/Old%20Dominion%20Freight%20Line%2C%20Inc_%20truck-by%20Andriy%20Blokhin%20via%20Shutterstock.jpg)

With a market cap of $33.3 billion, Old Dominion Freight Line, Inc. (ODFL) is a leading North American less-than-truckload (LTL) motor carrier that provides regional, inter-regional and national freight transportation services through an extensive network of service centers across the continental United States and strategic alliances throughout North America. Its core business combines LTL freight hauling with expedited transportation and value-added logistics services, including container drayage, truckload brokerage and supply chain consulting. Founded in 1934, the company is headquartered in Thomasville, North Carolina, and operates a large fleet of tractors and trailers to serve a diverse base of commercial customers.

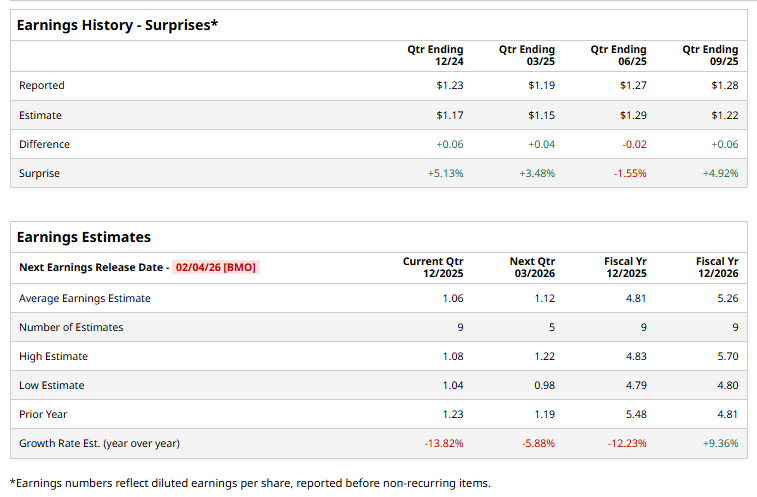

ODFL is set to release its fourth-quarter results before the markets open on Monday, February 4. Ahead of the event, analysts expect ODFL to report a non-GAAP profit of $1.06 per share, down 13.8% from $1.23 per share reported in the year-ago quarter. The company has surpassed the Street’s earnings estimates in three of the past four quarters, while missing the forecast in one quarter.

For FY2025, ODFL is expected to deliver a non-GAAP EPS of $4.81, down 12.2% from $5.48 in fiscal 2024. However, in fiscal 2026, ODFL’s earnings are expected to surge 9.4% year over year to $5.26 per share.

ODFL stock has declined 26% over the past 52 weeks, significantly underperforming the S&P 500 Index’s ($SPX) 17.8% rise and the Industrial Select Sector SPDR Fund’s (XLI) 14.7% gains during the same time frame.

On Dec. 1, shares of Old Dominion Freight Line rose 5.7% after BMO Capital upgraded the stock to “Outperform,” citing the company’s strong market position, resilient service quality, and sustained pricing power despite a broader freight industry slowdown. While the firm trimmed its price target slightly to $170, the upgrade reflected confidence that carriers focused on smaller shipments typically rebound earlier in economic recoveries, with Old Dominion’s exposure to industrial freight seen as an added tailwind as conditions improve.

The consensus opinion on ODFL stock is an overall “Moderate Buy” rating. Out of the 24 analysts covering the stock, nine recommend “Strong Buy,” one advises “Moderate Buy,” 11 suggest “Hold,” and three advocate a “Strong Sell” rating. It currently trades above the mean price target of $160.68.