Most expected stocks to stumble last year because of a recession. Instead, the S&P 500 rallied over 24%, surprising many who were convinced the Fed's interest rates would cause an economic reckoning.

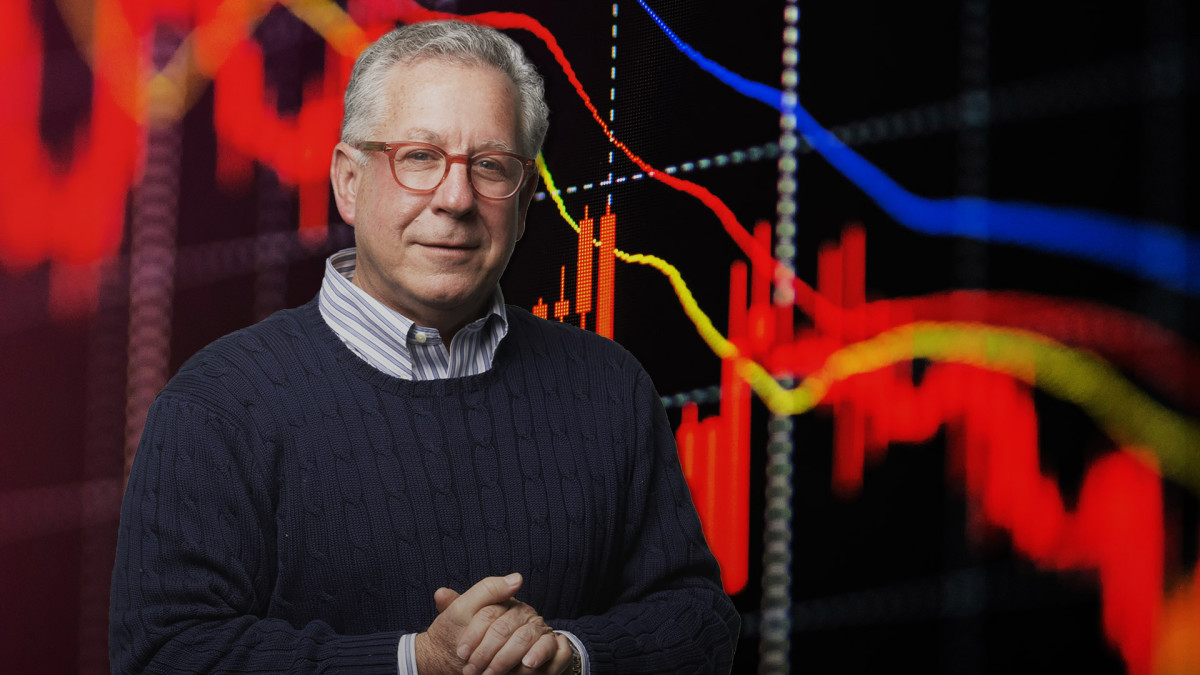

One person who wasn't surprised by the stock market's decisive move higher early last year was hedge fund manager Doug Kass.

Kass has been navigating the markets professionally for over 40 years, and he told investors in December 2022 to expect double-digit returns through the first six months of the year.

It's not the first time Kass' predictions have been prescient. He accurately forecasted in December 2021 that the S&P 500 would roll over in 2022 after an early-year high, inflation would accelerate to 8%, and the Fed would give up its dovish monetary policy in favor of rate hikes — all of which proved true.

More recently, he correctly said on Oct. 20 that Treasury yields would fall, picking the 20-year Treasury ETF as his single best trade almost to the day that yields peaked.

Of course, nobody gets every prediction correct. Kass expected stocks to give back gains in the second half of 2023. That looked smart in October, but stocks found their footing and gained into year's end.

Overall, Kass's track record managing money professionally, including as Director of Research for Leon Cooperman's Omega Advisors, and his particularly accurate calls suggest investors should pay attention to his forecasts.

He recently picked his favorite stocks to buy for 2024, and they may surprise you.

TheStreet

The stock market loses a little luster

Last year, the S&P 500's late-year rally began after a summertime swoon extended into October. The slide was caused by the fear that rebounding oil and gas prices meant sticky inflation. Treasury note yields used in models to value future earnings soared, and stocks suffered.

Related: Long-time fund manager makes a bold crude oil prediction for 2024

The sell-off was scary enough that most investors shunned stocks, sending sentiment measures to low levels historically coincident with bottoms. Bearish investors built overly large short positions, while others shifted money away from stocks to bonds, cash, and money market accounts.

Ultimately, those actions provided the fuel that propelled stocks higher after October, leading many to expect stocks' winning streak would continue into January. So far, that hasn't happened.

Unlike in October, when stocks were heavily oversold, stocks were heavily overbought in early January. As a result, stocks have made little headway. The S&P 500 is flat year-to-date, while the small-cap Russell 2000 is down about 3%.

Those returns aren't too concerning, given small declines are common. However, big sell-offs start from smaller sell-offs, suggesting investors should more selectively pick stocks than a few months ago.

Crude oil flirts with lows, creating opportunities

It isn't just stocks that are off to a disappointing start.

Crude oil prices have fallen since October because of sluggish global demand and weakening economies. More recently, OPEC's decision to cut per barrel prices on Jan. 8 to buyers in Asia, Europe, and North America by up to $2 per barrel has weighed down the commodity.

More From Wall Street Analysts:

- Veteran fund manager makes bold interest rate prediction for 2024

- Analyst who correctly predicted 8% mortgage rates has a new target

- Analyst who forecast the S&P 500’s rally has a new target for 2024

This weakness has caused energy stocks to fall, but Kass thinks these lower prices could create a buying opportunity.

A self-described "contrarian with a calculator," Kass is most comfortable when his stock picks go against conventional wisdom. Somewhat unsurprisingly, one of his "10 Surprises for 2024," released last month, is for oil prices to head higher this year.

Kass expects China's economy to improve, bolstering oil demand. However, the bigger reason for his bet is the chance that geopolitical instability will increase, jeopardizing global oil trade and causing prices to surge.

"The global economy is more susceptible to supply shocks than is generally believed. With Russia and Saudi Arabia conspiring on production cuts, the price of oil exceeds $110/barrel," predicts Kass.

Oil and gas stocks are his top picks for 2024

Kass believes oil prices could march substantially higher than the $70 per barrel they're trading at currently. If so, it would cause profits at exploration and production companies to surge.

As a result, Kass's favorite stock picks for 2024 are a basket of three of the largest global oil and gas producers.

"My Pick for 2024 is not an individual equity, but a basket of three oil stocks — Occidental Petroleum, Chevron, and Exxon Mobil," says Kass. "This is another contrarian pick... Shares of Exxon Mobil, Occidental Petroleum, and Chevron will each rise by over one-third next year."

Each company has seen its revenue and profit decline in the past year despite U.S. production climbing to records. Horizontal rig activity in the Permian Basin shale has helped U.S. crude oil production rise above 13 million barrels per day. However, lower crude oil prices have offset production growth in the wake of higher interest rates crimping economic activity worldwide.

While high prices in 2022 created stiff comparisons last year, lower profits in 2023 mean easier comparisons for 2024, potentially providing a tailwind to Kass' picks if he's correct about the direction of crude oil prices.