Valued at a market cap of $36.1 billion, Ventas, Inc. (VTR) is a healthcare real estate investment trust (REIT) that owns and operates a diversified portfolio of senior housing, medical office buildings, life science facilities, and healthcare-related properties. The Chicago, Illinois-based company is expected to announce its fiscal Q4 earnings for 2025 in the near future.

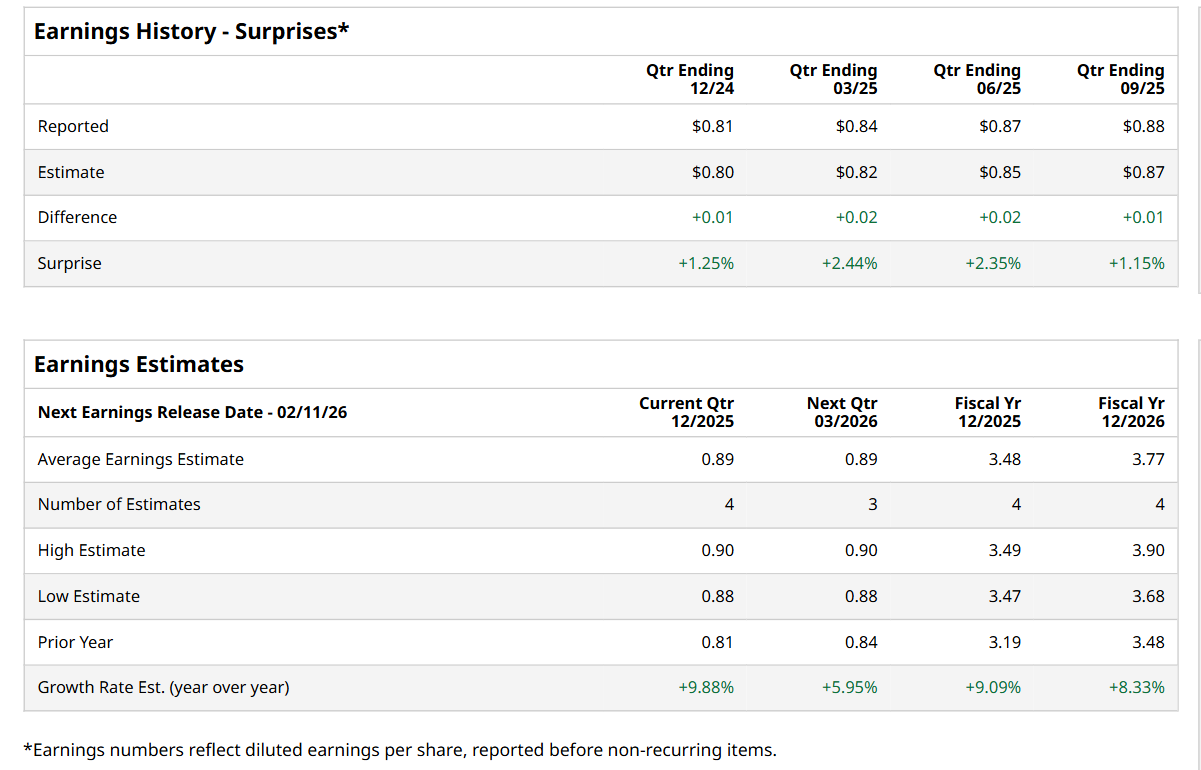

Before this event, analysts expect this healthcare REIT to report a profit of $0.89 per share, up 9.9% from $0.81 per share reported in the same quarter last year. The company has topped Wall Street’s bottom-line estimates in each of the last four quarters. Its FFO of $0.88 per share in the previous quarter exceeded the forecasted figure by 1.2%.

For the current fiscal year, ending in December, analysts expect VTR to report an FFO of $3.48 per share, up 9.1% from $3.19 per share in fiscal 2024. Its FFO is expected to further grow 8.3% year-over-year to $3.77 in fiscal 2026.

