While the start of the pandemic might have made some afraid to go inside fast-food restaurants, while others had to close their dining rooms for a period of time, things have been changing. Customers are clearly not just ordering online but coming in: foot traffic at a number of popular fast-food chains is now back to pre-pandemic levels.

In-person visits to McDonald’s (MCD) were up 1.1% compared to 2019 in December. While they are up 3.8% at Wendy’s (WEN), visits to the Restaurant Brands International (RBI) 's Burger King are still down 6.8%, according to a recent study by location analytics company Placer.

McDonald's, Wendy's, Burger King: The Big Three Of Burgers

"After recovering from Delta’s effects in October, nationwide dining visits promptly fell once more as the Omicron variant gained ground," reads the report. "Yet, it looks like the impact of each successive wave becomes more and more short-lived, because by December 2021 – as the United States continues to battle its fifth COVID wave – dining foot traffic rose once again to near-2019 levels."

Placer.ai

With 43% of all visits in December, McDonald's led the way for people looking for a burger. At a respective 12% and 10%, Wendy’s and Burger King came next. Those three are what is known as the "big three" of burger restaurants.

Sonic and Chick-Fil-A Drew Crowds Too

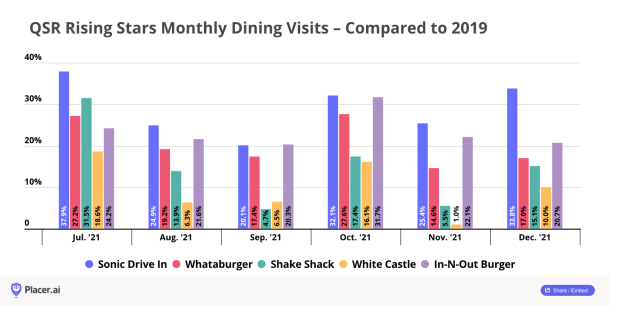

But while these three big players still dominate the market, a number of smaller burger chains saw visits to their restaurants soar dramatically — Sonic Drive-In of Inspire Brands saw 33.8% more foot traffic than it did in December 2019 while In-N-Out and Shake Shack (SHAK) also saw a respective 20.7% and 15.1% in growth.

When it comes to fried chicken, Chick-Fil-A saw 40% of all December visitors but that number was still down 2.7% from 2019. Visits to Kentucky Fried Chicken (KFC) and Popeye's (also owned by Restaurant Brands International) were down by a respective 15.6% and 21.5%.

For some chains, the rising numbers can indicate the country's exit of the pandemic — with most restrictions lifted, many are less afraid to wait inside the restaurants. But according to the study, Popeye's is experiencing something quite different as, in 2019, the launch of its wildly popular chicken sandwich caused widespread shortages and line-ups across restaurants. Since nothing quite that big is yet to come around from the chain, any ensuing traffic will struggle to keep up with the Chicken Sandwich Frenzy Of 2019.

"So while this year’s November-December numbers look weak, the drop should actually be attributed to the brand’s exceptional success two years ago rather than to any real drop in demand now," the study reads.