Stocks have soared over the past 12 months, with the S&P 500 climbing 24%, well above the average annual return of 10% over the last 40 years.

Stocks received a strong boost starting last year from expectations that the Federal Reserve would execute multiple interest-rate cuts this year.

With the economy expanding an annualized 3.4% in the fourth quarter, and inflation sticky at 3.5% year-on-year in March, the enthusiasm for rate cuts has dimmed.

Interest-rate futures positions point to a 71% probability of two rate cuts or less, according to CME's FedWatch Tool.

Some prominent experts, such as Apollo Global Management economist Torsten Slok, anticipate no action from the Fed this year.

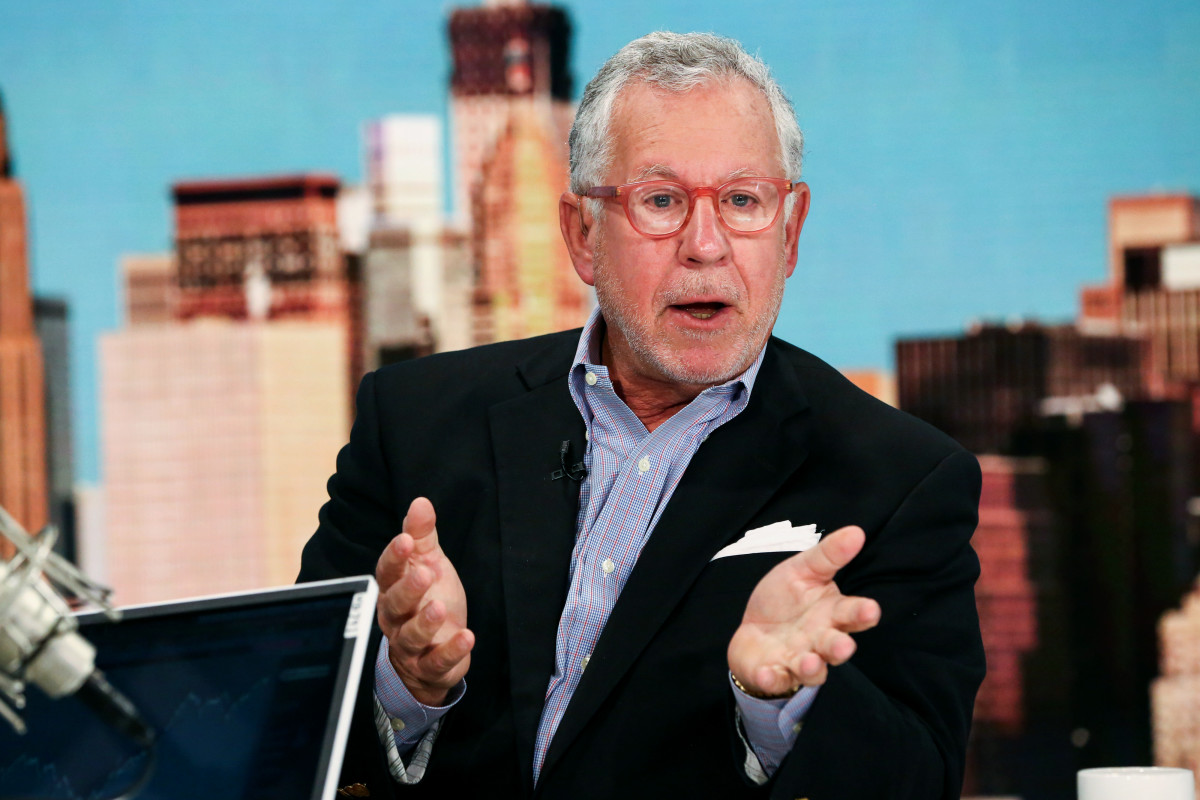

Jim Davis/The Boston Globe via Getty Images

Summers sees possible rate hike

Harvard economist and former Treasury Secretary Larry Summers sees a 15% to 25% chance that the Fed will raise rates this year.

With the shift of interest-rate forecasts, it’s been the strong economy fueling the stock market’s gains. The Atlanta Fed GDPNow forecast tool shows a slowdown to 2.4% growth in the first quarter, but that’s still a buoyant number.

Investors expect economic strength to boost earnings. According to FactSet, analysts predict S&P 500 earnings will gain 3.2% in the first quarter from a year earlier, representing the third straight quarter of growth.

Related: Analyst overhauls S&P 500 target ahead of earnings season

Earnings season kicked off on April 12, with major banks posting mixed results.

Another factor boosting stocks over the past year, of course, is investor mania for artificial intelligence. That has especially lifted technology stocks. The tech-heavy Nasdaq Composite index hit an all-time high on April 11. AI titan, Nvidia, is up about 125% from its low last October.

The S&P 500's valuation is stretched

The market rally has sent stock valuations above historical norms. The forward price-earnings ratio for the S&P 500 stood at 20.5 on April 5, according to FactSet, topping the five-year average of 19.1 and the 10-year average of 17.7.

To some experts that’s a sign stocks are out over their skis (overvalued). One bear is Vincent Mortier, chief investment officer at Amundi, Europe’s biggest money manager. “I have a feeling we’re at the beginning of 2000,” when tech stocks crashed, he told Bloomberg.

Fund manager interviews:

- Fund manager of $100 million long/short mutual fund explains pair trade strategy

- $7 billion fund manager touts 3 blue-chip stocks

- $1 billion fund manager lauds several big tech stocks, including Nvidia

Trouble in the commercial real estate market means “there’s also a little bit of 2007,” when the financial system began to wobble, he said.

Fund manager Doug Kass’ tough take on stocks

Another prominent bear is TheStreet Pro’s Doug Kass, a hedge fund manager whose career spans the 1970s and includes a stint as the Director of Research at Leon Cooperman's Omega Advisors.

Like Summers, he doesn’t see inflation going away easily. “The Fed's 2024 narrative that inflation was coming under control is as feckless and wrong-footed as its 2021 narrative that inflation would be transitory,” Kass wrote on April 11.

On April 6, he cited a host of factors that will weigh on stocks in the future:

- Geopolitical tension in the Mideast. The escalation of tension between Iran and Israel is buoying oil prices and will fan more inflationary fears.

- The likelihood of higher interest rates for longer and less Fed easing than the consensus expects.

- Interest rates have been rising in recent months. The equity risk premium is the lowest in 16 years. That premium is the excess return earned in stocks over safe Treasury bonds.

Related: Risk Happens Fast: Doug Kass

- There are “accumulating signs of ‘slugflation’ (sticky inflation, slowing economic growth and corporate profits).”

- Commodity prices are rising, with gold and silver hitting record highs.

- Market breadth has been deteriorating, meaning gains in the stock market aren’t widespread among companies.

- When energy is a market leader, like now, that generally indicates a maturing bull market.

- Valuations leave little room for error.

- Investor sentiment has moved to a bullish extreme.

Kass' long bearish list of headwinds suggests a lot must go right for stocks to continue higher, but not much must go wrong for them to go lower.

Related: Veteran fund manager picks favorite stocks for 2024