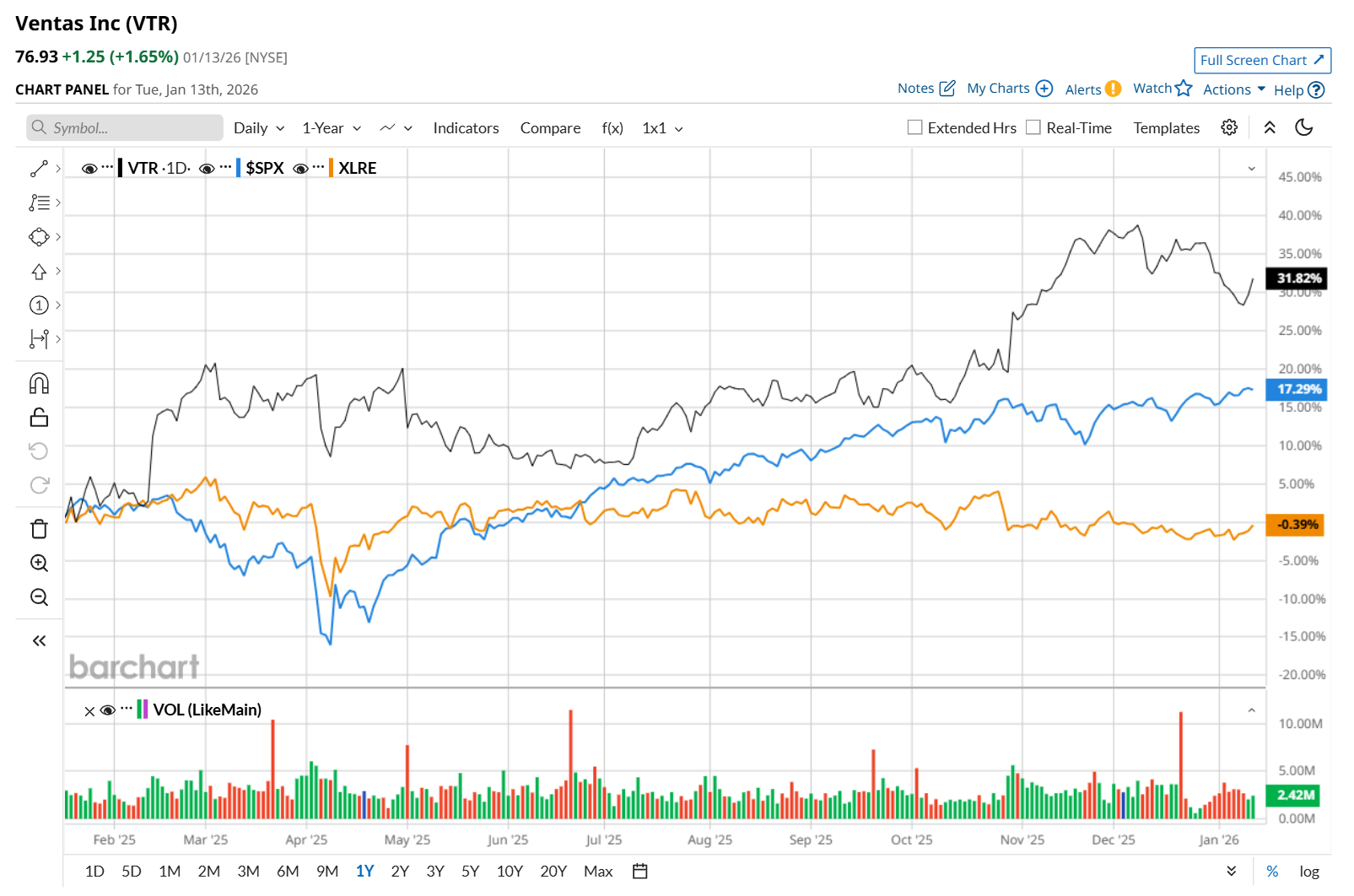

Ventas has soared 32.6% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 19.3% return and the State Street Real Estate Select Sector SPDR ETF’s (XLRE) 2.3% uptick over the same time period.

Ventas delivered better-than-expected Q3 earnings results on Oct. 29, and its shares surged 6.6% in the following trading session. The company’s total revenue increased 20.4% year-over-year to $1.5 billion, exceeding consensus estimates by 4.2%. Moreover, its normalized FFO of $0.88 improved 10% from the year-ago quarter, topping analyst expectations by a penny. VTR’s upbeat performance was driven by its senior housing operating portfolio (SHOP), which experienced broad-based demand and grew organically year-over-year by double digits.

Wall Street analysts are highly optimistic about VTR’s stock, with a "Strong Buy" rating overall. Among 21 analysts covering the stock, 16 recommend "Strong Buy," one indicates a "Moderate Buy," and four suggest "Hold.” The mean price target for VTR is $86.40, indicating a 12.3% potential upside from the current levels.