/Ingersoll-Rand%20Inc%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Valued at a market cap of $34 billion, Ingersoll Rand Inc. (IR) provides various mission-critical air, fluid, energy, and medical technologies services and solutions. The Davidson, North Carolina-based company is ready to announce its fiscal Q4 earnings for 2025 after the market closes on Thursday, Feb. 12.

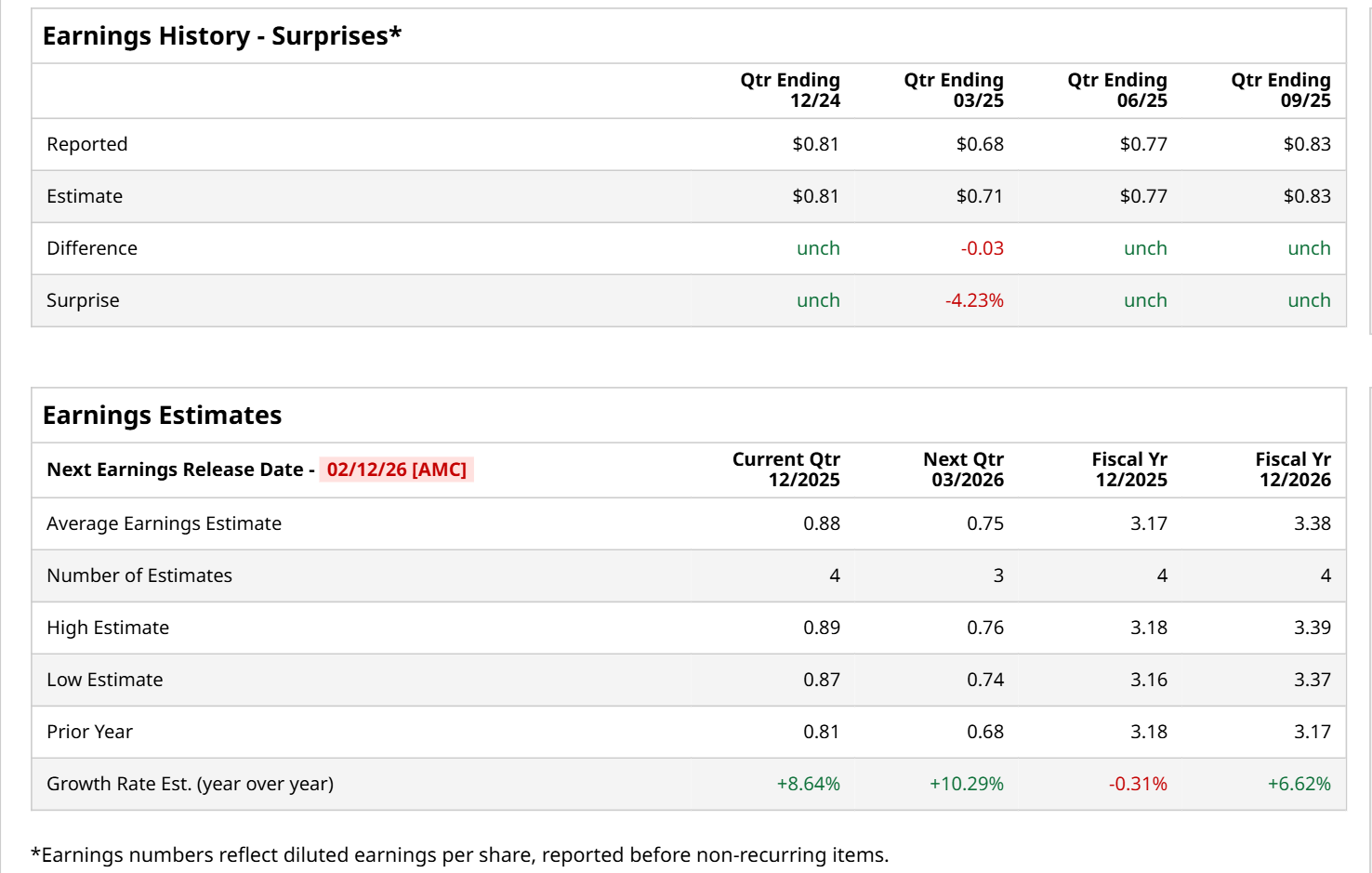

Before this event, analysts expect this industrial company to report a profit of $0.88 per share, up 8.6% from $0.81 per share in the year-ago quarter. The company has met Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. Its earnings of $0.83 per share in the previous quarter came in line with the consensus estimates.

For the current fiscal year, ending in December, analysts expect IR to report a profit of $3.17 per share, down marginally from $3.18 per share in fiscal 2024. Nonetheless, its EPS is expected to grow 6.6% year-over-year to $3.38 in fiscal 2026.

