/Ford%20Motor%20Co_%20logo%20by-%20Vera%20Tikhonova%20via%20iStock.jpg)

Valued at a market cap of $53.2 billion, Ford Motor Company (F) develops, delivers, and services Ford trucks, sport utility vehicles, commercial vans and cars, and Lincoln luxury vehicles. The Dearborn, Michigan-based company is scheduled to announce its fiscal Q4 earnings for 2025 in the near future.

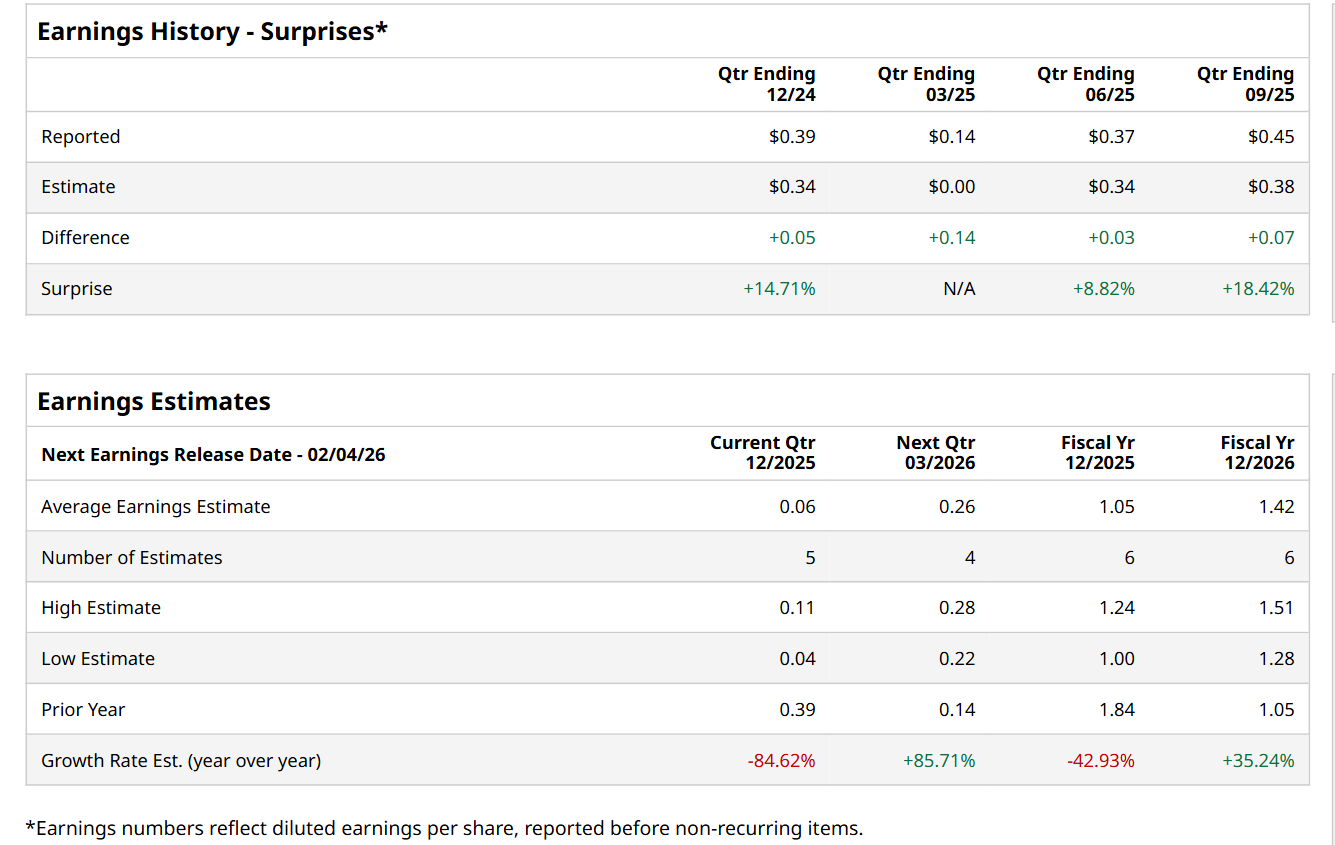

Before this event, analysts expect this auto manufacturer to report a profit of $0.06 per share, down 84.6% from $0.39 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $0.45 per share in the previous quarter exceeded the forecasted figure by a notable margin of 18.4%.

For the current fiscal year, ending in December, analysts expect F to report a profit of $1.05 per share, down 42.9% from $1.84 per share in fiscal 2024. Nonetheless, its EPS is expected to grow 35.2% year-over-year to $1.42 in fiscal 2026.

