Stocks have been on fire over the past two years, with the S&P 500 index soaring 49% and hitting multiple record highs this year.

Now, bulls and bears are arguing: Will the upward momentum continue, or is it time for a substantial correction?

Bulls see the Federal Reserve cutting interest rates perhaps twice this year, stimulating the economy and boosting corporate earnings.

Easing inflation will permit the Fed to move, they say. Consumer prices, excluding food and energy, climbed 3.4% in the 12 months through May, the lowest reading in three years.

Bulls also note that earnings are already on the upswing. According to FactSet, the S&P 500's profit grew 5.9% per share in the first quarter compared to a year earlier.

Analysts forecast a 9% increase for the current quarter. If that number comes to fruition, it would be the largest gain since the first quarter of 2022.

Not everyone agrees with that rosy outlook, though.

Shutterstock

Reasons to be bearish on stocks

But bears say that number may be a major overestimate. They contend that the market is out over its skis on valuations.

As of June 14, the forward price-earnings ratio for the S&P 500 was 21, well above the five-year average of 19.2 and the 10-year average of 17.8, according to FactSet. “Forward” means the ratio is calculated by using analysts’ earnings estimates for the next 12 months.

Related: Analyst resets S&P 500 targets if Fed doesn’t cut interest rates

Bears also expect the Fed to leave interest rates “higher for longer.” The latest forecast by Fed officials produced a median estimate of only one rate cut for this year. Higher rates are bad for the economy, a bad economy is bad for profits, and bad profits are bad for stocks.

And inflation remains sticky, the bears say. The personal consumption expenditures price index, which is the central bank’s favored inflation indicator, registered 2.7% in the 12 months through April. That’s up from 2.5% in January and remains well above the Fed’s target of 2%.

Doug Kass’ issues a warning on stocks

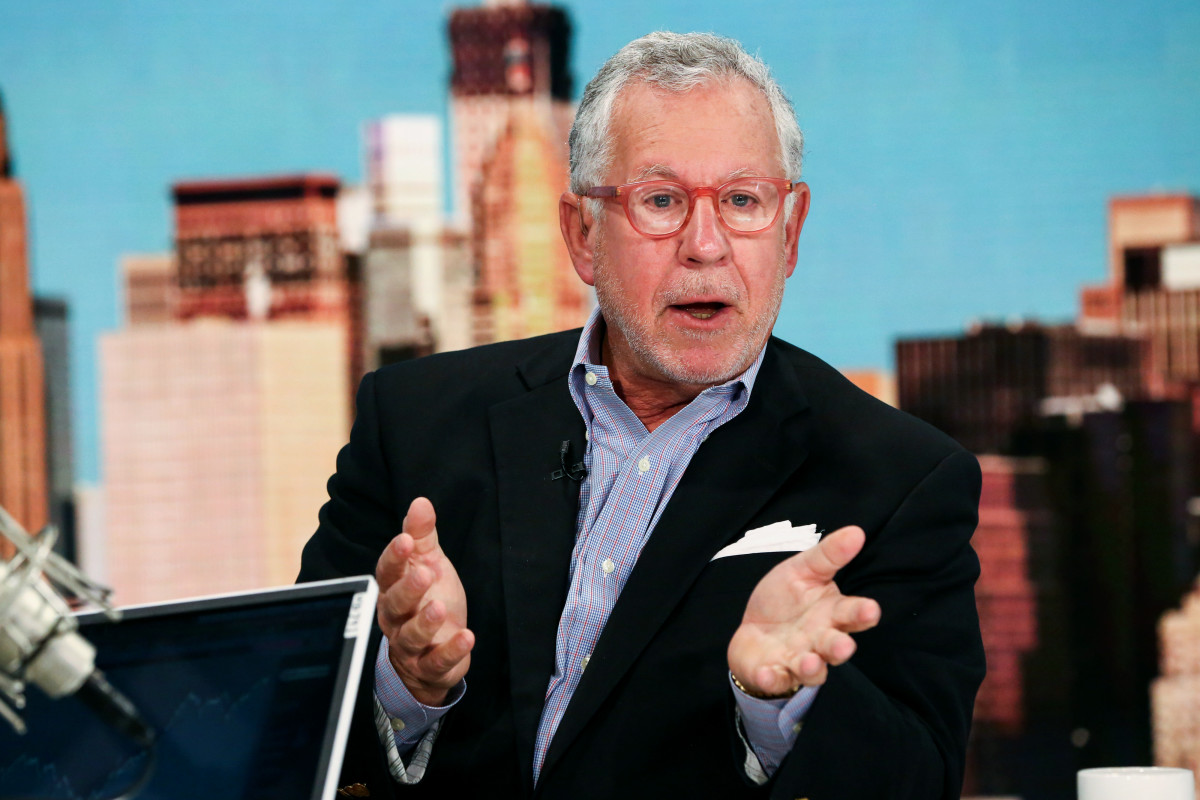

You can count TheStreet Pro columnist Doug Kass as one of the bears.

Kass certainly has a well-informed voice regarding the markets. He's a hedge fund manager whose career began in the 1970s. At one point, he was the research director at legendary investor Leon Cooperman's Omega Advisors.

Related: These stocks could start paying dividends soon

Here are some of Kass' points:

No. 1 “Equity performance has been top heavy, with five large-cap technology companies skewing returns.”

He’s referring to Internet search king Alphabet (GOOGL) , retail/technology titan Amazon (AMZN) , social media giant Meta Platforms (META) , software colossus Microsoft (MSFT,) and semiconductor sultan Nvidia (NVDA) .

“Nvidia has accounted for 35% of the S&P index's 2024 performance while the four others are responsible for another 26% of the annual return,” Kass said. Five stocks haven’t accounted for that much of the market’s return since the 1960s.

No. 2: “Corporate profit performance is also reliant on mega-cap tech,” Kass said. In the first quarter, without the seven largest tech stocks, there was a 2% profit decline. Furthermore, “profit expectations are unrealistic,” running far above historical averages, he said.

More Wall Street Analysts:

- Analyst revamps Microsoft stock price target despite controversy

- Analysts reset Nio stock price targets after earnings

- Dollar Tree’s new price strategy prompts analysts to revise targets

No. 3: Valuations are a problem, Kass said, citing commentary from ace economist David Rosenberg. Rosenberg has pointed out that since October, earnings forecasts for 2025 have increased by 2.6%.

“What has the S&P 500 done since that time? Try up 26%. A 10x surge relative to earnings expectations,” Rosenberg said. “This has been and remains a multiple-driven market, definitely not an earnings-driven market.”

No 4: “Equities have rarely been as overvalued against interest rates as they are today,” Kass said.

“The S&P dividend yield stands at only 1.32% compared to a 5.37% yield on the six-month Treasury bill. The equity risk premium is at the lowest level in nearly two decades.”

The equity risk premium is the excess return that investing in the stock market provides over Treasury bonds. It’s only a guess, as no one knows where stocks and bonds are headed in the future.

Given Kass's reasons, investors may want to examine their portfolios more closely. Now might be a good time to ensure that the reasons for owning stocks remain intact.

Related: Veteran fund manager picks favorite stocks for 2024