during the quarter.

Analysts’ consensus opinion on the stock is cautiously optimistic, with a “Moderate Buy” rating overall. Among the 12 analysts covering the stock, five are recommending a “Strong Buy,” six recommend a “Hold,” and one suggests a “Moderate Sell.” As of writing, the stock is trading above the average analyst price target of $336.70.