This article is part of The Conversation’s “Business Basics” series where we ask experts to discuss key concepts in business, economics and finance.

Today is July 1, the first day of the new financial year in Australia.

Also called fiscal years, financial years are often abbreviated in print. The one that’s just begun in Australia – July 1 2024 to June 30 2025 – will typically be denoted by FY24/25 or FY25.

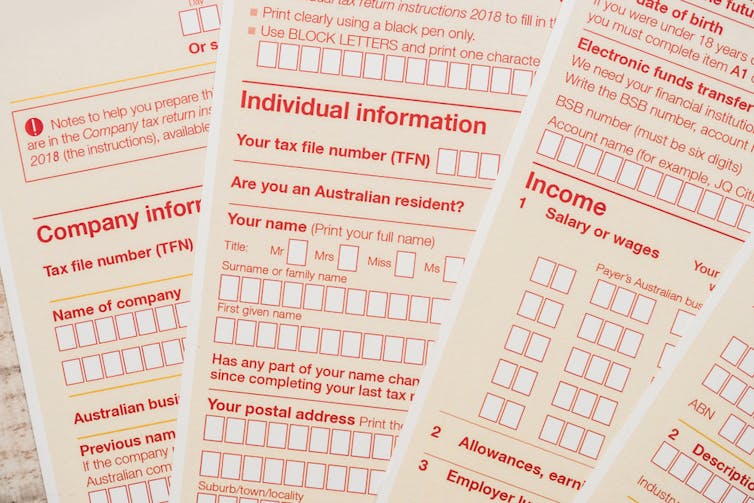

As the name suggests, financial years are used for financial reporting, tax and budgeting purposes. Whether you are preparing an individual tax return or financial statements for a business, it is important to understand the difference between financial and calendar years.

Both have 365 days. But the calendar year, based on the Gregorian calendar, runs from New Years’ Day on January 1 through to December 31.

Australian financial years on the other hand run from July 1 of one year to June 30 the next.

But this July to June financial year does not apply in all countries. Many align their financial year with the calendar year, but others have further variations still.

So why are they different, and what does that mean for businesses operating across borders?

Different around the world

In contrast to our own, the United Kingdom’s financial year starts on April 6 each year and runs to April 5 the next.

The English and Irish New Year traditionally fell on March 25, when taxes and other accounts were due. But in the 18th century, the British empire switched from the Roman Julian calendar to the Gregorian calendar, and had to adjust the start date to avoid losing tax revenue.

India’s fiscal year runs from April 1 until March 31, for a number of reasons. Historically a country that was heavily focused on agriculture, this timeframe aligned with the crop cycle and allowed the government to develop financial plans for the sector.

The British empire also influenced the April reporting schedule in India, as prior to independence many financial policies were based on the British system.

Government budgets play a role

In the United States, fiscal years once ran from July 1 to June 30, like Australia’s do now. But in 1974 this was changed to instead span October 1 to September 30, giving Congress more time to agree on a budget each year.

In the US, however, companies can also choose their own fiscal years. Some choose a calendar year, but others elect dates that better align with their business cycle.

Walmart’s, for example, ends on January 31 each year to reflect its typically strong financial performance over the holiday period at the end of the year.

In Australia, the financial year matches government reporting cycles.

Unlike the northern hemisphere, our parliamentarians typically take holidays over summer in December and January, which makes meeting over November and December to approve government budgets difficult.

The federal budget is issued in May for the following financial year, giving parliament time to consider it before the new fiscal year begins.

Comparing (and taxing) performance

Regardless of the time period over which a financial year operates, its primary purpose is to provide a standardised time frame for financial reporting.

Financial years allow income and expenses to be tracked and compared over the same timeframe each year. This allows investors to compare business performance across consistent periods. They are also used to determine the collection of personal income tax.

Our government uses this information to calculate the amount of tax it will collect through the Australian Taxation Office each year.

Businesses with operations spanning multiple countries may have to contend with fiscal years that do not align. Where this is the case, they may need to choose one financial year for the whole company, typically that used by the parent company.

Keeping track of the financial year is helpful for individuals, in knowing when tax returns need to be prepared (and when to expect end-of-financial-year sales).

It is also important for businesses to consider the financial year in making budgeting, business and tax planning decisions.

Read more: How do companies pay tax?

Michaela Rankin does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

This article was originally published on The Conversation. Read the original article.