It’s finally official. After nearly a whole year of delays and federal inquiries, Walmart’s $2.3B buyout of Vizio is inked and completed. It’s a surprising turn of events, showing Walmart’s perception of the TV market and how it will leverage that market to ignite its ever-growing ads business.

And while ads are definitely an important facet to Walmart’s purchase of Vizio, it’s not the whole story. There’s a lot of different ways Vizio can help Walmart, main among them being the design of some of the best cheap TVs yet. Of course, we'll have to wait a bit before we see the full weight of its purchase of Vizio come to fruition.

But for those who might own a Vizio TV or one of Walmart's Onn TVs, what can you expect to see in the coming months? Or, maybe you're considering on buying a Vizio TV right now, how might Walmart’s new acquisition change your decision? Let's dive into what Walmart's new purchase of Vizio means for you.

A whole lotta ads

It’s no coincidence that Walmart’s US-based chief growth officer is Seth Dellaire, who previously ran Amazon’s global ad sales. It’s clear that advertising is a major part of Walmart’s business and its purchasing of Vizio will only strengthen its potential here, allowing Walmart to bridge its ads into far, far more households.

It's also not too unsurprising just how much ads make up Walmart's general business. Walmart Connect is this very arm, which saw a 30% increase in revenue year over year as of Q2 2024. Walmart Connect takes up a massive part of Walmart's business, and it wouldn't be surprising to see Vizio amplify this growth tremendously over the course of the next few years.

Walmart isn't alone. Other top-name TV brands are driving growth through ads sales, main among them being Roku. According to TVTech, Roku's platform revenue, corralling ad sales, rose by 11% in Q2 2024. Ads are so important to specific TV makers and OS leads that some are willing to take a loss on TV sales as ads are proving far more lucrative.

In addition, anyone who owns a Fire TV Stick or Fire TV will certainly have noticed that the Prime Video home screens for these devices have turned into billboards. You'll see ads for products you can buy on Amazon as well as for shows or movies you may want to watch.

And Walmart is eyeing that potential growth in excited glee, because Walmart and Roku weren't the only ones cashing in on the ads front. Vizio, too, is no stranger to making big on ads sales. Despite seeing double the gross loss on devices year over year in Q3 2024, Vizio still made bank primarily via its Platform+ business, which Walmart has its sights set on.

How best will Walmart push its ads business going into the future? Vizio's SmartCast platform, of course.

SmartCast adoption

The TV interface battle is heating up and there’s no question that Google TV is winning that race. Over the course of the last two years, Google TV has grown into one of the largest TV interfaces, with top manufacturers from TCL, Hisense, and Sony turning to Android 11 for their TV operating systems.

Not far behind Google TV is Roku, Amazon's Fire TV, and even Vizio's SmartCast. According to Statista, SmartCast had as many as 18 million users in 2023. You can assume that's grown significantly since, with Walmart Connect potentially seeing an instant major growth jump primarily through those users.

It wouldn't be too far fetched to see Walmart adopt SmartCast for its own Onn TVs, as well. Onn currently uses Google TV for its main interface, but with SmartCast Walmart could bolster its ads revenue tremendously through an additional user base, and I wouldn't be surprised to see more variety in terms of how those ads are served to users.

