Richmond, Virginia-based Dominion Energy, Inc. (D) provides regulated electricity and natural gas services. Valued at a market cap of $50.4 billion, the company is ready to announce its fiscal Q4 earnings for 2025 on Monday, Feb. 23.

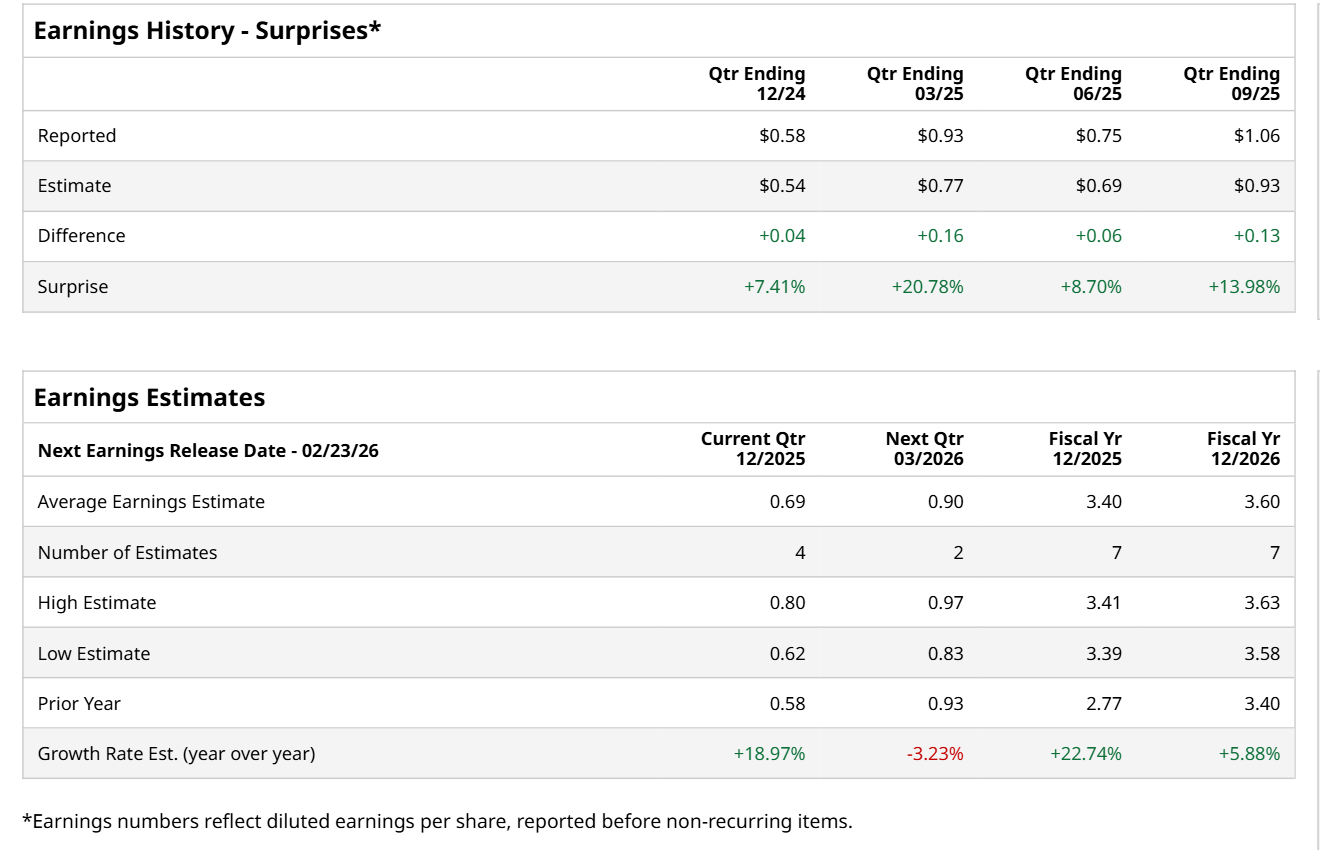

Ahead of this event, analysts expect this utility company to report a profit of $0.69 per share, up 19% from $0.58 per share in the year-ago quarter. The company has topped Wall Street’s bottom-line estimates in each of the last four quarters. In Q3, its EPS of $1.06 exceeded the consensus estimates by a notable margin of 14%.

For the current fiscal year, ending in December, analysts expect D to report a profit of $3.40 per share, up 22.7% from $2.77 per share in fiscal 2024. Furthermore, its EPS is expected to grow 5.9% year-over-year to $3.60 in fiscal 2026.

