Whales with a lot of money to spend have taken a noticeably bearish stance on Nike.

Looking at options history for Nike (NYSE:NKE) we detected 45 trades.

If we consider the specifics of each trade, it is accurate to state that 42% of the investors opened trades with bullish expectations and 46% with bearish.

From the overall spotted trades, 10 are puts, for a total amount of $577,519 and 35, calls, for a total amount of $2,225,357.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $47.5 to $155.0 for Nike over the last 3 months.

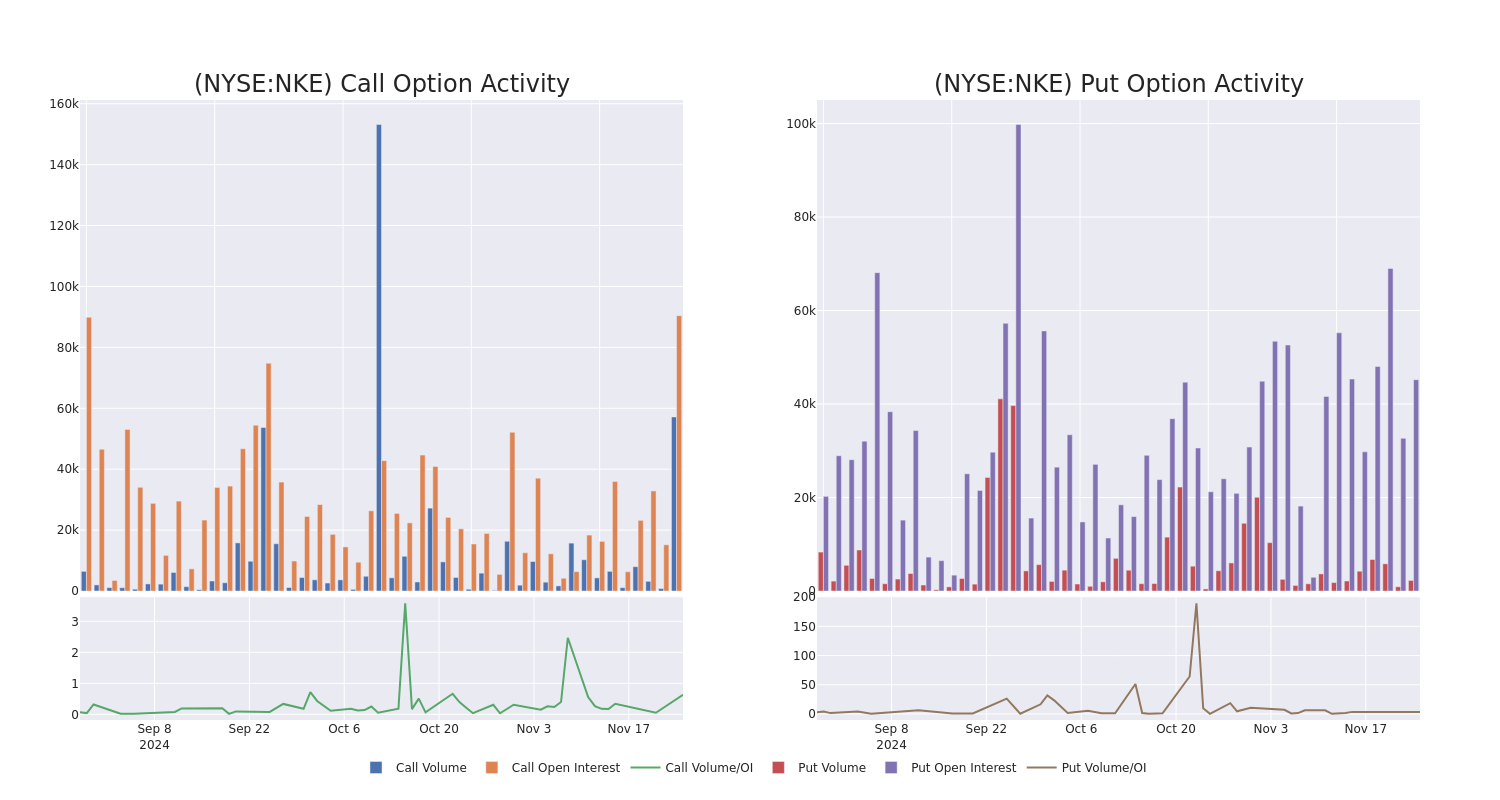

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Nike's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Nike's whale trades within a strike price range from $47.5 to $155.0 in the last 30 days.

Nike 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NKE | CALL | SWEEP | BEARISH | 07/18/25 | $8.55 | $8.35 | $8.35 | $80.00 | $221.2K | 206 | 271 |

| NKE | CALL | SWEEP | BULLISH | 12/18/26 | $8.45 | $8.2 | $8.45 | $100.00 | $169.0K | 5.6K | 907 |

| NKE | CALL | TRADE | BEARISH | 01/16/26 | $2.58 | $2.48 | $2.52 | $115.00 | $125.7K | 2.4K | 502 |

| NKE | PUT | TRADE | BEARISH | 01/15/27 | $7.75 | $7.65 | $7.75 | $70.00 | $105.4K | 403 | 147 |

| NKE | CALL | SWEEP | BEARISH | 12/20/24 | $4.2 | $4.15 | $4.15 | $78.00 | $103.7K | 635 | 331 |

About Nike

Nike is the largest athletic footwear and apparel brand in the world. Key categories include basketball, running, and football (soccer). Footwear generates about two thirds of its sales. Its brands include Nike, Jordan (premium athletic footwear and clothing), and Converse (casual footwear). Nike sells products worldwide through company-owned stores, franchised stores, and third-party retailers. The firm also operates e-commerce platforms in more than 40 countries. Nearly all its production is outsourced to contract manufacturers in more than 30 countries. Nike was founded in 1964 and is based in Beaverton, Oregon.

Where Is Nike Standing Right Now?

- With a trading volume of 10,629,515, the price of NKE is up by 1.12%, reaching $78.27.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 24 days from now.

What Analysts Are Saying About Nike

3 market experts have recently issued ratings for this stock, with a consensus target price of $79.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from TD Cowen has decided to maintain their Hold rating on Nike, which currently sits at a price target of $73. * An analyst from Needham downgraded its action to Buy with a price target of $84. * Consistent in their evaluation, an analyst from RBC Capital keeps a Sector Perform rating on Nike with a target price of $80.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Nike with Benzinga Pro for real-time alerts.