It was the comedy that rocked Wall Street.

In the 1983 film "Trading Places" two very rich and very mean old brothers, Randolph and Mortimer Duke, decide to swap the lives of their firm’s managing director — portrayed by Dan Ackroyd — with Eddie Murphy’s street hustler character in a nature versus nurture wager.

Related: Top Wall Street analyst unveils unexpected S&P 500 price target for 2025

The climax on the commodities trading floor sees Ackroyd and Murphy joining forces to ruin the Duke brothers while enriching themselves.

The film earned more than $90.4 million to become the fourth-highest-grossing film of 1983 in the U.S. and Canada, and $120.6 million worldwide.

Free Newsletter From TheStreet - TheStreet 🐻

Nearly 30 years later, in 2010, the film was cited by Gary Gensler, then chief of the Commodity Futures Trading Commission and currently chairman of the Securities and Exchange Commission.

He called for a ban on using misappropriated government information to trade in the commodity markets — just like the characters in the film.

GDP growth drives stock market returns this year

The result was an addition to the Wall Street Transparency and Accountability Act, which became known as the Eddie Murphy Rule.

Now TheStreet Pro's Doug Kass is reflecting on the high levels of enthusiasm surrounding today's market, and he sees a warning in "Trading Places" stemming from the Duke Brothers' desperate bid to avoid bankruptcy.

The stock market surged on Nov. 6, the day after Donald Trump won the U.S. presidency for the second time, as the Dow Jones Industrial Average, the S&P 500 and the Nasdaq all posted fresh record highs.

Most observers are expecting an easing of regulations under the new administration, and several investment firms are seeing brighter days ahead.

Analysts at Wells Fargo Investment Institute said they were raising their forecast targets for U.S. economic growth — measured by gross domestic product growth and Consumer Price Index inflation — “as we anticipate a significant infusion of new cash from strong equity market performance and the U.S. Treasury, as well as gradual deregulation.”

Related: Walmart issues warning as Trump preps massive tariff hikes

The firm said in a Nov. 20 research note that the expectation of extra economic strength, as well as expected new immigration and tariff policies, also boosted its year-end inflation forecast.

"Our forecast and target changes reflect improving conditions in the US economy and lack the policy changes from the incoming administration in Washington," Wells Fargo said.

"Beyond a stronger pace of growth than we previously expected, we believe some additional inflation is likely by year end 2025. "

"We believe the implication for U.S. financial markets are higher interest rates, a stronger U.S. dollar, as well as higher equity prices and S&P index earnings per share," the firm added.

Morgan Stanley analysts say that economic growth and corporate earnings could push the S&P 500 to 6,500 by the end of next year, up 11% from current levels.

“U.S. valuations are rich, but this is helped by better macro in the U.S., potential future U.S. tariff policy being more negative for rest-of-world growth, and animal spirits leading to the rally broadening out,” the investment firm's chief U.S. equity strategist, Mike Wilson, said.

But Wilson also urged investors to "stay nimble amid changing market leadership" into next year."

"We also appreciate that valuation may be volatile depending on the impact of new policy initiatives,” he added.