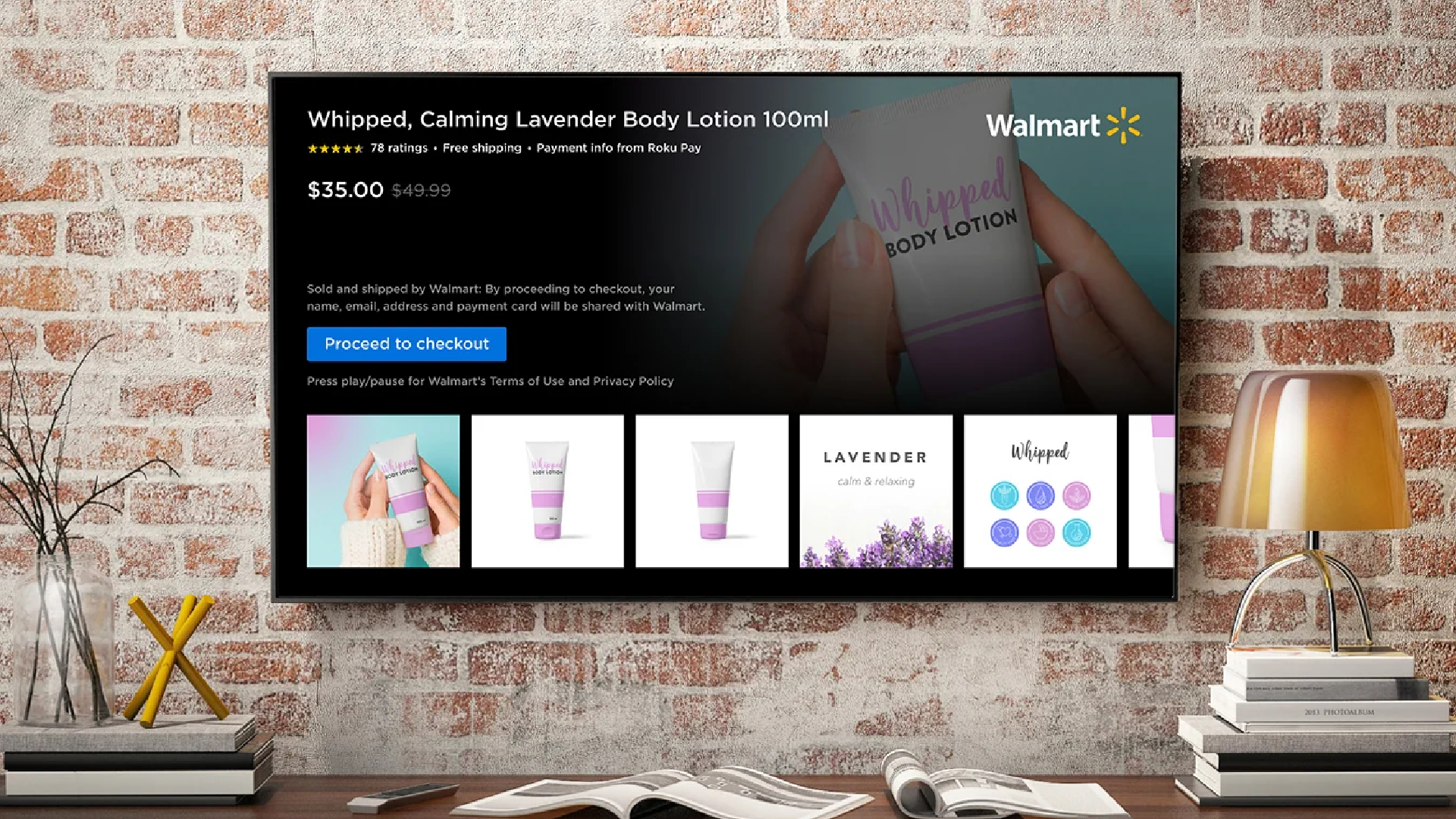

For reference, just look to what Roku's got cooking to see where Walmart's gaze is set. Earlier this year, we reported how Roku patented a way to show ads when content is paused. There's no doubt Walmart has similar plans for both Onn and Vizio sets, and potentially even more ways to sell you things — like shoppable ads.

SmartCast will not only make these integrations far easier (and cheaper) to deliver to customers, bypassing Google TV entirely, but also give them instant access to over 18 million households. That's a huge, huge win for Walmart's ads business, and lends credence to its $2.3B spend.

For that very reason, I might staying away from buying any of the best Vizio TVs right now — unless, of course, if you're a huge fan of ads. At least until we know how this deal is going to shake out.