Okta (NASDAQ:OKTA) underwent analysis by 16 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 12 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 3 | 0 | 0 |

| 2M Ago | 2 | 2 | 6 | 0 | 0 |

| 3M Ago | 0 | 0 | 2 | 0 | 0 |

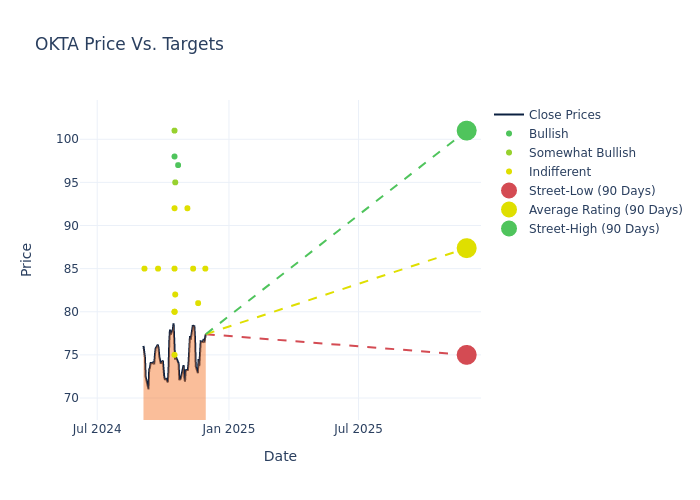

Analysts have recently evaluated Okta and provided 12-month price targets. The average target is $87.38, accompanied by a high estimate of $101.00 and a low estimate of $75.00. Highlighting a 16.25% decrease, the current average has fallen from the previous average price target of $104.33.

Understanding Analyst Ratings: A Comprehensive Breakdown

A clear picture of Okta's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brian Essex | JP Morgan | Lowers | Neutral | $85.00 | $105.00 |

| Saket Kalia | Barclays | Announces | Equal-Weight | $81.00 | - |

| Brad Zelnick | Deutsche Bank | Lowers | Hold | $85.00 | $115.00 |

| Simeon Gutman | Morgan Stanley | Lowers | Equal-Weight | $92.00 | $100.00 |

| Gabriela Borges | Goldman Sachs | Lowers | Buy | $97.00 | $113.00 |

| Shrenik Kothari | Baird | Lowers | Outperform | $95.00 | $105.00 |

| Kingsley Crane | Canaccord Genuity | Lowers | Hold | $82.00 | $90.00 |

| Rudy Kessinger | DA Davidson | Lowers | Neutral | $75.00 | $85.00 |

| Gray Powell | BTIG | Lowers | Buy | $98.00 | $128.00 |

| Andrew Nowinski | Wells Fargo | Lowers | Equal-Weight | $80.00 | $90.00 |

| Joel Fishbein | Truist Securities | Lowers | Hold | $80.00 | $95.00 |

| Gregg Moskowitz | Mizuho | Lowers | Neutral | $92.00 | $104.00 |

| Matthew Hedberg | RBC Capital | Lowers | Outperform | $101.00 | $125.00 |

| Rob Owens | Piper Sandler | Lowers | Neutral | $85.00 | $100.00 |

| Joseph Gallo | Jefferies | Lowers | Hold | $85.00 | $100.00 |

| Shyam Patil | Susquehanna | Lowers | Neutral | $85.00 | $110.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Okta. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Okta compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

For valuable insights into Okta's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Okta analyst ratings.

Discovering Okta: A Closer Look

Okta is a cloud-native security company that focuses on identity and access management. The San Francisco-based firm went public in 2017 and focuses on two key client stakeholder groups: workforces and customers. Okta's workforce offerings enable a company's employees to securely access its cloud-based and on-premises resources. The firm's customer offerings allow its clients' customers to securely access the client's applications.

Okta: Delving into Financials

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Okta's revenue growth over a period of 3 months has been noteworthy. As of 31 July, 2024, the company achieved a revenue growth rate of approximately 16.19%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Okta's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.49% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Okta's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 0.48%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Okta's ROA excels beyond industry benchmarks, reaching 0.32%. This signifies efficient management of assets and strong financial health.

Debt Management: Okta's debt-to-equity ratio is below the industry average at 0.2, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Basics of Analyst Ratings

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.