The S&P 500 closed up 0.55% yesterday on good news about U.S. GDP growth and President Trump retracting his threat to impose more tariffs on Europe if he isn’t given Greenland. After a selloff earlier this week, the S&P is again above 6,900 and within 1% of its all-time high. Gold hit another record yesterday, too.

But futures on the index were down 0.24% prior to the opening bell in New York, and markets in Europe sold off slightly this morning after Asia closed mixed, a sign that traders are booking profits after yesterday’s rally.

On the macro front, Wall Street analysts are bullish. It’s a marked change from the fraught mood of the past few days.

In fact, Trump’s tariffs are turning out to be a much smaller economic deal than “earlier worst-case fears,” JPMorgan Chase says. Companies have adjusted their pricing and supply chains, and the result is “the realized tariff rate has been much lower at ~11% (versus expectations of 15%)”, according to Dubravko Lakos-Bujas and his team. “Only 14% of S&P 500 companies are highly sensitive to tariffs.”

And it could get better if the U.S. Supreme Court decides the president lacks the power to unilaterally enact tariffs, the bank says.

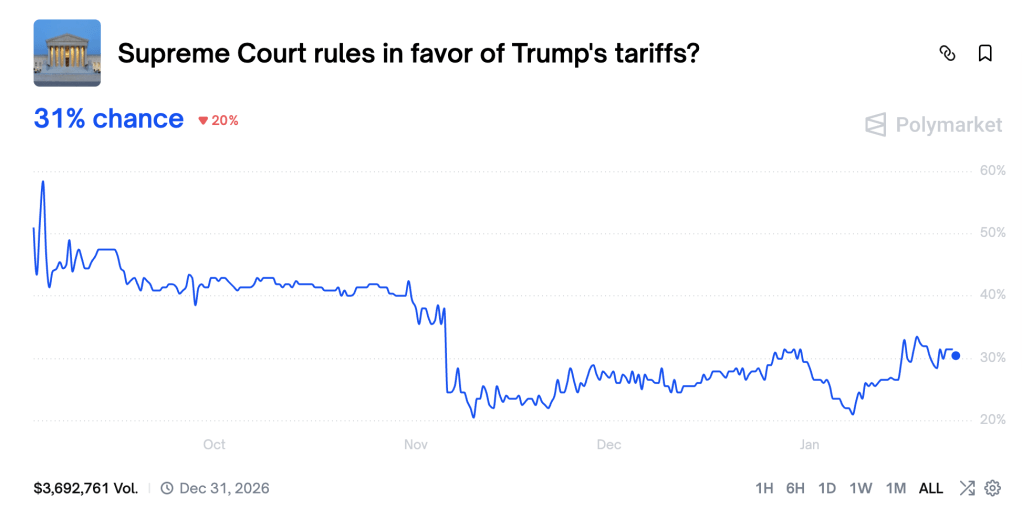

“Prediction markets assign >65% odds that the Supreme Court rules against the government, and those odds have consistently been against the government, especially following the November Supreme Court oral arguments,” Lakos-Bujas told clients.

Analysts were also cheered by a new upward revision for U.S. GDP in the third quarter of last year, at 4.4%.

“The 4.4% real growth rate is much higher than normal and is likely to moderate over the course of the year, but if we can stay above 3% for the entire year it could lead to double-digit returns in the stock market,” Chris Zaccarelli, chief investment officer at Northlight Asset Management, said in an email seen by Fortune.

EY-Parthenon chief economist Gregory Daco was singing from the same hymnbook. “Momentum was driven by resilient consumer spending, robust equipment and AI-related investment, a sizable boost from net international trade, and a rebound in federal government outlays. The U.S. economy is neither overheating nor stalling—it is adjusting,” he said in a note.

All of that explains the calm we’re seeing in the markets today.

“For some assets, it was almost like the selloff never happened, with the VIX index of volatility (–1.26pts) back at 15.64pts, which is beneath its levels prior to Saturday’s tariff announcements,” according to Jim Reid and his team at Deutsche Bank.

Here’s a snapshot of the markets ahead of the opening bell in New York this morning:

- S&P 500 futures were down 0.24% this morning. The last session closed up 0.55%.

- The STOXX Europe 600 was down 0.22% in early trading.

- The U.K.’s FTSE 100 was down 0.11% in early trading.

- Japan’s Nikkei 225 was up 0.29%.

- China’s CSI 300 was down 0.55%.

- The South Korea KOSPI was up 0.76%.

- India’s Nifty 50 was down 0.95%.

- Bitcoin was flat at $89.9K.

.png?w=600)