Fund manager warns of major headwinds

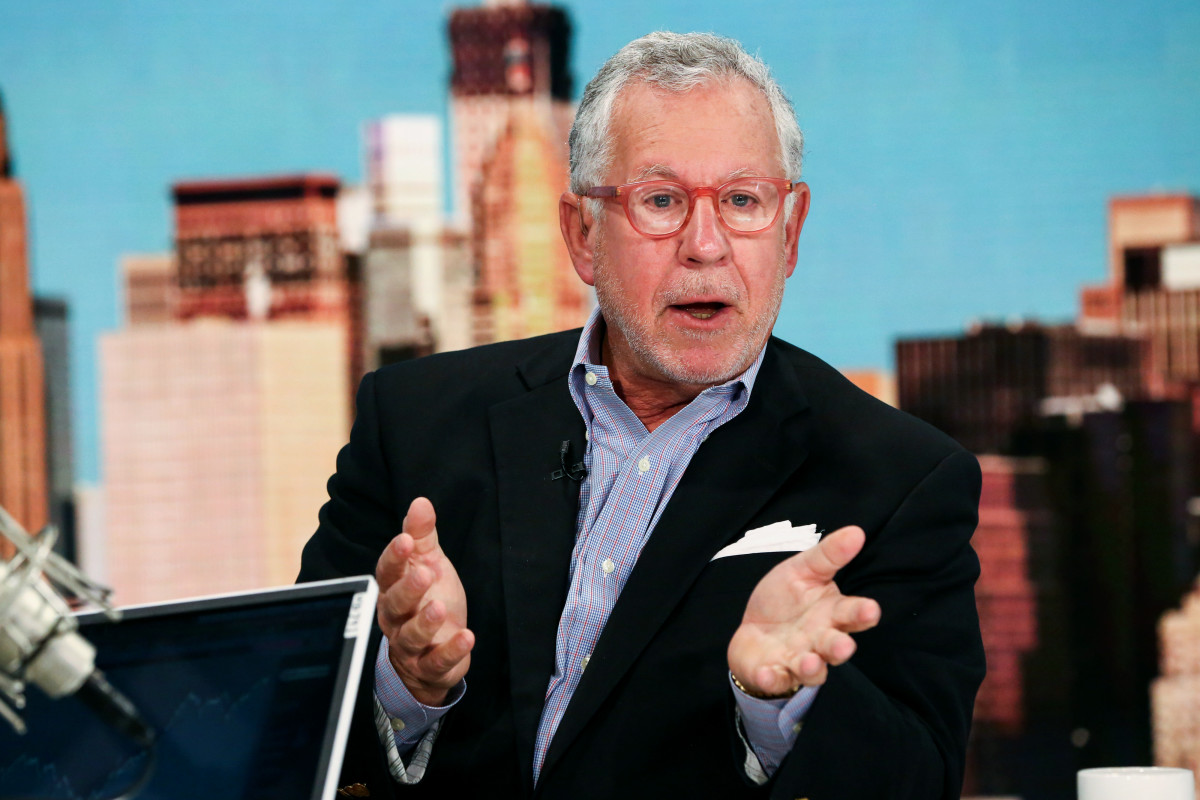

Doug Kass isn't feeling all that rosy about the market. The veteran hedge fund manager has been picking stocks since the 1970s. His career spans nearly 50 years, including a stint as the director of research for Leon Cooperman's Omega Advisors.

Kass recently took direct aim at the previously bearish Wilson by updating a line from "Trading Places."

"Something's wrong, Wilson, sell!"

"The bullish cabal, apparently influenced importantly by the strong price momentum of the indexes, have grown more optimistic with higher stock prices," he wrote.

"By contrast ... a plethora of developing market headwinds [are] being ignored by most market participants."

More Economic Analysis:

- Top Wall Street analyst unveils unexpected S&P 500 price target for 2025

- October retail sales add further complexity to Fed rate cut bets

- CPI inflation sparks Fed interest rate cut bets

Kass said the market's upside reward is now dwarfed by the downside risk and that current share-price levels include virtually no "margin of safety."

He said that Treasury Secretary Janet Yellen front-loaded Treasury issuance in bills, above the recommended level of 15% to 20% of total offerings by the Treasury Borrowing Advisory Committee, instead of issuing more longer-term coupons when the 10-year yield was back under 4%.

"While no one at the Treasury will admit it," he said, "they were playing the yield curve, didn't want to upset the longer end of the curve with too much supply, and instead with the backup in short rates missed an opportunity to term out U.S. debt."

"Stated simply, the Fed blew it," Kass added..

Over the past five decades interest rates have never been so high, at 3.5-times the S&P dividend yield, he said.

"The S&P equity risk premium — forward earnings yield less the 10-year yield — has turned negative for the first time since 2002," Kass said. "In other words, investors are now paying to take risk rather than being compensated for taking risk."

Kass: Inflation risks tied to Trump tariffs

Trump has proposed tariffs of between 60% and 100% on Chinese goods and a tax of between 10% and 20% on every product imported from all U.S. trading partners.

He also promised mass deportation for millions of undocumented immigrants living in the U.S.

Kass said inflation will worsen if the new administration follows through with tariffs and a tough immigration policy.

Related: October retail sales add further complexity to Fed rate cut bets

Shifting into Grateful Dead mode, Kass quoted the line from the iconic band’s song “Casey Jones,” which warned of “trouble ahead, trouble behind."

He said he continued to embrace a cautious and defensive strategy based on the expectations that stocks will fall to more attractive levels for purchase in the next few months.

"It remains our view that the U.S. stock market is overvalued against interest rates, earnings, cash flow and sales — and most other metrics that have stood the test of time," Kass said.

Related: Veteran fund manager sees world of pain coming for stocks