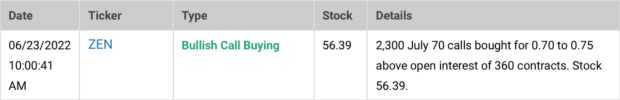

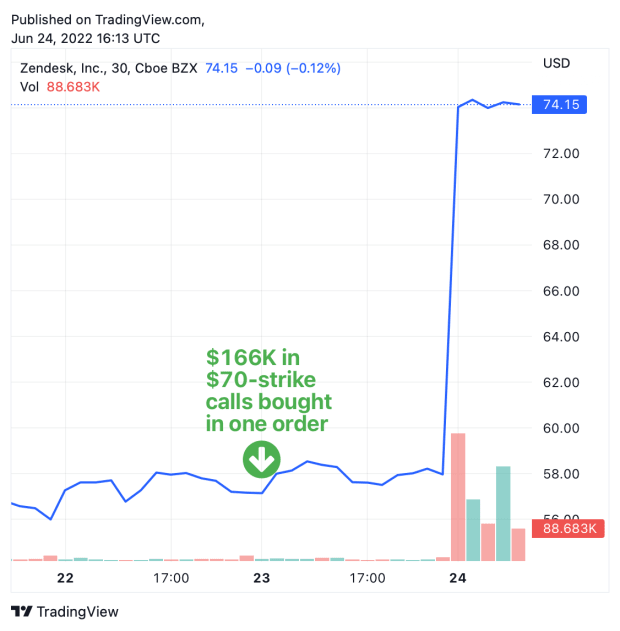

Market Rebellion’s Unusual Option Activity service identified a massive, bullish purchase of call options yesterday, June 23rd. A trader spent more than $166,000 on 2,300 far out-of-the-money ZenDesk calls at the $70-strike, bought well above the open interest of just 360 contracts.

At the time, (ZEN) was trading at $56.39. Today, the stock is surging, trading as high as $93.57 in the premarket, a share-price appreciation of more than 61%. The stock opened at $75.35, and those $70-strike July calls jumped in price by 700% — trading as high as $5.80 per contract. Not bad for an average trade price of $0.725. That means this trader had the opportunity to make nearly a million dollars overnight on this suspiciously well-timed trade.

What Caused ZEN Stock to Take Flight?

News broke early Friday morning (June 24th) that software company ZenDesk agreed to be acquired in an all-cash deal. The deal valued the company at $10.2 billion dollars, and values shares of ZenDesk at $77.50.

Hmm… $77.50. Recall that the unusual option trade Market Rebellion discovered yesterday was in $70-strike call options, which when bought, were more than 24% out-of-the-money.

The bottom line: This is why we follow the “smart money”. Whether this trade was made by an insider who knew about the acquisition ahead of its press release, or by an institutional trader who had access to powerful research tools that we as individual traders can’t use, the point is the same: it’s important to keep an eye on option order flow. It’s the only way to get inside the minds (and wallets) of the Wall Street elite.

Ready to start trading? Try Unusual Option Activity Essential. Learn how you can follow the "smart money" with a fresh UOA trade idea each week - including technical levels so that you know where to enter and exit!