Valued at $44.9 billion by market cap, W.W. Grainger, Inc. (GWW) is a leading U.S. industrial-supply distributor serving over 4.5 million customers across manufacturing, healthcare, government, and construction. Founded in 1927 and based in Lake Forest, Illinois, it provides a wide range of MRO products, including safety gear, tools, HVAC, and electrical supplies. Grainger operates through its High-Touch Solutions network and its digital Endless Assortment platforms, such as Zoro and MonotaRO, offering both traditional service and strong e-commerce support.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and GWW perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the industrial distribution industry. Grainger benefits from a strong brand reputation and decades-long industry presence. It has a broad product portfolio and deep supplier relationships, offering reliability and scale. Its hybrid model of branch service and powerful e-commerce platforms gives it a major competitive edge.

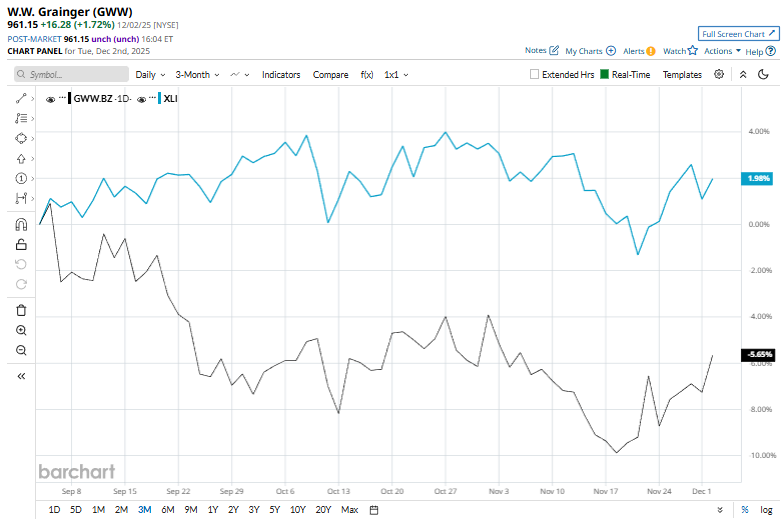

Despite its notable strength, GWW slipped 20% from its 52-week high of $1,201.68, achieved on Dec. 3 last year. Over the past three months, GWW stock declined 5.5%, underperforming the Industrial Select Sector SPDR Fund's (XLI) 1.5% gainduring the same time frame.

In the longer term, shares of GWW dipped 8.8% on a YTD basis and 19.5% over the past 52 weeks, underperforming XLI’s YTD gains of 15.9% and 6.9% returns over the last year.

Reinforcing its bearish trend, GWW has remained below both its 50-day and 200-day moving averages since mid-June.

On Oct. 31, W.W. Grainger saw its shares climb more than 2% after delivering third-quarter results, reflecting resilient demand and disciplined execution. The company posted adjusted EPS of $10.21, beating Wall Street’s expectation of $9.93, driven by solid pricing and cost management. Revenue came in at $4.7 billion, slightly ahead of the $4.6 billion consensus estimate, supported by growth across both its High-Touch Solutions and Endless Assortment segments.

Looking ahead, Grainger reaffirmed its full-year guidance, projecting adjusted EPS between $39 and $39.75 and revenue in the range of $17.8 billion to $18 billion, signaling confidence in continued operational stability despite macroeconomic headwinds.

In the competitive arena of industrial distribution, Core & Main, Inc. (CNM) has taken the lead over GWW, showing resilience with 1.4% gains over the past 52 weeks and a 3.8% downtick on a YTD basis.

Wall Street analysts are cautious on GWW’s prospects. The stock has a consensus “Hold” rating from the 19 analysts covering it, and the mean price target of $1,031.62 suggests a potential upside of 7.3% from current price levels.