You can do everything right and still get punished.

That’s especially true regarding the stock market and may be true for Nvidia, this past year’s artificial intelligence darling.

Nvidia has ridden a tsunami of interest following the successful launch of OpenAI’s ChatGPT in November 2022.

ChatGPT was so successful that it became the fastest app to eclipse one million users. Its success prompted every company worldwide to reconsider how AI could be exploited, particularly large language models that turn huge datasets into simple results.

Related: Nvidia isn't the only tech titan targeting OpenAI deal

The seismic interest in training and running AI models has caused a similarly seismic shift in information-technology budgets, resulting in surging demand for fast, energy-efficient equipment.

At the top of the IT-budget wish list are next-generation graphics-processing units, or GPUs — Nvidia’s wheelhouse.

Unsurprisingly, Nvidia’s sales, profit and stock price have soared, making it the third-largest company in the S&P 500.

The trouble, however, is that with each market-trouncing earnings report, the bar gets ratcheted higher, becoming tougher and tougher to overcome.

In short, the law of large numbers is working against it, and that’s a problem, according to long-time hedge-fund manager Doug Kass.

Sky-high expectations are a problem for Nvidia’s stock

Kass, a 40-year Wall Street veteran whose career stretches back to the 1970s, including a stint as director of research at Leon Cooperman's Omega Advisors, says Nvidia’s best days might be behind it.

There’s little argument that topping what it’s accomplished this past year would be remarkable.

Related: Analysts overhaul Nvidia stock price targets after Q2 earnings

Over the past 12 months, Nvidia’s (NVDA) sales have surged nearly 200% to $96.3 billion. Its profit growth has been similarly eye-popping, with net income last quarter climbing to about $17 billion, more than twice the $6.7 billion of the year-earlier period.

Nvidia’s fiscal second-quarter results show that its sales more than doubled due to robust demand for its H200 GPUs.

However, they also showed that its growth rate, while outstanding, is slowing. Revenue was up 122% year over year in Q2 to $30 billion, the slowest growth since last summer.

