In early March, the old sewage pipes of a Houston public middle school broke. By noon, there were only two bathroom stalls for 1,200 students. At 2 p.m., sewage water started leaking out into the hallways. Teacher Traci Laston tried to push ahead instructing her class, but the students couldn’t focus.

“This is happening all over Texas in schools with old infrastructure. There’s just no extra funds for building repairs, for anything,” Laston said. “The politicians are worried about what content is being taught or not being taught … versus truly fixing the problems in schools.”

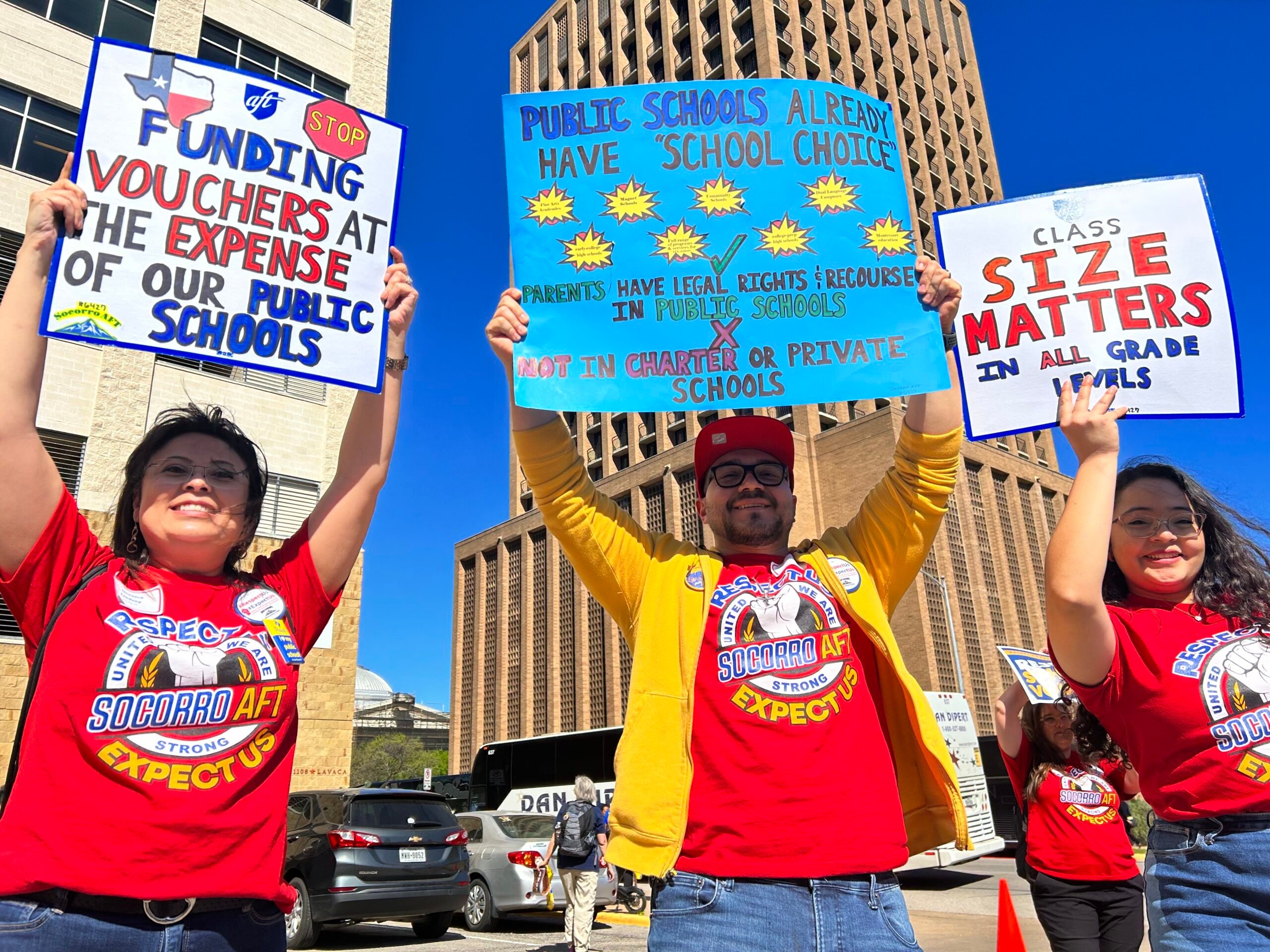

Even as Texas sits on a $33 billion surplus, the state, in what seems like an apt metaphor, has offered crap to public schools so far this legislative session. Earlier this year the state released a report recommending pay raises to keep Texas teachers in public schools. Instead, it seems to be draining school funding: The state Legislature is advancing multiple private school voucher bills alongside measures that restrict public schools’ ability to raise funds through property taxes.

Last year, a record 43,000 teachers left Texas public schools. According to a Texas Observer analysis of Texas Education Agency data, almost 10 percent of reporting school districts experienced a turnover rate of 30 percent or more last school year. Most of these were charter operators or smaller school districts. The average statewide teacher turnover rate last year was 17 percent. The Texas American Federation of Teachers union reported 77 percent of their members surveyed earlier this year were seriously considering leaving their jobs.

“The politicians are worried about what content is being taught or not being taught versus truly fixing the problems in schools.”

“The decisions legislators are making seem like it’s just making it harder for teachers to teach,” said Laston, adding that she and her colleagues already labor off-the-clock to manage their workloads. “It is just not sustainable. We are in a crisis.”

