In the last three months, 5 analysts have published ratings on Vulcan Materials (NYSE:VMC), offering a diverse range of perspectives from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 1 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 2 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

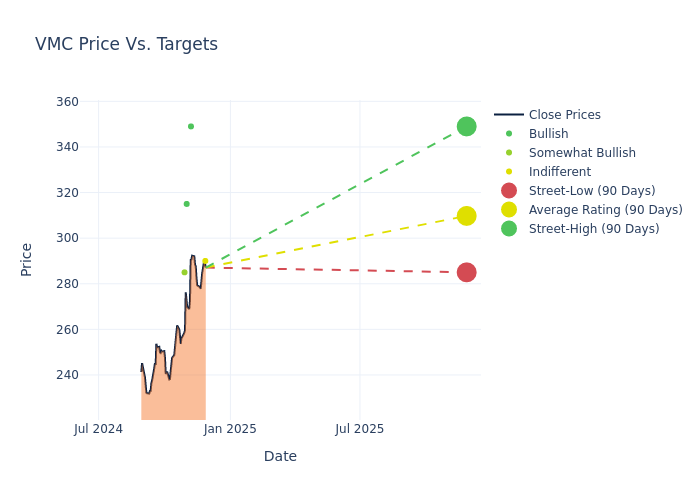

Analysts have set 12-month price targets for Vulcan Materials, revealing an average target of $296.8, a high estimate of $349.00, and a low estimate of $245.00. Marking an increase of 13.61%, the current average surpasses the previous average price target of $261.25.

Decoding Analyst Ratings: A Detailed Look

The standing of Vulcan Materials among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Adrian Huerta | JP Morgan | Raises | Neutral | $290.00 | $245.00 |

| Steven Fisher | UBS | Announces | Buy | $349.00 | - |

| Keith Hughes | Truist Securities | Raises | Buy | $315.00 | $300.00 |

| Adam Seiden | Barclays | Raises | Overweight | $285.00 | $250.00 |

| Adrian Huerta | JP Morgan | Lowers | Neutral | $245.00 | $250.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Vulcan Materials. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Vulcan Materials compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Vulcan Materials's stock. This examination reveals shifts in analysts' expectations over time.

Capture valuable insights into Vulcan Materials's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Vulcan Materials analyst ratings.

Discovering Vulcan Materials: A Closer Look

Vulcan Materials is the United States' largest producer of construction aggregates (crushed stone, sand, and gravel). Its largest markets include Texas, California, Virginia, Tennessee, Georgia, Florida, North Carolina, and Alabama. In 2023, Vulcan sold 234.3 million tons of aggregates, 13.4 million tons of asphalt mix, and 7.5 million cubic yards of ready-mix. As of Dec. 31, 2022, the company had nearly 16 billion tons of aggregates reserves.

Vulcan Materials's Economic Impact: An Analysis

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Challenges: Vulcan Materials's revenue growth over 3 months faced difficulties. As of 30 September, 2024, the company experienced a decline of approximately -8.32%. This indicates a decrease in top-line earnings. When compared to others in the Materials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 10.36%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Vulcan Materials's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 2.67%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Vulcan Materials's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 1.45%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Vulcan Materials's debt-to-equity ratio is below the industry average. With a ratio of 0.49, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Significance of Analyst Ratings Explained

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.