A number of stocks were hit by the glitch at the NYSE this morning, Verizon (VZ) among them.

It was among dozens of stocks that many investors consider blue-chip holdings. The interruption also affected a number of NYSE-listed stocks that reported earnings this morning.

Some of those are Johnson & Johnson (JNJ), 3M (MMM), Raytheon (RTX) and Union Pacific (UNP).

For Verizon, the telecom-service provider reported in-line earnings and beat revenue estimates, while its outlook was a bit disappointing.

Despite the odd-looking charts, though, order seems to be restored.

Verizon will followed by rival AT&T (T), which reports tomorrow before the open.

Trading Verizon Stock

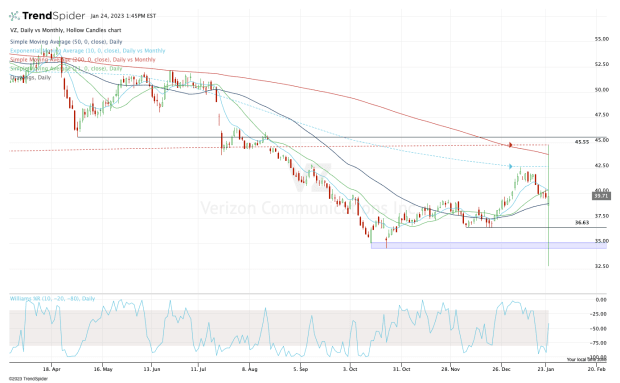

Chart courtesy of TrendSpider.com

Because of today’s volatility, we have to take Tuesday’s price action with a grain of salt. But it highlights some key areas on the upside and the downside.

On the upside, $42.50 and $45 are two key levels that the stock must reclaim in order to enjoy a sustained upside rally.

On the downside, $36.50 is vital for the bulls. A break of this level opens the door down to the $35 area, which was a double-bottom support area in October.

Verizon stock fell out of favor last summer and has been struggling to gain traction. Once viewed as a strong blue-chip holding with a big dividend yield, the stock has really disappointed investors.

That’s even as the shares trade at less than 10 times earnings and yield more than 6.5%.

For shorter-term investors, watch for a close over $40.75, which would propel the shares over the 10-day and 21-day moving averages and open the door back to the $42 to $42.50 area.

On the downside, a close below $38.75 puts Verizon stock below all its key daily moving averages and opens the door down to the aforementioned $36 zone.

We’ll see if AT&T’s report can cause the short-term range — $38.75 to $40.75 — to break and give us a bit more direction.