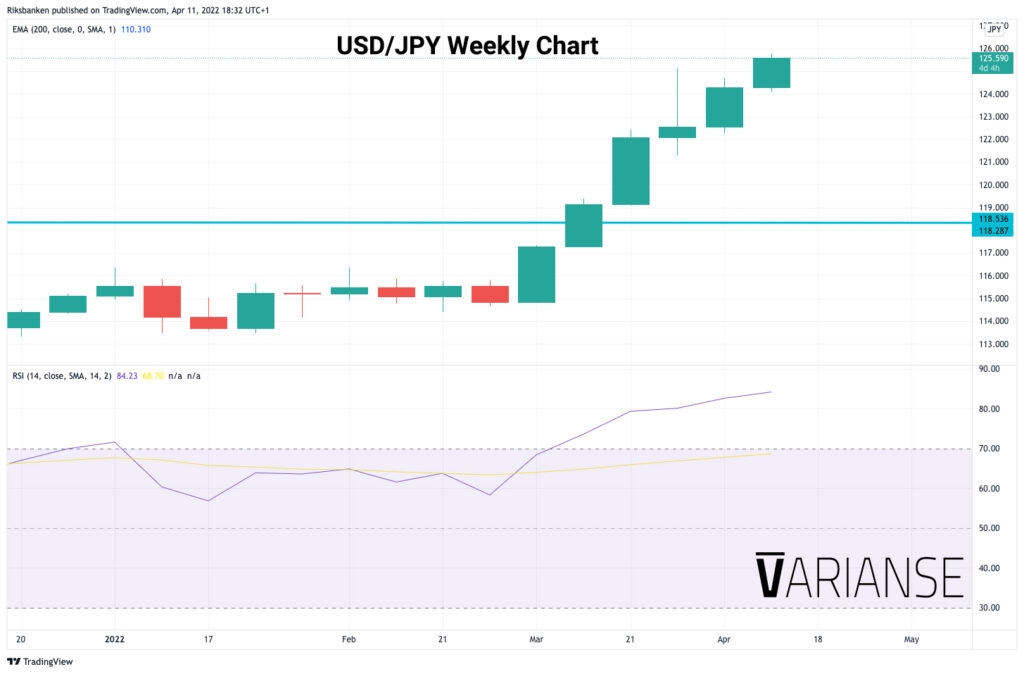

USD/JPY soared to new heights on Monday as the Bank of Japan pledged overnight to keep interest lows against the backdrop of rising US bond yields. The latest swing higher put USD/JPY within a whisker of breaking through the June 2015 high of 125.85. Eisuke Sakakibara, a former top currency diplomat, identified the 130 as a potential level where the Bank of Japan may intervene to support the yen in a recent Reuters article. Doing so, however, would require the Bank of Japan to use some of its c. $1.38 trillion of currency reserves and consent from the rest of the G7 counterparts, most notably the US.

Even if the Bank of Japan were to intervene, there is no guarantee of success. Traders are more apt to test the central bank’s resolve in light of its commitment to keep monetary policy ultra-accommodative. Meanwhile, any verbal rather than direct intervention risks keeping USD/JPY down only temporarily. The last time the Bank of Japan directly intervened to prop up the yen was back in 1998 during the Asian financial crisis. Japan’s export-driven economy has historically left the Bank of Japan to take a more hands-off approach in the face of yen weakness.

Equally, traders with the guts to contemplate short positions should take into consideration the correlation between US yields and USD/JPY. The Bank of Japan’s commitment to ultra-accommodative policy really makes the yen’s performance more about what happens to US yields than what happens to those in Japan. Safer to look for confirmation that US yields may have topped out rather than solely relying on intervention from the Bank of Japan. The Bank of Japan faces a Godzilla challenge in terms of retracing the yen’s losses in the face of ever-higher US yields.