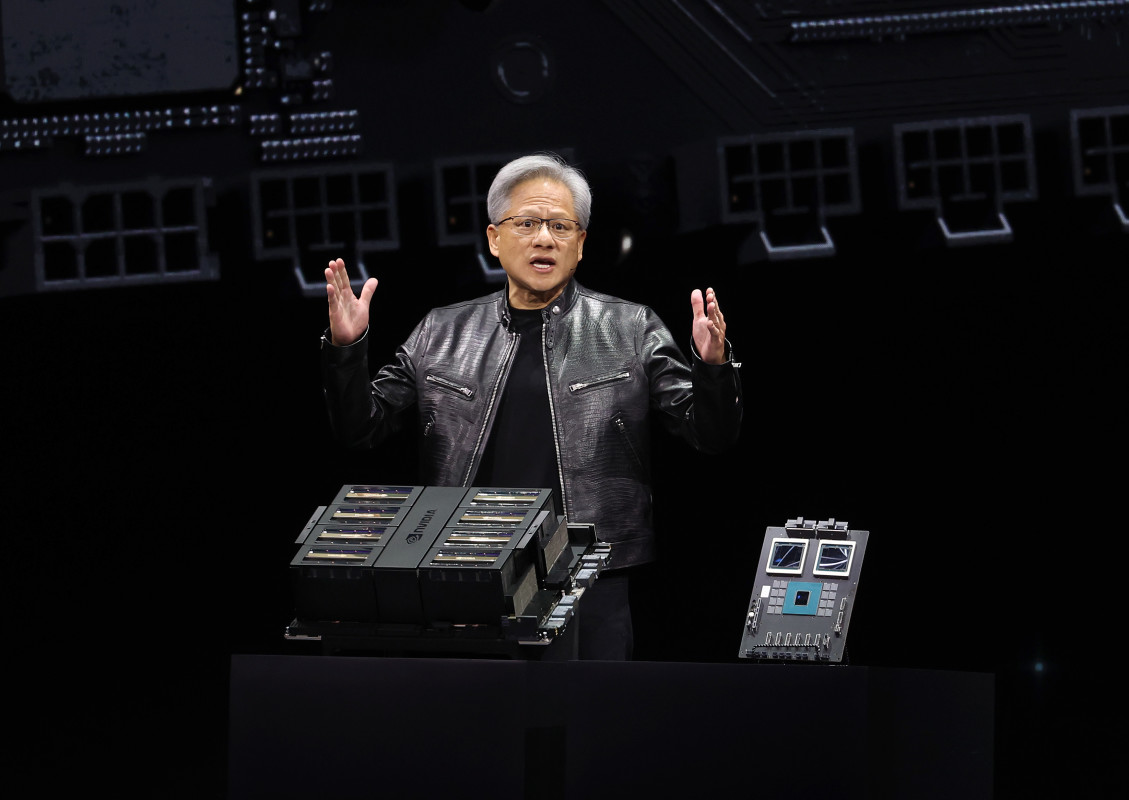

CEO Jensen Huang’s guidance for Nvidia’s third quarter shows that the slowing trend will continue as the law of large numbers increasingly kicks in.

Huang predicts Nvidia’s revenue will be $32.5 billion in Q3, representing “only” 79% year-over-year growth.

Admittedly, that’s still fantastic, but stocks are forward-looking, and many traders and investors who bought Nvidia’s stock more recently may start getting antsy about possibly buying at the highs of demand, profitability, and stock price.

“Concerns include, but are not restricted to, supply outpacing demand during the AI buildout, the pace of adoption, that the real return on AI investment may be disappointing (as there might be a mismatch between capital spend and revenues being generated), potential production problems and the ultimate size of the total addressable market,” noted Kass. “Notably, Nvidia's profit margins have peaked and will shrink going forward.”

Related: Intel's future suddenly may be in doubt

It’s also not lost on Kass that Nvidia shares are trading about 10% below their June peak despite the S&P 500 marching to new all-time highs.

Nvidia’s valuation is high, but it could be worse

Investors often gauge whether a stock is pricey using the stock price-to-earnings multiple or p/e multiple. The p/e multiple shows how much investors are willing to pay for earnings, and the higher the multiple, the more rarified the air.

Related: Major analyst delivers crushing blow after Super Micro stock price crashes

Typically, growth investors are willing to reward fast-growing stocks with a higher p/e multiple, assuming that the company will eventually grow into its valuation. But a premium valuation can increase investors' risk in a world where “what have you done for me lately?” reigns supreme.

Nvidia’s trailing-12-month p/e multiple arguably isn't a bargain at 74. The forward P/E multiple, which considers the stock price relative to earnings expected for the coming year, is friendlier at 43, but plenty of investors will still toss and turn over paying that much to own a stock.

Kass is one of them.

“I have concluded — in that series — that AI and Nvidia's (NVDA) role and prospects in the AI industry might be more than discounted in the share price of industry participants,” said Kass.

Nvidia investors’ hopes are heavily tied to Blackwell

The crucial thing necessary to justify Nvidia's valuation is the successful launch of its next-generation Blackwell chips. They're faster and more energy efficient than H200s, and that's critical for hyperscalers like Amazon's AWS, Microsoft's Azure, and Alphabet's Google Cloud. These are the major providers of cloud services, like computing power and storage, for enterprises.

More AI Stocks:

- Analyst revisits Microsoft stock price target after AI reporting change

- Analyst resets Nvidia stock price target before earnings

- Analysts revise Palo Alto Networks stock price targets after earnings

Unfortunately, developing new, high-end chips like Blackwell isn't easy. Problems are common when it comes to getting new designs out the door, and supply has been an ongoing problem that has hamstrung Nvidia for a while.

Blackwell isn't an exception. Analysts and investors had hoped that Blackwell chips would already be shipping. Instead, customers have only samples, and Nvidia is still ironing things out.

Nevertheless, optimism is high. Nvidia expects Blackwell to ramp ahead of year's end and contribute billions of dollars of revenue to its fiscal fourth quarter.

If Blackwell's launch is further delayed or fails to generate the expected interest, Nvidia could have a much tougher time impressing investors.

“I see volatility and underperformance ahead as the share prices of Nvidia and others digest their large gains — reflecting, in large measure, the growing likelihood of increasingly small sales and profit beats (especially relative to the consensus),” concluded Kass.

Related: Veteran fund manager sees world of pain coming for stocks