Walmart Inc. (WMT) is an Arkansas-based multinational retail corporation and one of the largest companies in the world by revenue and scale. Founded in 1962, Walmart operates a global network of over 10,750 retail locations across 19 countries in formats that include supercenters, discount stores, neighborhood markets, and warehouse clubs under the Sam’s Club banner, as well as a substantial e-commerce presence. With a market cap of $954 billion, it serves approximately 270 million customers and members weekly and employs about 2.1 million people worldwide.

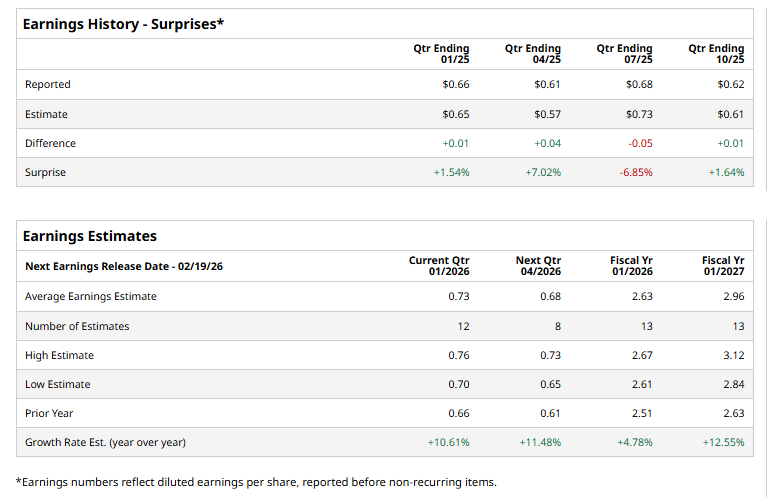

The discount retail giant is expected to announce its fourth-quarter results shortly. Ahead of the event, analysts expect Walmart to report a profit of $0.73 per share, up 10.6% from $0.66 per share reported in the year-ago quarter. While the company has surpassed the Street’s bottom-line estimates three times over the past four quarters, it missed the Street's bottom-line estimates once.

For FY2026, Walmart’s EPS is expected to come in at $2.63, up 4.8% from $2.51 reported in fiscal 2025. In fiscal 2026, its earnings are expected to surge 12.6% year over year to $2.96 per share.

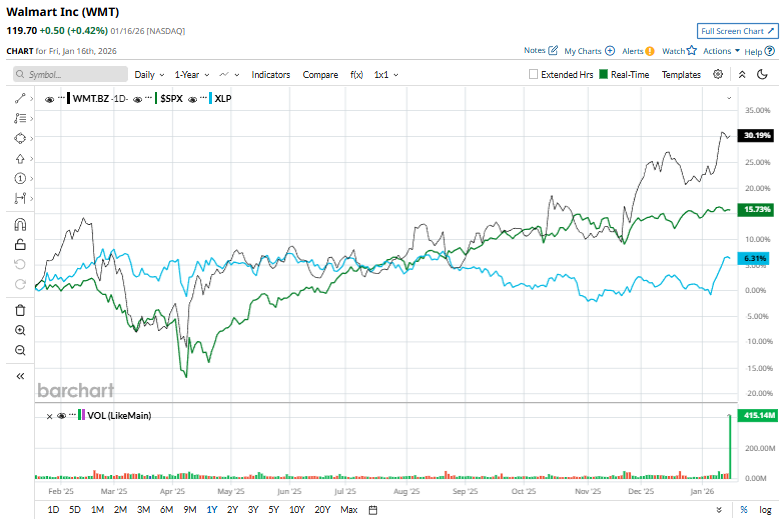

WMT shares have soared 31.1% over the past 52 weeks, outperforming the S&P 500 Index’s ($SPX) 16.9% gains and the Consumer Staples Select Sector SPDR Fund’s (XLP) 6.9% rise during the same time frame.

Walmart’s stock rose 1.3% on Jan. 9 after Nasdaq announced that Walmart will be added to the Nasdaq-100 and related indices effective Jan. 20, 2026, replacing AstraZeneca across multiple Nasdaq benchmarks, a move seen as a validation of Walmart’s market relevance and trading liquidity.

Analysts remain extremely bullish on the stock’s long-term prospects. WMT has a consensus “Strong Buy” rating overall. Of the 37 analysts covering the stock, opinions include 29 “Strong Buys,” six “Moderate Buys,” and two “Holds.” Its mean price target of $124.75 suggests a 4.2% upside potential from current price levels.