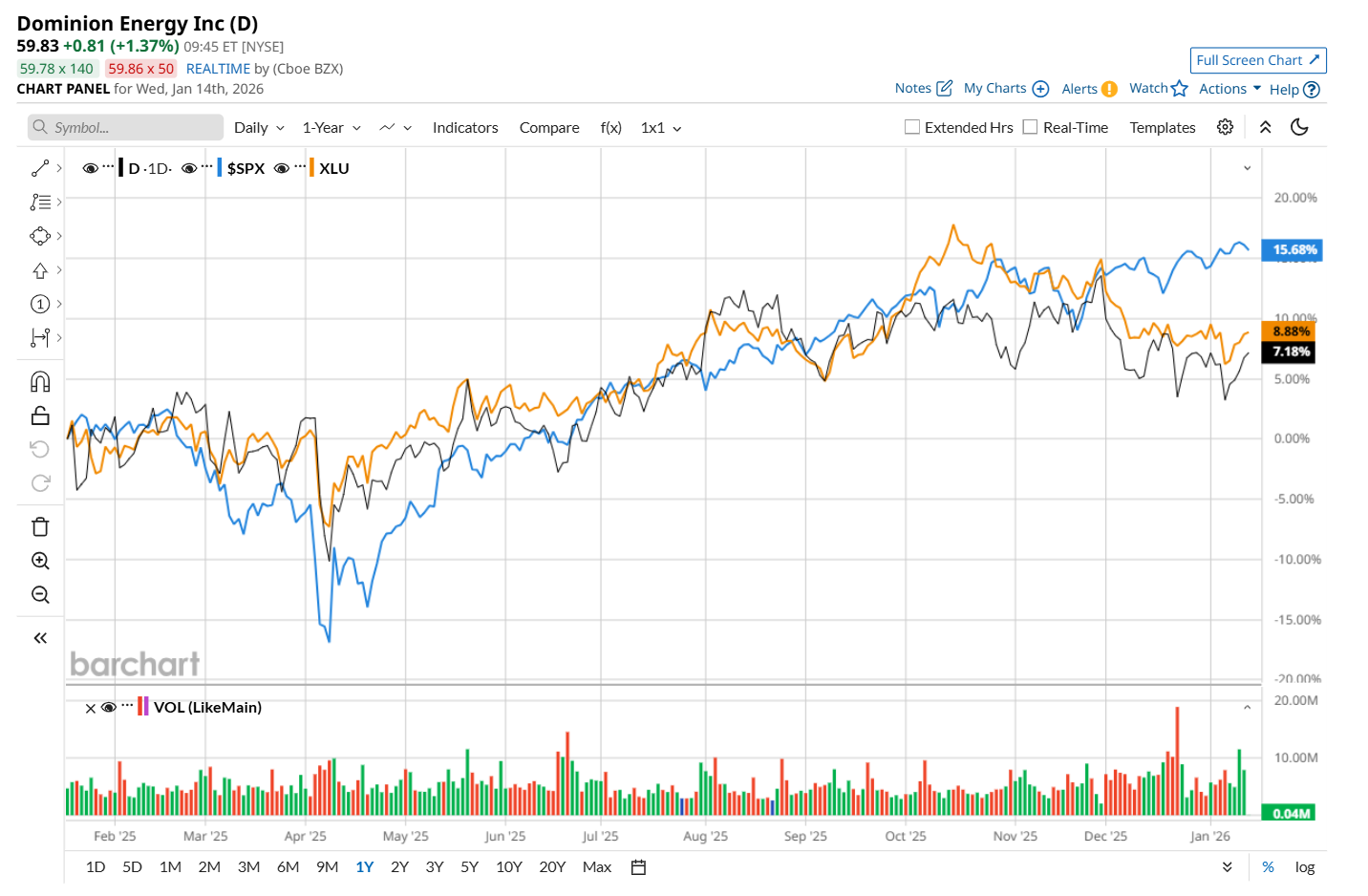

Dominion Energy has gained 10.2% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 19.3% return and the State Street Utilities Select Sector SPDR ETF’s (XLU) 13.3% uptick over the same time period.

On Oct. 31, shares of D fell 1.4% despite delivering better-than-expected Q3 earnings results. The company’s operating revenue increased 14.9% year-over-year to $4.5 billion, surpassing consensus estimates by 8.1%. Additionally, its operating earnings came in at $1.06 per share, higher than the expected $0.93 per share.

Wall Street analysts are cautious about D’s stock, with a "Hold" rating overall. Among 21 analysts covering the stock, three recommend "Strong Buy," 17 indicate “Hold," and one suggests a "Strong Sell.” The mean price target for D is $64.47, indicating a 7.7% potential upside from the current levels.