In early March, reports surfaced suggesting usage of the world’s most popular subscription streaming service, Netflix, was off at the start of the year.

Based on Next TV’s analysis of Netflix’s top shows, the trend line for 2023 is still below 2022.

Using Netflix’s weekly “Global Top 10” ranker of the leading series and movies on the platform, Next TV found that for the five-month period between January - May of this year, Netflix viewing was down around 330 million viewing hours vs. the same period of 2022.

This isn’t a huge chasm. Hit Netflix shows like Wednesday, the re-imagined reboot of The Addams Family, can register well over 330 million streaming hours on the Global Top 10 in a single week. In terms of the sample Next TV compared, it equates to around a 4% year-over-year drop.

Also Read: Is ‘Manifest’ Subscription Streaming’s Most Enduring Hit? — Netflix Weekly Rankings for June 5-11

But the Wednesday reference probably gets to the heart of the issue — Netflix just hasn’t had as many big hits so far in 2023. Only one show, producer Shawn Ryan’s spy thriller The Night Agent, has generated more than 200 million viewing hours in a single week on the Global Top 10’s measuring stick of more than 90 countries. And that only happened for one week, when it generated nearly 216.4 million viewing hours from March 27-April 2, the biggest weekly total for any show measured by the Global Top 10 so far this year.

Conversely, by the first week of June last year, Netflix had two shows blow past the 200 million hours streamed mark — season two of Shonda Rhimes’ wildly popular period rom-com Bridgerton and season four of Stranger Things, the latter of which did it twice in the first-five-month span, generating over 335 million viewing hours for the last week of May 2022.

And season four of Bridgerton actually came close to a second 200 million-hour week, clocking 193 million hours in its first three days on the platform during the week of March 21-27, 2022. Meanwhile, Rhimes’s true-crime limited series biopic, Inventing Anna, captured over 195 million streaming hours for the week of February 14-20, 2022.

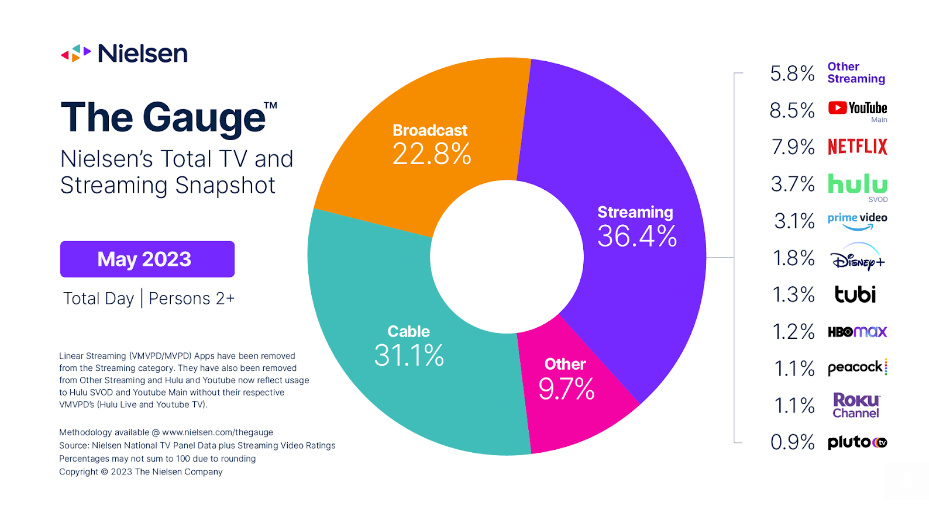

Netflix wouldn’t comment to Next TV for this story. But an individual familiar with the company’s metrics said the ranker doesn’t capture a complete picture of Netflix viewing. The source pointed to Nielsen’s monthly U.S. market share tracker, “The Gauge,” which just showed Netflix in control of nearly 8% of all domestic TV viewing for the month of May, far more than any other streaming company save for YouTube. That figure stood at only 5.8% in May 2022.

But is the sample analysis conducted by Next TV good enough to tell us Netflix might have at least a little bit of an engagement problem?

The Global Top 10 ranks and reports total viewing hours for 10 shows in each of four categories every week: English language film, English language TV, and foreign (non-English language) films and TV series.