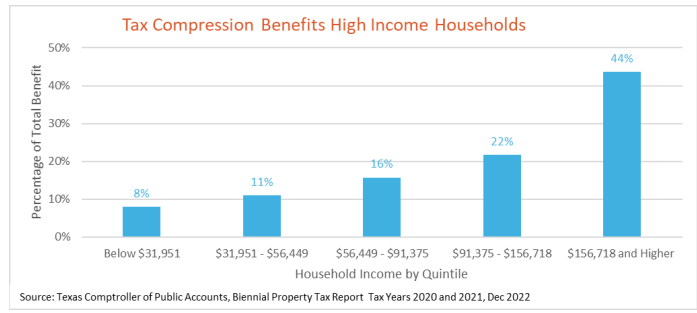

Both the Texas House and Senate plans would cut school property taxes and expand the 2019 school property tax compression bill, HB 3, which choked school revenue sources. Before the state Legislature passed HB 3, school districts taxed property owners at a rate of $1.00 per $100 of property value to generate revenue. HB 3 cut that rate to 80 cents, and now proposals from both chambers would cut it to as low as 65 cents. Further, under HB 3, the greater the property value grows, the more the school tax rate declines. Since 2019, the state has had to furnish more than $10 billion to cover district-level shortfalls.

Chandra Villanueva, director of policy and advocacy at the organization Every Texan, said school property tax cuts are digging a hole for public schools in the future.

“Most states have what we call a three-legged stool of taxation—an income tax, a property tax, and a sales tax. We do not have an income tax here and a sales tax is extremely regressive and very volatile,” said Villanueva. “So if you’re cutting property taxes … you’re really putting our state in a precarious position.”

While Texas has a budget surplus this year and an infusion of federal stimulus money the last two years, state Senator Nathan Johnson said there is no guarantee money will be available in the future. “Historically, Texas has surpluses and deficits. If we hit a deficit in two, four, or six years, and we have these very large mandatory contributions from the state to school systems in lieu of local property tax dollars, the state could respond by cutting funding for public schools when there’s not enough money, as it did in 2011.”

Zeph Capo, president of the Texas American Federation of Teachers, said the state needs to invest $33 billion in public schools to fulfill Governor Greg Abbott’s promise to “fully fund” schools. This amount would pay for raises and increase staffing and stagnant contributions to retired teachers. But there has been no commitment to meet these needs from the Legislature as the House debates the budget this Thursday. Thus far, the House has proposed to increase the basic per-pupil spending by $50, which accounts for a $455 raise for teachers. The union is pushing for amendments to the budget to include a $10,000 teacher raise and to prohibit using state dollars to fund vouchers. “There’s been a lot of talk about fixing the teacher staffing crisis, but there’s not a lot of action that we’re seeing in this current budget,” Capo said.

Currently, Texas allocates only $6,160 per student—$4,000 behind the national average, ranking 42nd in the nation in per-pupil spending. Representative Gina Hinojosa and Senator Johnson, both Democrats, have filed bills to increase the basic allotment to $7,075 with subsequent increases to keep pace with inflation. But these bills appear stalled in the GOP-controlled Legislature.

Texas is one of only six states nationwide to still use attendance-based funding. Under this model, the state determines funding based on the average daily attendance. This means if a student misses school, they are not counted for funding purposes that day. During the pandemic, this funding method left an average of 8 percent of kids uncounted. Meanwhile, districts still have to pay for the fixed costs of campuses, like classrooms, teachers, and desks, based on the number of students enrolled. Bills to reform this model appear stalled too.

The Senate will also soon vote on voucher proposal SB 8, which would further shrink state revenue that schools are now more dependent on as a result of property tax cuts. The bill would use state revenue to pay $8,000 per-student for an “education savings account” for kids not enrolled in public schools. In a bid to woo skeptical rural communities, the bill would also compensate small school districts for students who leave for private schools—a provision that would cost the state billions more in coming years.

“It’s a very expensive transition to a voucher system for which there appears to be scant evidence nationwide that it does anything positive. It doesn’t help. It is more expensive. It divides communities, and in many cases, it blurs the lines between church and state,” Senator Johnson said. “When we fund education systems operating without state oversight and state standards, you’ve got to ask yourself—is this a worthwhile idea? I don’t think it is.”

Ultimately, any failures of the Legislature will fall once again on the backs of the state’s hardworking educators.

Alecyn Fink, an Austin Independent School District elementary teacher still recalls a preschool drawing her mom saved. It was a picture of a teacher, and on the top Fink had written, “What I want to be when I grow up.” After graduating from the University of Texas at Austin, Fink earned a master’s degree in educational psychology and started teaching. Now, after 10 years, she’s not sure she can continue.

Fink works at a tutoring agency three days a week to make ends meet. Her co-worker Maria Poorman does Doordash deliveries every evening after teaching and staying late to grade, plan, and prepare for the next day. During the weekend, Poorman works an additional 10 hours for Doordash. Fink said she will leave after this year if there is no pay raise. Poorman said she and her daughter will move back in with her parents.

“It’s disheartening because I feel like our jobs are so important. I love my job. The kids are great here,” Fink said. “But I can’t afford to teach anymore.”

Update: On Thursday, the state House voted 86-52 to ban the use of public funds for school vouchers, while voting down teachers’ demands for a $10,000 pay raise. The Senate voted to approve the voucher bill SB 8.