/Motorola%20Solutions%20Inc%20smartphone%20and%20logo-by%20rafapress%20via%20Shuttestock.jpg)

Chicago, Illinois-based Motorola Solutions, Inc. (MSI) provides mission-critical communications, software, and services primarily for public safety and enterprise customers. Valued at a market cap of $64.8 billion, the company is ready to announce its fiscal Q4 earnings for 2025 in the near future.

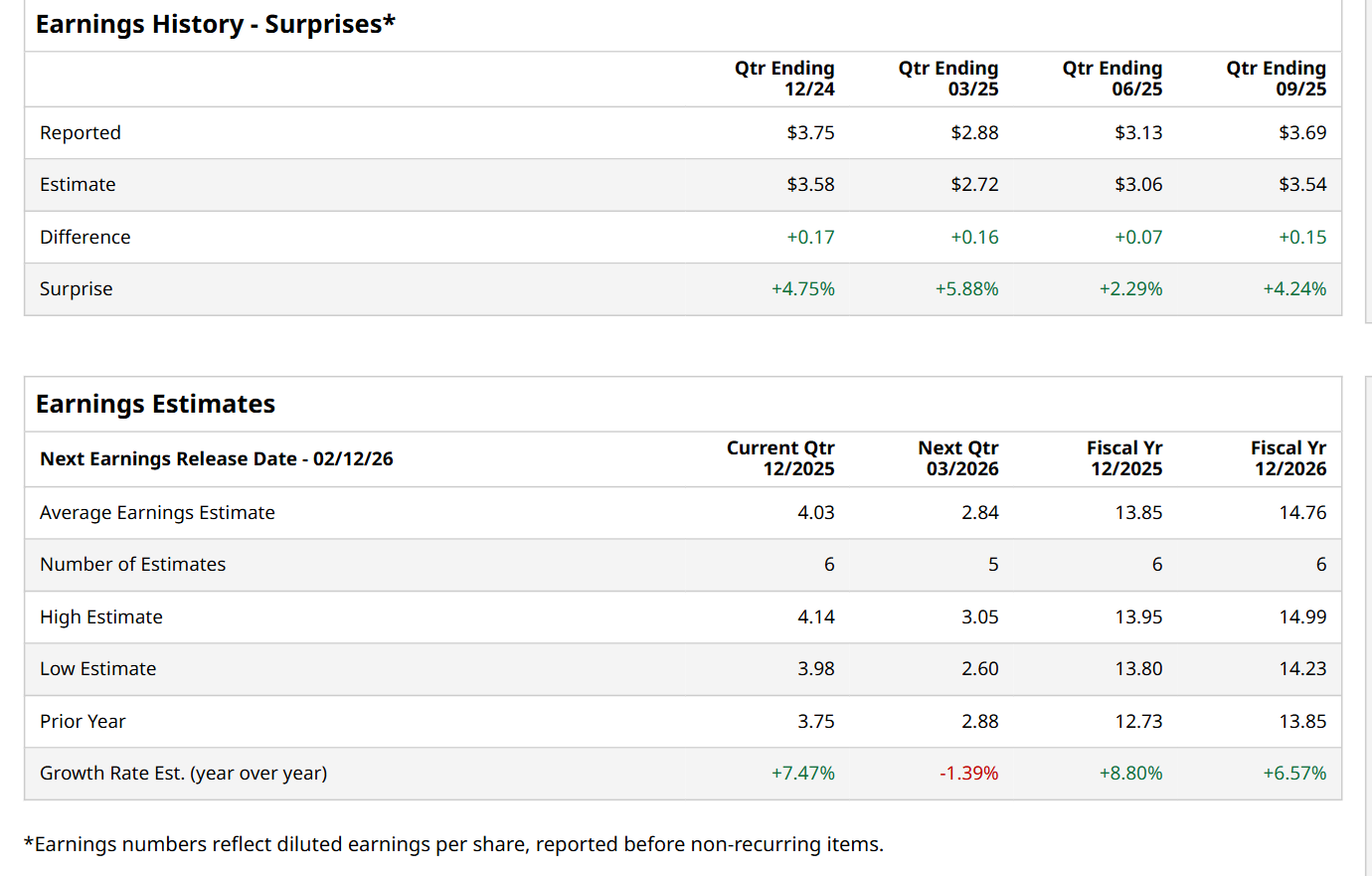

Before this event, analysts expect this tech company to report a profit of $4.03 per share, up 7.5% from $3.75 per share in the year-ago quarter. The company has topped Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $3.69 per share in the previous quarter exceeded the consensus estimates by 4.2%.

For the current fiscal year, ending in December, analysts expect MSI to report a profit of $13.85 per share, up 8.8% from $12.73 per share in fiscal 2024. Its EPS is expected to further grow 6.6% year-over-year to $14.76 in fiscal 2026.

