In the preceding three months, 5 analysts have released ratings for Adeia (NASDAQ:ADEA), presenting a wide array of perspectives from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 0 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 2 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

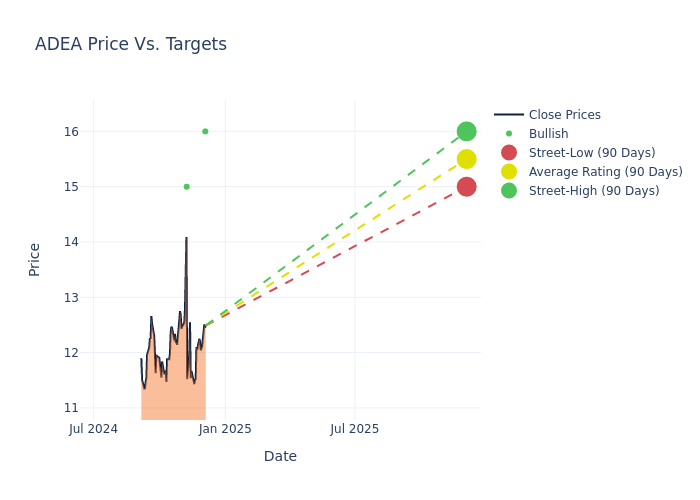

Analysts have set 12-month price targets for Adeia, revealing an average target of $15.6, a high estimate of $16.00, and a low estimate of $15.00. No alteration is observed as the current average remains at the previous average price target.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Adeia among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Hamed Khorsand | BWS Financial | Maintains | Buy | $16.00 | $16.00 |

| Hamed Khorsand | BWS Financial | Maintains | Buy | $16.00 | $16.00 |

| Kevin Cassidy | Rosenblatt | Maintains | Buy | $15.00 | $15.00 |

| Kevin Cassidy | Rosenblatt | Maintains | Buy | $15.00 | $15.00 |

| Hamed Khorsand | BWS Financial | Maintains | Buy | $16.00 | $16.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Adeia. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Adeia compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Adeia's stock. This analysis reveals shifts in analysts' expectations over time.

For valuable insights into Adeia's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Adeia analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Unveiling the Story Behind Adeia

Adeia Inc is a consumer and entertainment product/solutions licensing company. Its only operating segment being Intellectual Property Licensing (IP). In the IP segment, it primarily license innovations to leading companies in the broader entertainment industry, and those developing new technologies that will help drive this industry forward. It includes Pay-TV, Consumer Electronics, Connected Car, and Media Platform.

Understanding the Numbers: Adeia's Finances

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Negative Revenue Trend: Examining Adeia's financials over 3 months reveals challenges. As of 30 September, 2024, the company experienced a decline of approximately -15.09% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Adeia's net margin excels beyond industry benchmarks, reaching 22.43%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Adeia's ROE excels beyond industry benchmarks, reaching 5.24%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Adeia's ROA stands out, surpassing industry averages. With an impressive ROA of 1.8%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.41, caution is advised due to increased financial risk.

The Basics of Analyst Ratings

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.