Warren Buffett’s investments are closely followed, even though he’s not the sole decision maker at Berkshire Hathaway (BRK.A) (BRK.B).

For its part, Berkshire Hathaway has seen its shares outperform the S&P 500. That goes for the price action over the past few months as well as over longer stretches.

The shares are up slightly over the past 12 months, while the S&P 500 is down almost 16%. Over the past three years the company is up 41% vs. a gain of less than half that (21%) for the index.

Now, despite the recent underperformance of Apple (AAPL) -- Berkshire’s largest position -- shares of Berkshire Hathaway are trying to break out.

Buffett’s Berkshire Hathaway Is Trying to Break Out

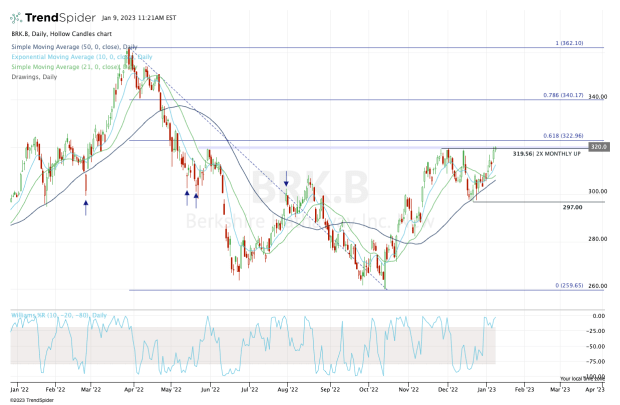

Chart courtesy of TrendSpider.com

Before we dive into the setup, notice how Berkshire stock was hitting all-time highs in late March. Investors were flocking to quality names and clearly they found plenty of safety in Buffett.

Berkshire Hathaway made a couple of runs at the $319 to $320 area in November and December but couldn’t push through this zone. Prudent traders will also see that $320 was a resistance level in June.

That led to a pullback to the $300 area and the 50-day moving average. Now the stock is pushing higher again, and Berkshire is not only trying to break out over last week’s high, it’s trying to clear two months’ worth of highs.

If the stock can clear $319.56, the monthly-up rotation will be in effect.

Noteworthy: The bulls will need to keep a close eye on $323 to $325, which is a prior breakout zone, as well as the 61.8% retracement of the 2022 range.

But if the stock can clear this area, it opens the door to $340.

On the downside, the 50-day moving average must act as support. If it fails, the $300 zone is back in play, where bulls will need to see $297 hold as support.

A close below $297 could prompt more downside levels, while momentum shifts to the bears’ favor rather than the bulls'. For now, though, traders must keep an eye on $320.