Whales with a lot of money to spend have taken a noticeably bullish stance on Broadcom.

Looking at options history for Broadcom (NASDAQ:AVGO) we detected 54 trades.

If we consider the specifics of each trade, it is accurate to state that 42% of the investors opened trades with bullish expectations and 38% with bearish.

From the overall spotted trades, 18 are puts, for a total amount of $699,224 and 36, calls, for a total amount of $2,878,881.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $72.0 and $194.0 for Broadcom, spanning the last three months.

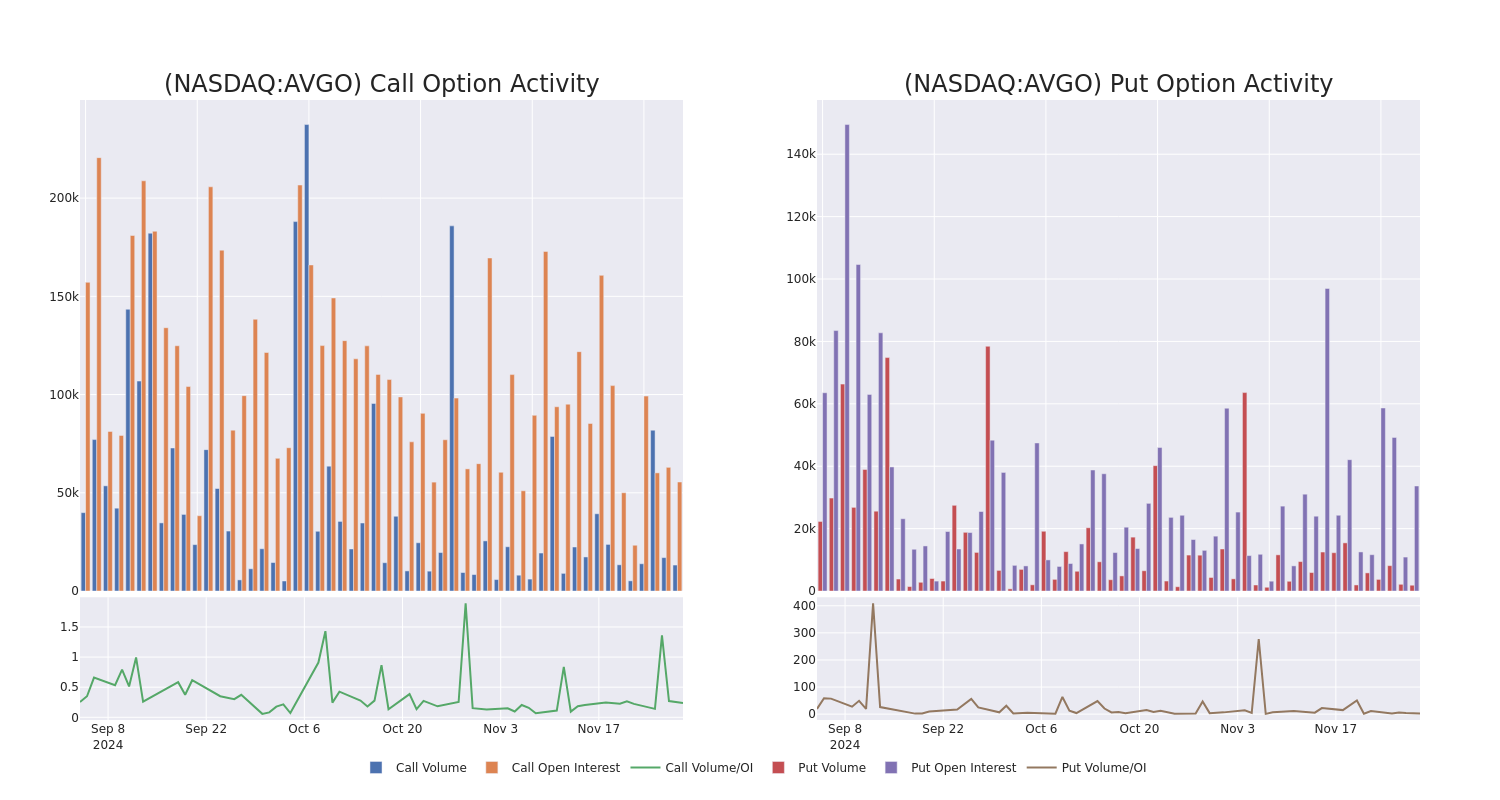

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Broadcom options trades today is 2073.81 with a total volume of 14,722.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Broadcom's big money trades within a strike price range of $72.0 to $194.0 over the last 30 days.

Broadcom Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AVGO | CALL | SWEEP | BULLISH | 12/13/24 | $5.65 | $5.55 | $5.65 | $165.00 | $449.1K | 1.6K | 2.1K |

| AVGO | CALL | TRADE | BEARISH | 01/16/26 | $33.8 | $31.8 | $31.8 | $150.00 | $327.5K | 1.5K | 103 |

| AVGO | CALL | SWEEP | BEARISH | 12/13/24 | $5.9 | $5.8 | $5.8 | $162.50 | $182.7K | 153 | 360 |

| AVGO | CALL | TRADE | BULLISH | 12/20/24 | $1.09 | $1.05 | $1.08 | $188.00 | $167.4K | 1.8K | 1.5K |

| AVGO | CALL | TRADE | NEUTRAL | 12/20/24 | $6.25 | $6.15 | $6.2 | $166.00 | $161.2K | 1.1K | 355 |

About Broadcom

Broadcom is the sixth-largest semiconductor company globally and has expanded into various software businesses, with over $30 billion in annual revenue. It sells 17 core semiconductor product lines across wireless, networking, broadband, storage, and industrial markets. It is primarily a fabless designer but holds some manufacturing in-house, like for its best-of-breed FBAR filters that sell into the Apple iPhone. In software, it sells virtualization, infrastructure, and security software to large enterprises, financial institutions, and governments.Broadcom is the product of consolidation. Its businesses are an amalgamation of former companies like legacy Broadcom and Avago Technologies in chips, as well as Brocade, CA Technologies, and Symantec in software.

Broadcom's Current Market Status

- With a volume of 10,305,448, the price of AVGO is up 1.51% at $162.08.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 13 days.

Professional Analyst Ratings for Broadcom

1 market experts have recently issued ratings for this stock, with a consensus target price of $200.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Maintaining their stance, an analyst from UBS continues to hold a Buy rating for Broadcom, targeting a price of $200.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Broadcom options trades with real-time alerts from Benzinga Pro.