With a market cap of around $18 billion, The Trade Desk, Inc. (TTD) is a global technology company that provides a self-service, cloud-based platform for planning, managing, optimizing, and measuring data-driven digital advertising campaigns across multiple formats and channels. IT serves advertising agencies, advertisers, and other marketing service providers worldwide.

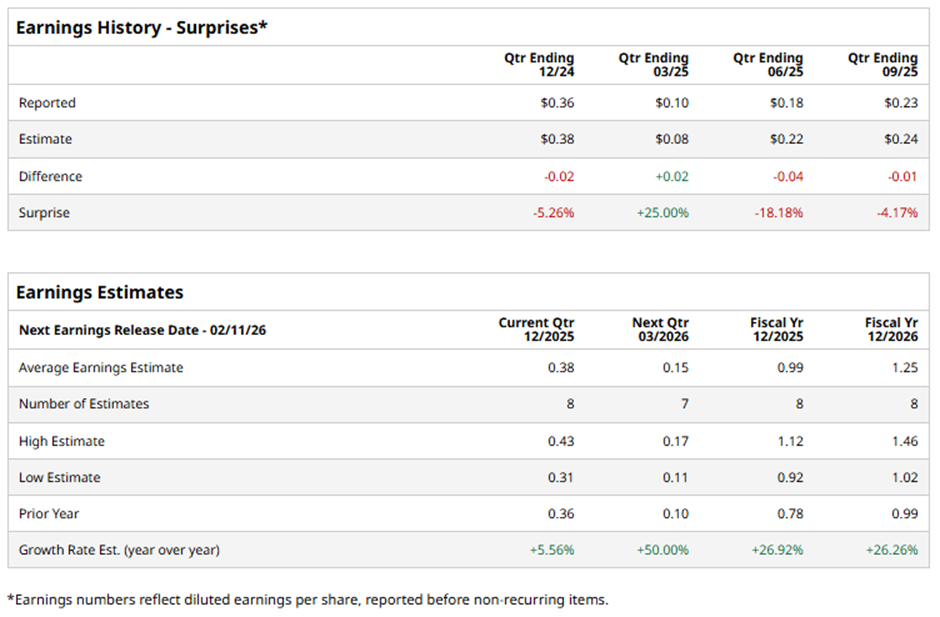

The Ventura, California-based company is expected to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts predict TTD to report an EPS of $0.38, up 5.6% from the previous year's $0.36. It has surpassed Wall Street's bottom-line estimates in one of the past four quarters while missing on three other occasions.

For fiscal 2025, analysts forecast the digital-advertising platform operator to post an EPS of $0.99, an increase of 26.9% from $0.78 in fiscal 2024.

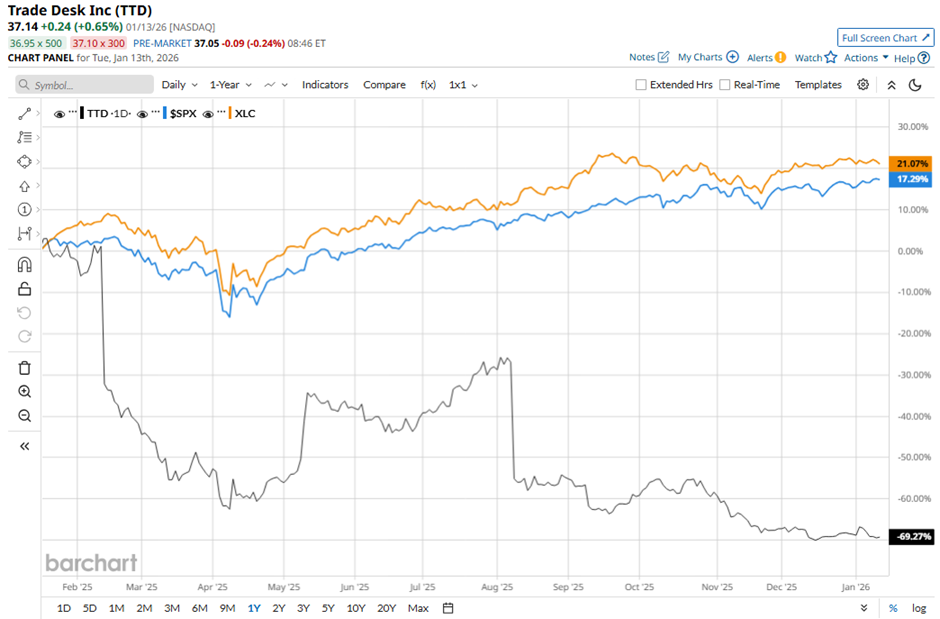

TTD stock has dropped 68.2% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 19.3% gain and the State Street Communication Services Select Sector SPDR ETF's (XLC) nearly 22% return over the same period.

Despite beating expectations with Q3 2025 adjusted EPS of $0.45 and revenue of $739.4 million on Nov. 6, shares of The Trade Desk tumbled 6.3% the next day. Revenue growth decelerated to 18% this quarter, and management cited ongoing macroeconomic uncertainty affecting sectors like CPG and retail due to tariffs and inflation.

Analysts' consensus view on TTD stock is cautiously optimistic, with a "Moderate Buy" rating. Out of 38 analysts covering the stock, 18 give a "Strong Buy," three "Moderate Buys," 14 have a "Hold," one suggests a "Moderate Sell," and two give a "Strong Sell" rating.

The average analyst price target for Trade Desk is $61.52, indicating a potential upside of 65.6% from the current levels.