What happened to WeWork?

WeWork, a tech company that operates rent-based shared workspaces in metropolitan areas across the globe, has fallen on hard times. Despite at one time reaching unicorn status and a valuation topping $47 billion, it has yet to turn in a profit from its billions of dollars in investments, and as of mid-August 2023, its market valuation has dipped to below $200 million—down 98% from its first day of trading in 2021.

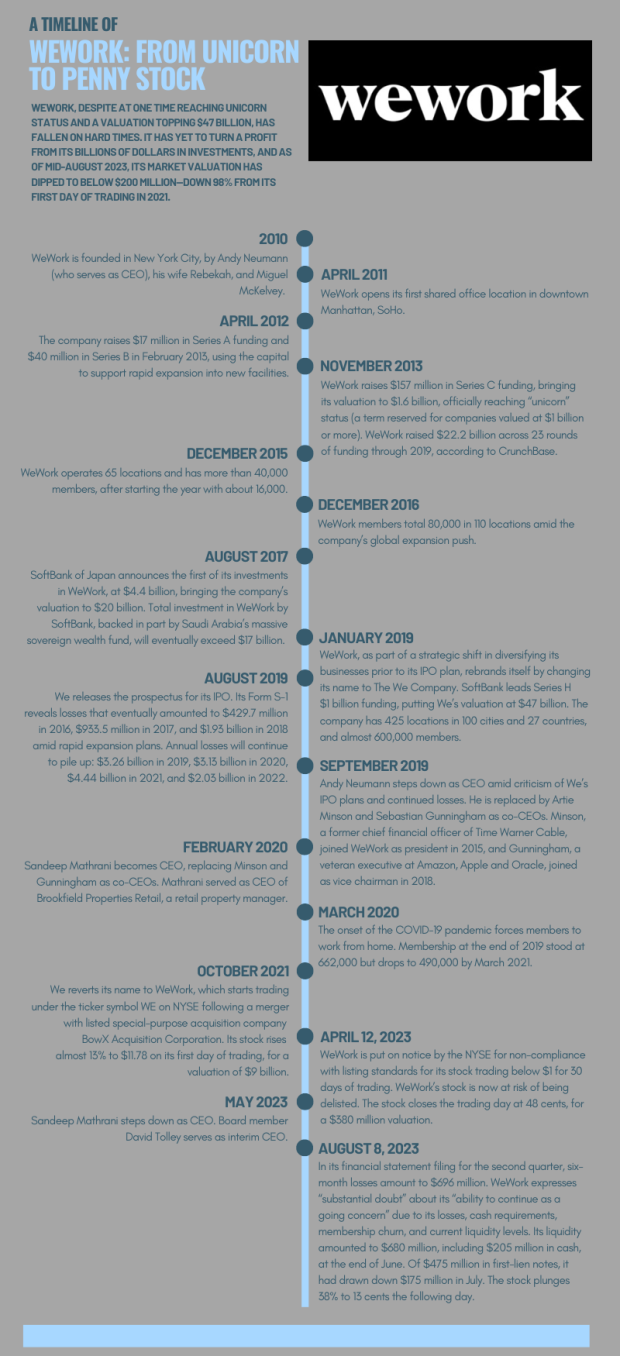

Below is a visual timeline of events followed by a plaintext version.

A visual timeline of WeWork's rise and fall

2010: WeWork is founded in New York City, by Andy Neumann (who serves as CEO), his wife Rebekah, and Miguel McKelvey.

April 2011: WeWork opens its first shared office location in downtown Manhattan, SoHo.

April 2012: The company raises $17 million in Series A funding and $40 million in Series B in February 2013, using the capital to support rapid expansion into new facilities.

November 2013: WeWork raises $157 million in Series C funding, bringing its valuation to $1.6 billion, officially reaching “unicorn” status (a term reserved for companies valued at $1 billion or more). WeWork raised $22.2 billion across 23 rounds of funding through 2019, according to CrunchBase.

December 2015: WeWork operates 65 locations and has more than 40,000 members, after starting the year with about 16,000.

December 2016: WeWork members total 80,000 in 110 locations, amid the company’s global expansion push.

August 2017: SoftBank announces the first of its investments in WeWork, at $4.4 billion, bringing the company’s valuation to $20 billion. Total investment in WeWork by SoftBank, backed in part by Saudi Arabia’s massive sovereign wealth fund, will eventually exceed $17 billion.

January 2019: WeWork, as part of a strategic shift in diversifying its businesses prior to its IPO plan, rebrands itself by changing its name to The We Company. SoftBank of Japan leads Series H $1 billion funding, putting We’s valuation at $47 billion. The company has 425 locations in 100 cities and 27 countries, and almost 600,000 members.

August 2019: We releases the prospectus for its IPO. Its Form S-1 reveals losses that eventually amounted to $429.7 million in 2016, $933.5 million in 2017, and $1.93 billion in 2018 amid rapid expansion plans. Annual losses will continue to pile up: $3.26 billion in 2019, $3.13 billion in 2020, $4.44 billion in 2021, and $2.03 billion in 2022.

September 2019: Andy Neumann steps down as CEO amid criticism of We’s IPO plans and continued losses. He is replaced by Artie Minson and Sebastian Gunningham as co-CEOs. Minson, a former chief financial officer of Time Warner Cable, joined WeWork as president in 2015, and Gunningham, a veteran executive at Amazon, Apple and Oracle, joined as vice chairman in 2018.

February 2020: Sandeep Mathrani becomes CEO, replacing Minson and Gunningham as co-CEOs. Mathrani served as CEO of Brookfield Properties Retail, a retail property manager.

March 2020: The onset of the COVID-19 pandemic forces members to work from home. Membership at the end of 2019 stood at 662,000 but drops to 490,000 by March 2021.

October 2021: We reverts its name to WeWork, which starts trading under the ticker symbol WE on NYSE following a merger with listed special-purpose acquisition company BowX Acquisition Corporation. Its stock rises almost 13% to $11.78 on its first day of trading, for a valuation of $9 billion.

April 12, 2023: WeWork is put on notice by the NYSE for non-compliance with listing standards for its stock trading below $1 for 30 days of trading. WeWork’s stock is now at risk of being delisted. The stock closes the trading day at 48 cents, for a $380 million valuation.

May 2023: Sandeep Mathrani steps down as CEO. Board member David Tolley serves as interim CEO.

August 8, 2023: In its financial statement filing for the second quarter, six-month losses amount to $696 million. WeWork expresses “substantial doubt” about its “ability to continue as a going concern” due to its losses, cash requirements, membership churn, and current liquidity levels. Its liquidity amounted to $680 million, including $205 million in cash, at the end of June. Of $475 million in first-lien notes, it had drawn down $175 million in July. The stock plunges 38% to 13 cents the following day, officially landing it in penny stock territory.