NoDerog from Getty Images Signature; Canva

What Are I Bonds in Simple Terms?

I bonds, or series I bonds, are savings bonds from the United States Treasury. This is a relatively new Treasury security that was introduced in 1998 by the U.S. government to “encourage Americans to save for the future while protecting their savings from inflation.”

These bonds can be bought for as little as $50. Artwork on the bonds honors distinguished Americans like Dr. Martin Luther King, Jr., Chief Joseph, and Marian Anderson.

According to former Treasury Secretary Robert Rubin, I bonds are particularly attractive investments during high inflationary periods, as they ensure a “real rate of return over and above inflation.” This is because some of the interest they offer is tied to the Consumer Price Index, so when consumer prices rise, these bonds’ rate of interest also goes up.

Typically in the bond market, prices move inversely to intererst rates: When interest rates rise, most bond prices fall, and vice versa.

Creating a high-yield Treasury like this might be one way the federal government is trying to encourage Americans to continue to invest in Treasury securities, even during periods of volatility, bear markets, and recessions. Historically, the Fed counters inflation by raising interest rates. So, with I bonds, the Fed may be offering investors the best of all worlds: A stable bond investment that offers a high yield, too.

How Do I Bonds Work?

I bonds are unique in that investors earn a combination of two interest rates: fixed and variable.

- The I bond’s fixed rate of return is set upon purchase and stays the same throughout the life of the bond.

- Its variable rate is adjusted every six months by the Bureau of Labor Statistics to reflect changes in the Consumer Price Index (CPI).

The interest is compounded semiannually and added to the bond’s principal and paid out when an investor cashes the bond, or it reaches maturity.

I bonds have a 20-year maturity period plus a 10-year extended period for a total of 30 years. Investors face penalties for cashing out too soon, which we’ll discuss below.

How Much Is an I Bond Worth?

Currently, the interest rate on I bonds purchased between May 2022 and October 2022 is 9.62%. Compare this with I bonds purchased between May, 2021 and October, 2021. The interest they offered was just 3.54% because the semiannual inflation rate was much lower. When inflation is low, the interest rate on I bonds falls.

I Bond Interest Rate Example

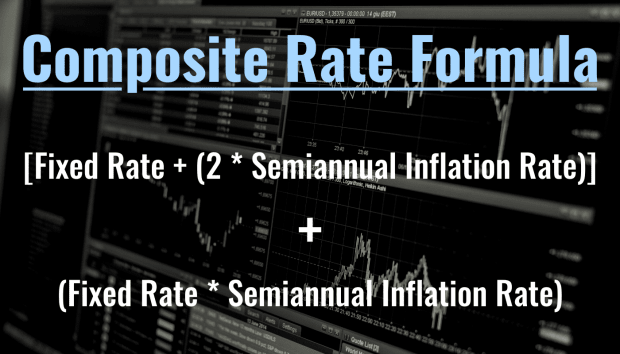

To calculate an I bond’s total interest rate, or composite rate, use this formula:

Lorenzo from Pexels; Canva

Here is an example of the interest rate for an I bond issued between November 2021 and April 2022:

Fixed Rate: 0.0%

Variable Inflation Rate: 3.56%

Composite Rate: (0.0% + 2 * 3.56) + (0.0% x 3.56) = 7.12%

The composite rate is 7.12%, and it is applicable to the first six months the bond is owned.

What Is the Calendar for I Bond Rate Changes?

How Are I Bonds Similar to TIPS? How Are They Different?

Another category of Treasury bonds that offers an element of inflation protection is Treasury Inflation-Protected Securities (TIPS). Both I bonds and TIPS originate from the U.S. government, and both carry the highest credit rating, AAA. However, TIPS differ from I bonds in that their principal is indexed to inflation, as measured by the Consumer Price Index (CPI), whereas with I bonds, their total payment reflects a fixed rate plus the inflation adjustment.

Another difference between TIPS and I bonds has to do with where they can be bought and sold. TIPS can be sold on the open market, and since older bonds often have higher yields than newer bonds, that makes them more valuable.

I bonds cannot be bought or sold on secondary markets; when you sell them, you redeem them at face value, so there is not much potential for price appreciation—just interest.

Why Are I Bonds Safe Investments?

Investors find I bonds attractive because they make twice-yearly interest payments and are backed by the “full faith and credit” of the U.S. government, which means their risk of default is next to nothing. They have the highest credit rating (AAA) of all debt securities, which means they are low risk. In addition, they are considered liquid, which means they can be converted easily into cash.

How Do I Buy I Bonds?

Investors can purchase I bonds through the Treasury Department’s website, TreasuryDirect.gov. They can be bought in electronic or paper format. Investors can purchase up to $10,000 worth of I bonds on an annual basis. They can also buy up to $5,000 of I bonds with their tax refund using Form 8888. The minimum investment is $50.

How Are I Bonds Taxed?

I bonds are taxed at the federal level but not the state. Investors can choose to pay taxes on a cash or an accrual basis. I bonds can be held in a tax-deferred retirement account like an IRA or 401k as well.

Are There Penalties for Redeeming I Bonds Early? What Other Important Considerations Are There?

I bonds can be held for as little as one year and as long as 30 years, but they do have early withdrawal penalties. If an I bond is sold before 5 years, a penalty of 3 months’ interest is applied.

In addition, Investors who purchase I bonds to pay for higher education are actually exempt from paying federal taxes on their I-bond income.

Are I Bonds a Good Investment?

TheStreet’s Dan Weil thinks that I bonds yields are "not too shabby"—even if inflation falls, there’s an easy fix.