With a market cap of $36.7 billion, WEC Energy Group, Inc. (WEC) provides regulated natural gas and electric service, along with renewable and nonregulated energy solutions, across several U.S. states. It owns and operates extensive electric and natural gas infrastructure and generates power from a diverse mix of fossil, nuclear, and renewable energy sources.

Shares of the electricity and natural gas provider have underperformed the broader market over the past 52 weeks. WEC stock has risen 11.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.4%. However, shares of the company are up 7.1% on a YTD basis, outpacing SPX's 1.4% gain.

Looking closer, the Milwaukee, Wisconsin-based company's stock has slightly lagged behind the State Street Utilities Select Sector SPDR ETF's (XLU) 11.9% return over the past 52 weeks.

Despite beating expectations with Q4 2025 adjusted EPS of $1.42 and revenue of $2.54 billion, WEC Energy shares fell 1.2% on Feb. 5. Investors focused on the sharp year-over-year decline in GAAP earnings, which dropped to $316.6 million ($0.97 per share) from $453.5 million ($1.43 per share) in Q4 2024 due to the Illinois settlement charge.

For the fiscal year ending in December 2026, analysts expect WEC's adjusted EPS to grow 6.3% year-over-year to $5.60. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

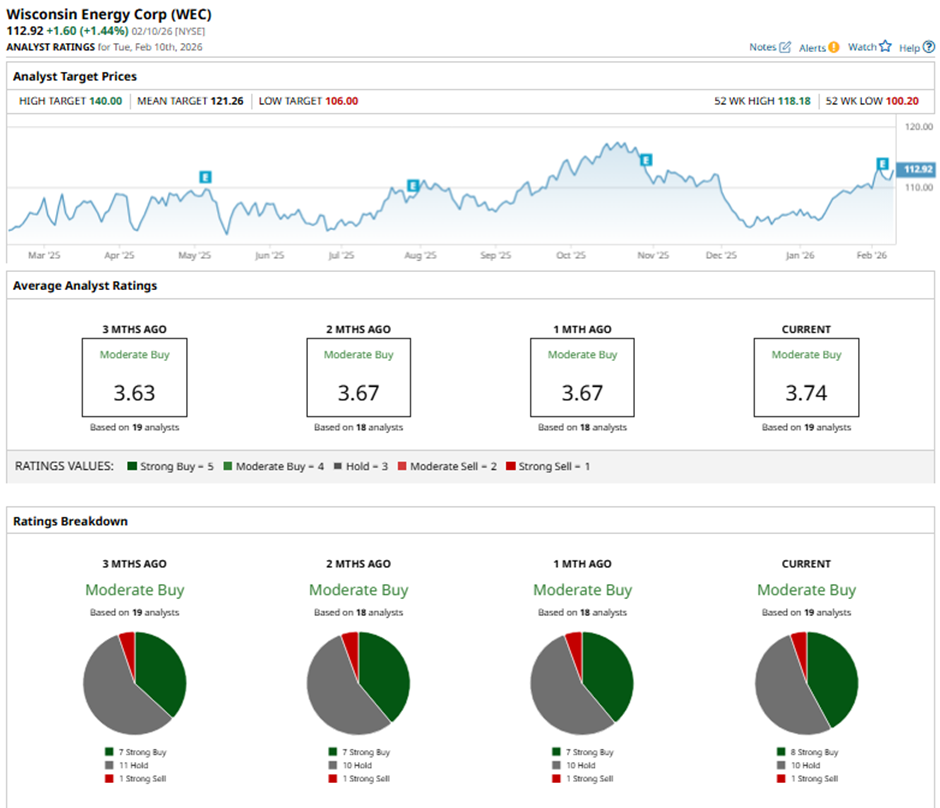

Among the 19 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, 10 “Holds,” and one “Strong Sell.”

On Feb. 10, TD Cowen analyst Shelby Tucker reiterated a “Hold” rating on WEC Energy Group and maintained a price target of $125.

The mean price target of $121.26 represents a premium of 7.4% to WEC's current levels. The Street-high price target of $140 implies a potential upside of nearly 24% from the current price levels.