What Is the Fed Funds Rate?

Princessdlaf; Canva

The federal funds rate is the rate of interest that banks use to lend money to each other. This rate is controlled by the Federal Reserve and can be adjusted through changing market conditions. For instance, the Fed may raise or lower the fed funds rate as a way to encourage lending, curb inflation, or generally maintain a strong economy.

Banks are required to keep a percentage of their deposits on hand as reserves. These reserves are also known as federal funds. Since banks are also profit-seeking businesses, they often lend some of their federal funds to other financial institutions, and the rate of interest they charge for these loans is known as the federal funds rate.

Why Is the Fed Funds Rate a Range?

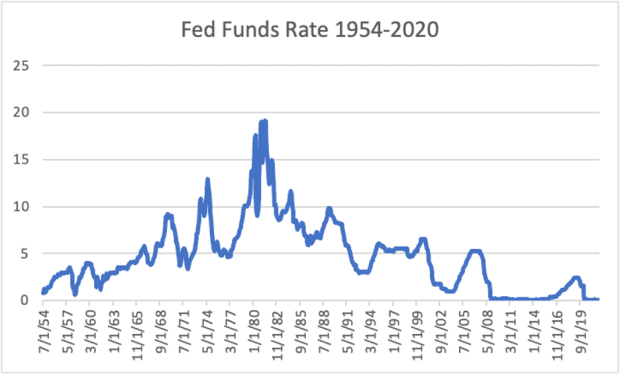

The Federal Reserve calculates a bank’s reserve requirements as a ratio based on its liabilities, and the fed funds rate is based on supply and demand for these funds. The Fed sets a target rate for the fed funds rate during each of its eight annual Federal Open Market Committee (FOMC) meetings. This rate has fluctuated widely, from as high as 20% in the 1980s to as little as nothing (0%) after the financial crisis of 2007–2008, for reasons we’ll detail below.

The fed funds rate is a range because the Federal Reserve cannot mandate a set number. Instead, it sets the target rate as a guide for banks to follow. Thus, the volume-weighted median of overnight banking transactions become the effective federal funds rate.

The Federal Reserve does much more than a mere suggestion, however. In addition to setting the range for its target rate, it also influences the monetary supply by mandating the reserve requirement amounts for banks and by buying Treasury securities, both in an effort to increase liquidity and keep the economy healthy. The fed funds rate may be what the Federal Reserve is best known for, but it isn’t the only thing it does.

What Is the Fed Funds Rate Today?

The effective federal funds rate is published each business day at 9:00 AM Eastern time on the Federal Reserve Bank of New York’s website.

Why Is the Fed Funds Rate Important?

Every time the Fed increases or lowers its target rate, it unleashes powerful changes to every corner of the financial markets. The fed funds rate impacts short-term and long-term interest rates as well as foreign exchange rates. It also plays into broader economic considerations, like growth and employment. For example, a decreased fed funds rate makes it easier for a business to obtain a loan and thus hire more workers, build new offices, or increase production.

What Causes the Fed Funds Rate to Rise?

When the Fed raises the fed funds rate, it is attempting to control inflation by tightening the monetary supply. This makes it more difficult for banks to grant loans to businesses or mortgages to homeowners. In a nutshell, inflation is a period of rising prices, and so when the Fed makes it more challenging to buy things, people will spend less, and they will buy fewer expensive things. Thus, prices will fall.

How Does the Fed Funds Rate Affect the Stock Market?

So much of what goes on in the stock market stems from emotion. And so, whenever the Fed tinkers with its target rates, analysts and economists may proclaim that the sky is falling. One might think the stock market would go into a tailspin when fed fund rates rise, but that’s actually not always true. If investor and analyst expectations have already priced the increase into their estimates, the stock market may actually go up on the news. However, the higher the rates go, the less value money has, and so over the longer term, prices would see a decline.

Are the Fed Funds Rate and Interest Rates the Same?

It may seem confusing, but the fed funds rate is actually not the same as short-term or long-term interest rates. The fed funds rate is a range that is set by the Federal Reserve and used by banks to make loans to each other. Banks, too, charge their customers a rate of interest, and the rate that they set for their most creditworthy customers is known as the prime rate. If the Fed wants lower short-term or long-term interest rates, it will set a lower range, but it is not directly involved with rates to consumers.

Fed Funds Rate vs. Discount Rate

The Fed sets a target rate for banks to lend to one another, which is known as the fed funds rate. But the Fed also lends directly to banks, and this rate of interest is known as the discount rate. The way that banks can obtain these funds from the Fed is through a discount window.

How Does the Fed Funds Rate Affect Treasury Yields?

Bonds and interest rates have an inverse relationship: When rates rise, bond prices decrease, and when rates decline, bonds go up. This is because many Treasury bonds offer a fixed-rate coupon. So, in an environment of rising interest rates, it is expected that these bonds will have less value when their coupon reaches maturity. That’s why longer-term Treasuries typically sport a higher yield than shorter-term Treasuries.

Fed Funds Rate Examples

Rewind back to 1980, when the fed funds rate hit an unprecedented high of 20%. Why was it so high? The answer is the Federal Reserve was attempting to combat the sky-high inflation that had run rampant in the 1970s, with much to blame on an oil embargo that caused oil prices to rise exponentially from $3 to $12 per barrel.

Transportation became wildly expensive, plus rising food prices stemming from global shortages caused inflation to skyrocket even further. Union leaders advocated for increased wages to offset these hikes, but they were unknowingly adding to the toxic inflationary mess. The Federal Reserve had to step in with enormous rate hikes, causing the U.S. economy to enter a recession for the next year. Rates would eventually come down.

At the opposite end of the rate spectrum, the Federal Reserve slashed the fed funds rate to 0% in response to the financial crisis that roiled global markets after the U.S. housing bubble burst in 2008. The Fed would keep rates this low for the next seven years; in addition, it instituted a massive Treasury buyback program known as quantitative easing in order to increase liquidity. As a result, the economy entered a decade-long bull market.