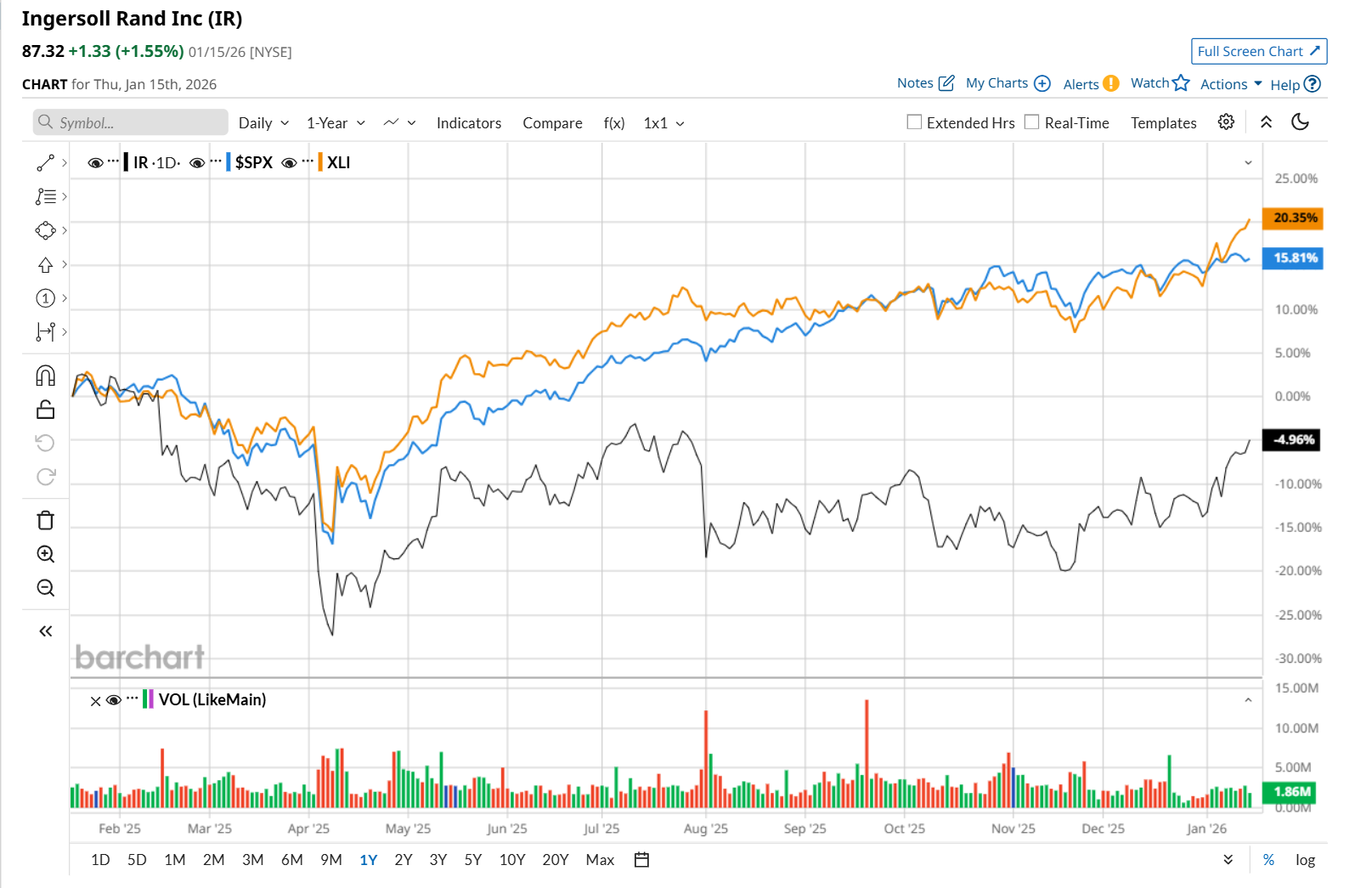

IR has declined 3.6% over the past 52 weeks, considerably lagging behind both the S&P 500 Index's ($SPX) 16.7% return and the State Street Industrial Select Sector SPDR ETF’s (XLI) 22.5% uptick over the same time period.

On Jan. 5, IR shares rose 3.1% following the acquisition of Scinomix, Inc., which strengthened the company’s life sciences portfolio. The deal is expected to enhance IR’s ability to offer more end-to-end solutions by leveraging technologies that improve workflow efficiency through higher levels of automation and accuracy for customers.

Wall Street analysts are moderately optimistic about IR’s stock, with a "Moderate Buy" rating overall. Among 16 analysts covering the stock, eight recommend "Strong Buy," and eight suggest "Hold.” The mean price target for IR is $89.64, indicating a 2.7% potential upside from the current levels.