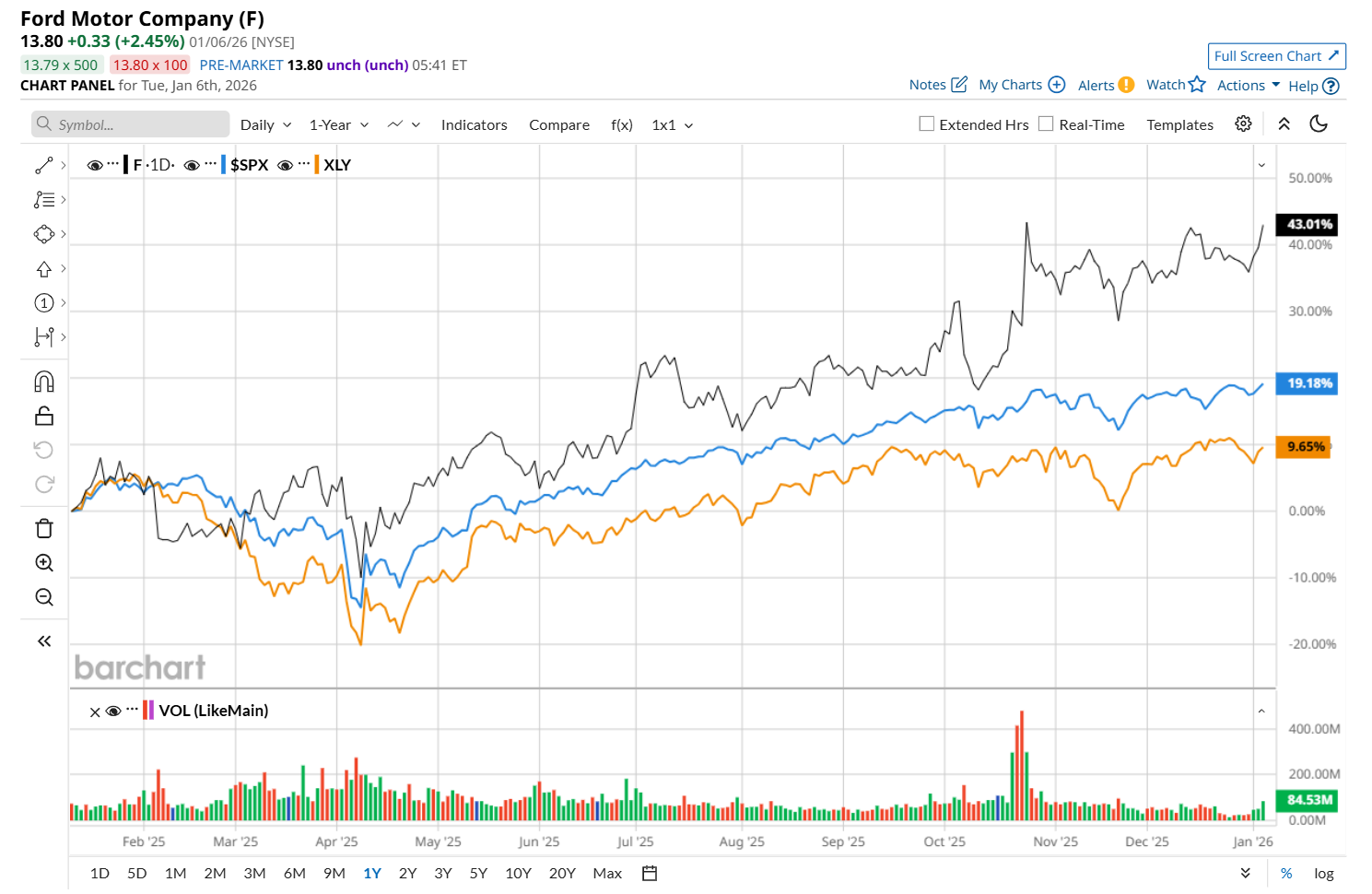

Shares of F have soared 39.1% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 16.2% return and the State Street Consumer Discretionary Select Sector SPDR ETF’s (XLY) 6.8% uptick over the same time period.

On Jan. 6, shares of Ford Motor rose 2.5% after the company posted strong sales and market-share gains. Ford beat the auto industry for the 10th straight month in December, lifting full-year market share by 0.6 percentage points. Total 2025 sales rose approximately 6% to 2.2 million vehicles, while Q4 sales increased 2.7%, marking its best annual and Q4 performance since 2019.

Momentum was further supported by record hybrid sales, with 228,072 units sold in 2025, up 21.7% year over year, including a record Q4 quarter.

Wall Street analysts are cautious about F’s stock, with a "cautious" rating overall. Among 23 analysts covering the stock, two recommend "Strong Buy," 16 indicate “Hold,” one advises a "Moderate Sell,” and four suggest "Strong Sell.” While the company is trading above its mean price target of $12.39, its Street-high price target of $15 suggests an 8.7% premium to its current price levels.