Rankings span usage for over 90 countries but don’t extend out to Netflix’s broader global footprint of over 170 nations. So each week, the Global Top 10 measures usage of Netflix’s 40 most popular shows across its biggest markets in North America, Europe, Asia and Latin America, among other regions.

Certainly, for a streaming company that has exponentially grown its usage each year since it started streaming back in 2007, an analysis of a significant audience measurement sampling, revealing zero growth — or in this case, a narrow decline — would seem to be pertinent.

“It's enormously meaningful IMHO,” responded noted Evan Shapiro, one of several TMT pundits and equity analysts who validated Next TV’s methodology. “If you could go back to 2021 and 2020, and see the larger trend, I think it would be that much more so.”

Unfortunately, Netflix only started publishing its Global Top 10 ranker in late June 2021, so we can’t compare the 2023 January-May sampling to a similar period beyond last year.

Notably, Netflix seems to be drawing less platform usage with more paid members — subscribers were up globally by around 11 million at the end of Q1 vs. the end of March 2022.

Of course, 2023 is far from over, and a Netflix source pointed out to Next TV that anticipated summer premieres of The Witcher season four and The Lincoln Lawyer season two await.

The problem with that argument are the really tough comparables: By early June of last year, Stranger Things season four was only getting started and on its way to becoming Netflix’s biggest ever English-language series release after 28 days. From June 6-July 17, season four of Stranger Things ranked as Netflix’s No. 1 show five times, surpassing well over 100 million viewing hours each week.

That was followed in September by the monstrous performance of producer Ryan Murphy’s true-crime biopic Monster: The Jeffrey Dahmer Story, as well as Murphy’s creepy The Watcher starring Naomi Watts and Bobby Cannavale in October. Then came the runaway success of Wednesday in November and December, with the dark comedy topping out at a whopping 411.3 million viewing hours for the week of November 28-December 4.

Season one of Wednesday ended up becoming Netflix’s second biggest English-language TV show debut ever, racking up 1.237 billion streaming hours in its first 28 days.

Does Netflix have two mega hits comparable to Stranger Things season four and the debut of Wednesday lined up in the second half of this year? Possibly. Based on the solid if not wildly spectacular performance of Bridgerton spinoff Queen Charlotte in May, anticipation for the third season of Rhimes’ flagship Bridgerton seems strong. But Netflix hasn’t announced a drop date for Bridgerton S3.

Other prolific Netflix heavy hitters, including Murphy, also have upcoming projects for the platform. But there is this little thing called the Writers Guild of America strike that could get in the way of a rally.

Meanwhile, Netflix is investing more of of the roughly $17 billion it now spends each year on content in fruitful foreign production markets like Korea. Two years ago, a dark Korean sci-fi drama, Squid Game, generated more viewing on Netflix than any show before or since. So WGA strike or no, a foreign wild card emerging late as Squid Game did in September 2021 is always possible.

The emergence of new subscription streaming services, particularly in the U.S., caused investors to worry a year ago — somewhat acutely — that Netflix wouldn’t be able to sustain subscriber and revenue growth. But Netflix's share price is up nearly 47% since January, with Wall Street pleased by recent growth of key metrics, as well as early data from Netflix;s much talked about password sharing crackdown.

Regardless of these aforementioned factors, like clockwork, in each and every quarterly letter to shareholders, Netflix talks up its latest hits, crediting them for driving inexorable revenue and subscriber expansion.

For Q1, Netflix attributed its success to season three of Outer Banks, season 4 of You, the second season of Ginny & Georgia, and the Spanish-language reality hit Soy Georgina.

Since there’s no “hours streamed” line item in Netflix’s key metrics, investors seem to take the Los Gatos, Calif. company at its word that usage is going up, up, up.

Indeed, while operators of ad-supported services like Roku tend to talk about things like “platform engagement” during earnings calls, Netflix has kept the discussion focused largely on paid members and revenue.

But with the company pivoting, at least a little, to advertising sales, that could begin to shift.

Sustained success in the dynamic streaming industry hinges on the ability to attract and engage audiences with compelling content. Investors will undoubtedly be monitoring Netflix’s strategies and content offerings closely to gauge its ability to navigate these challenges and differentiate itself in the streaming market.