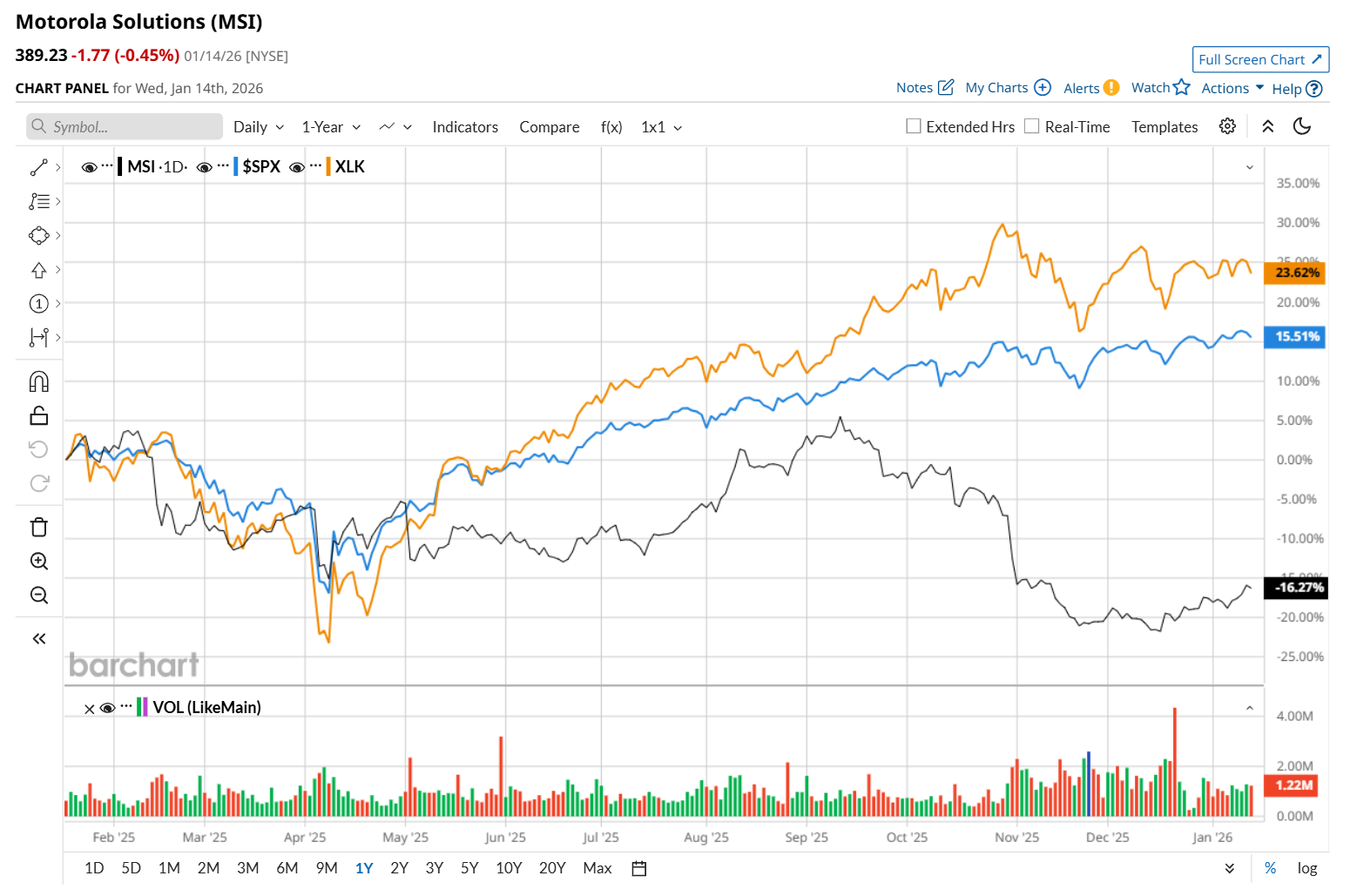

MSI has declined 15.5% over the past 52 weeks, notably underperforming both the S&P 500 Index's ($SPX) 18.6% return and the State Street Technology Select Sector SPDR ETF’s (XLK) 27.1% uptick over the same time period.

On Oct. 30, MSI delivered better-than-expected Q3 earnings results, yet its shares plunged 5.9% in the following trading session. The company reported record Q3 revenue, earnings and cash flow, driven by robust demand for its safety and security solutions. Its overall revenue increased 7.8% year-over-year to $3 billion, beating consensus expectations by a slight margin. Moreover, its adjusted EPS increased 8.6% year-over-year to $4.06, exceeding analyst estimates by 4.2%.

Wall Street analysts are highly optimistic about MSI’s stock, with an overall "Strong Buy" rating. Among 12 analysts covering the stock, eight recommend "Strong Buy," one indicates a "Moderate Buy,” and three suggest "Hold.” The mean price target for MSI is $493.78, indicating a 26.9% potential upside from the current levels.